Yo, dive into the world of Understanding inflation rates where the cash flow and economy collide in a wild ride. Get ready to unravel the mysteries behind rising prices and economic impacts.

Let’s break down the basics and get to the juicy details of how inflation rates shape our financial landscape.

What is Inflation?

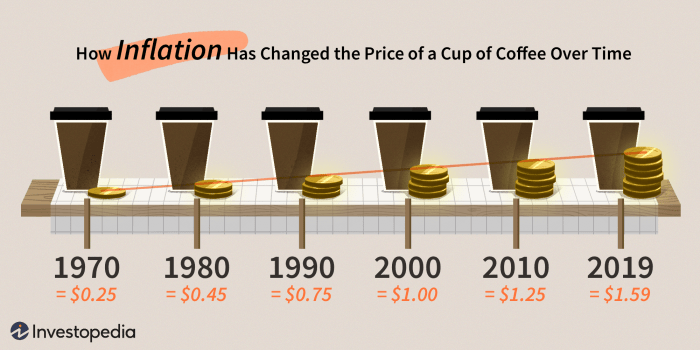

Inflation refers to the general increase in prices of goods and services in an economy over a period of time. It results in the decrease in the purchasing power of a currency, as more money is needed to buy the same amount of goods and services.

How is Inflation Measured?

Inflation is typically measured using the Consumer Price Index (CPI), which tracks the prices of a fixed basket of goods and services commonly purchased by households. The percentage change in the CPI over time indicates the rate of inflation. Additionally, the Producer Price Index (PPI) measures the average change in selling prices received by domestic producers for their output.

Impact of Inflation on the Economy

- Inflation erodes the value of money, leading to a decrease in purchasing power for consumers. This can result in lower standards of living for individuals and families.

- Businesses may struggle with higher costs of production as wages and prices increase, affecting profitability and potentially leading to layoffs or reduced investments.

- Inflation can also impact interest rates, with central banks adjusting rates to control inflation. Higher interest rates can discourage borrowing and spending, slowing economic growth.

- Uncertainty caused by high inflation rates can lead to instability in financial markets, affecting investments and overall economic performance.

Types of Inflation

Inflation can be classified into different types based on the underlying causes and effects it has on the economy. Here are some of the main types of inflation:

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the available supply, leading to an increase in prices. This type of inflation is often associated with strong economic growth and increased consumer spending. For example, when there is a sudden surge in demand for a particular product, its price may increase due to scarcity.

Cost-Push Inflation

Cost-push inflation happens when the production costs of goods and services increase, causing businesses to raise prices to maintain their profit margins. This type of inflation can be triggered by factors such as rising wages, raw material costs, or energy prices. For instance, if the cost of oil rises significantly, it can lead to higher prices for transportation and other goods that rely on oil.

Built-In Inflation

Built-in inflation, also known as wage-price spiral, occurs when workers demand higher wages to keep up with the rising cost of living, and businesses subsequently increase prices to cover these wage hikes. This creates a cycle where rising prices lead to higher wages, which in turn lead to even higher prices. Over time, this can result in a self-perpetuating cycle of inflation. An example of built-in inflation is when annual wage increases become a standard practice, leading to a continuous rise in prices.

Each type of inflation has its own set of causes and effects on the economy. While demand-pull inflation is typically associated with economic growth, cost-push inflation can lead to reduced consumer purchasing power. Built-in inflation, on the other hand, can create instability in the economy by fueling expectations of future price increases.

Factors Influencing Inflation Rates

Inflation rates are influenced by various factors that play a significant role in shaping the economy. Understanding these factors is crucial to comprehend the dynamics of inflation and its impact on the overall economic landscape.

Money Supply

The amount of money circulating in the economy has a direct impact on inflation rates. An increase in the money supply without a corresponding increase in goods and services can lead to a rise in prices, causing inflation. This is because people have more money to spend, but the same amount of goods available for purchase, driving prices up.

Demand

Consumer demand also plays a crucial role in influencing inflation rates. When demand for goods and services exceeds supply, prices tend to increase, leading to inflation. Factors such as consumer confidence, disposable income, and overall economic conditions can impact demand and subsequently affect inflation rates.

Production Costs

The cost of production for businesses can impact inflation rates as well. When production costs, such as labor, raw materials, and energy expenses, increase, businesses may pass on these costs to consumers in the form of higher prices. This cost-push inflation can contribute to overall inflation rates in the economy.

Government Policies and External Factors

Government policies, such as monetary and fiscal measures, can also influence inflation rates. For example, central banks adjusting interest rates or implementing quantitative easing can impact the money supply and subsequently affect inflation. External factors like international trade, geopolitical events, and natural disasters can also impact inflation rates by affecting supply chains and production costs.

Relationship between Inflation and Interest Rates

There is a close relationship between inflation and interest rates. Central banks often adjust interest rates in response to inflationary pressures. Higher inflation rates may prompt central banks to raise interest rates to curb spending and reduce inflation. Conversely, lower inflation rates may lead to lower interest rates to stimulate spending and economic growth.

Effects of Inflation

Inflation can have a significant impact on consumers, businesses, and the overall economy. It affects purchasing power, savings, and can lead to various financial challenges.

Impact on Consumers

- Decreased purchasing power: As prices rise, the same amount of money can buy fewer goods and services, reducing the standard of living for consumers.

- Erosion of savings: Inflation can erode the value of savings over time, making it harder for individuals to reach their financial goals.

- Uncertainty: Rising prices can create uncertainty for consumers, making it difficult to plan for the future and potentially impacting consumer confidence.

Impact on Businesses

- Cost of production: Inflation can increase the cost of raw materials, labor, and other inputs, reducing profit margins for businesses.

- Pricing strategies: Businesses may need to adjust their pricing strategies to account for inflation, potentially leading to higher prices for consumers.

- Investment decisions: Inflation can impact investment decisions, as businesses may need to allocate more resources to offset the effects of rising prices.

Mitigating the Effects of Inflation

- Diversifying investments: Individuals can mitigate the effects of inflation by diversifying their investments across different asset classes.

- Adjusting wages: Businesses can consider adjusting employee wages to keep up with inflation and maintain employee purchasing power.

- Hedging strategies: Businesses can use hedging strategies to protect against the impact of inflation on input costs and prices.