Venture capital funds kick off this epic journey, offering a sneak peek into a world teeming with innovation and financial prowess. Get ready to dive deep into the realm of high-stakes investments and game-changing opportunities.

As we unravel the layers of venture capital funds, we uncover the key players, the risks involved, and the crucial role they play in shaping the entrepreneurial landscape.

Overview of Venture Capital Funds

Venture capital funds are investment funds that provide financing to startups and small businesses with high growth potential. These funds typically invest in early-stage companies in exchange for equity ownership.

Purpose of Venture Capital Funds

Venture capital funds aim to help entrepreneurs turn their innovative ideas into successful businesses by providing them with the necessary capital and resources. These funds play a crucial role in fueling innovation and driving economic growth.

How Venture Capital Funds Operate

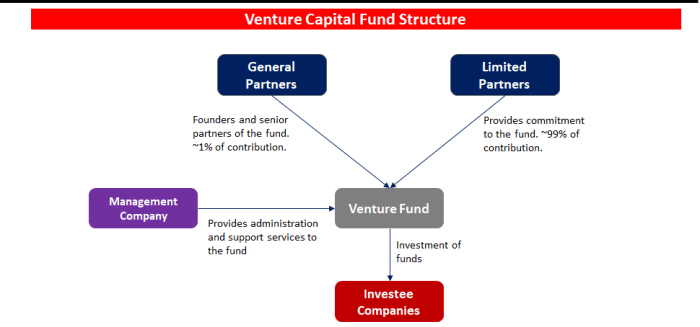

Venture capital funds raise money from institutional investors, such as pension funds, endowments, and wealthy individuals. They then invest this capital in promising startups and provide them with strategic guidance and support. In return, venture capital funds expect a high return on their investment if the startup succeeds.

Characteristics of Venture Capital Funds

When it comes to venture capital funds, there are several key characteristics that define them. These include the types of investors involved, the companies that benefit from these funds, and the risks associated with such investments.

Investors in Venture Capital Funds

Venture capital funds typically attract high-net-worth individuals, institutional investors, and even corporations looking to invest in high-growth potential startups. These investors are willing to take on higher risks in exchange for the potential for significant returns.

Types of Companies Benefiting from Venture Capital Funds

Startups and early-stage companies with innovative ideas and high growth potential are the primary beneficiaries of venture capital funds. These companies often operate in technology, biotech, and other cutting-edge industries where traditional financing may be hard to come by.

Risks of Investing in Venture Capital Funds

Investing in venture capital funds comes with inherent risks due to the high failure rate of startups. Not all companies will succeed, and investors may lose their entire investment in some cases. Additionally, these funds are illiquid, meaning that investors may not be able to easily cash out their investments.

Process of Venture Capital Funding

Venture capital funding involves several key stages, each crucial in determining the success of the investment. From sourcing potential opportunities to conducting due diligence, venture capitalists follow a structured process to identify and support promising startups.

Stages of Venture Capital Funding

- Deal Sourcing: Venture capitalists actively seek out potential investment opportunities through various channels such as networking events, referrals, pitch competitions, and online platforms.

- Due Diligence: Once a potential investment is identified, due diligence is conducted to assess the startup’s business model, market potential, team capabilities, and financial health.

- Term Sheet Negotiation: If the due diligence phase is successful, a term sheet outlining the terms and conditions of the investment is presented to the startup founders for negotiation.

- Investment: After finalizing the terms, the venture capital firm invests capital in exchange for equity in the startup, becoming a partner in the company’s growth.

- Post-Investment Support: Venture capitalists provide strategic guidance, industry connections, and operational support to help the startup scale and succeed.

- Exit: The final stage involves the exit strategy, where the venture capitalist aims to realize returns on their investment through methods like acquisitions, IPOs, or secondary sales.

Venture Capitalists’ Evaluation Process

- Market Potential: Venture capitalists assess the size, growth rate, and competitive landscape of the target market to determine the startup’s growth opportunities.

- Team Capabilities: Evaluating the startup team’s experience, skills, and ability to execute the business plan is crucial in assessing the venture’s potential for success.

- Business Model Viability: Venture capitalists analyze the startup’s revenue model, customer acquisition strategy, and scalability to ensure long-term profitability.

- Financial Health: Reviewing the startup’s financial statements, burn rate, and runway helps venture capitalists gauge the company’s financial stability and future funding needs.

Role of Due Diligence in Venture Capital Funding

- Assessing Risk: Due diligence allows venture capitalists to identify and mitigate potential risks associated with the investment, ensuring a more informed decision-making process.

- Verifying Information: Through due diligence, venture capitalists verify the accuracy of the startup’s claims, financial projections, and market assumptions, reducing the chances of misrepresentation.

- Building Confidence: Conducting thorough due diligence builds trust between the venture capitalist and the startup, laying the foundation for a successful partnership based on transparency and mutual understanding.

Importance of Venture Capital Funds

Venture capital funds play a crucial role in driving innovation and economic growth by providing funding to early-stage and high-potential startups that may not have access to traditional sources of financing.

Impact on Innovation and Economic Growth

- Venture capital funds fuel innovation by investing in cutting-edge technologies and disruptive business models that have the potential to transform industries.

- These funds help bridge the gap between ideas and commercialization, fostering the development of new products and services that drive economic growth.

- By taking calculated risks on innovative ventures, venture capital funds contribute to job creation, wealth generation, and overall economic prosperity.

Support for Entrepreneurship

- Venture capital funds provide not only financial support but also valuable expertise, mentorship, and networking opportunities to entrepreneurs.

- These funds enable startups to scale and grow rapidly, accelerating their path to success and market dominance.

- Through strategic guidance and access to resources, venture capital firms empower entrepreneurs to navigate challenges and capitalize on opportunities.

Success Stories

- Companies like Google, Facebook, and Amazon have all received funding from venture capital firms in their early stages, propelling them to become global tech giants.

- Startups such as Airbnb, Uber, and Spotify have also benefited from venture capital funding, transforming them into industry disruptors and market leaders.

- These success stories highlight the pivotal role that venture capital funds play in identifying and nurturing promising startups with the potential for exponential growth and impact.