Dive into the world of Understanding financial ratios, where numbers tell a story of a company’s financial health and performance. Get ready to unravel the mysteries behind these crucial metrics that drive decision-making and shape the business landscape.

As we journey through the realm of financial ratios, we’ll uncover the key insights and calculations that empower investors, analysts, and stakeholders to make informed choices.

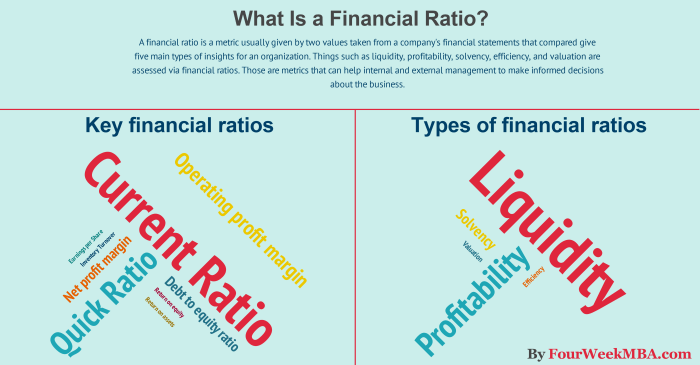

What are Financial Ratios?

Financial ratios are tools used in financial analysis to evaluate a company’s performance and financial health. These ratios provide insights into various aspects of a company’s operations, profitability, liquidity, and solvency.

Significance of Financial Ratios

Financial ratios play a crucial role in assessing a company’s financial health as they help investors, analysts, and stakeholders to make informed decisions. By analyzing these ratios, one can determine the efficiency of a company’s operations, its ability to generate profits, manage debt, and meet its financial obligations.

- Profitability Ratios: These ratios measure a company’s ability to generate profits relative to its revenue, assets, or equity. Examples include:

- Profit Margin:

Net Income / Revenue

- Return on Assets (ROA):

Net Income / Total Assets

- Profit Margin:

- Liquidity Ratios: These ratios assess a company’s ability to meet its short-term obligations. Examples include:

- Current Ratio:

Current Assets / Current Liabilities

- Quick Ratio:

(Current Assets – Inventory) / Current Liabilities

- Current Ratio:

- Debt Ratios: These ratios indicate a company’s leverage and ability to repay its debt. Examples include:

- Debt-to-Equity Ratio:

Total Debt / Shareholders’ Equity

- Interest Coverage Ratio:

EBIT / Interest Expense

- Debt-to-Equity Ratio:

Types of Financial Ratios

Financial ratios are essential tools used by investors, analysts, and companies to evaluate the financial health and performance of a business. These ratios can be classified into different categories based on the aspect of a company’s operations they assess. The main categories of financial ratios include liquidity, profitability, solvency, and efficiency.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. These ratios indicate how easily a company can convert its assets into cash to pay off its current liabilities. Some common liquidity ratios include:

- Current Ratio: Calculated by dividing current assets by current liabilities, this ratio shows the company’s ability to cover its short-term obligations.

- Quick Ratio (Acid-Test Ratio): This ratio is a more stringent measure of liquidity as it excludes inventory from current assets.

Profitability Ratios

Profitability ratios assess a company’s ability to generate profits relative to its revenue, assets, or equity. These ratios help investors determine the efficiency of a company in generating profits. Some common profitability ratios include:

- Net Profit Margin: Calculated by dividing net income by total revenue, this ratio indicates the percentage of revenue that translates into profit.

- Return on Assets (ROA): This ratio measures how effectively a company utilizes its assets to generate profits.

Solvency Ratios

Solvency ratios evaluate a company’s long-term financial stability and its ability to meet long-term debt obligations. These ratios provide insights into a company’s long-term financial health. Some common solvency ratios include:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity, indicating the proportion of financing that comes from debt.

- Interest Coverage Ratio: It measures a company’s ability to pay interest on its outstanding debt with its operating income.

Efficiency Ratios

Efficiency ratios assess how well a company utilizes its assets and liabilities to generate revenue and manage its operations. These ratios provide insights into the operational efficiency of a company. Some common efficiency ratios include:

- Asset Turnover Ratio: This ratio measures how efficiently a company uses its assets to generate revenue.

- Inventory Turnover Ratio: It indicates how many times a company sells and replaces its inventory within a specific period.

Understanding Liquidity Ratios

In the world of finance, liquidity ratios play a vital role in determining a company’s short-term financial health. These ratios help assess a company’s ability to meet its immediate obligations.

Current Ratio and Quick Ratio

Liquidity ratios are calculated to gauge a company’s ability to pay off its short-term debts. The two most commonly used liquidity ratios are the current ratio and quick ratio.

- The current ratio is calculated by dividing current assets by current liabilities. It measures the company’s ability to cover its short-term liabilities with its current assets.

- The quick ratio, also known as the acid-test ratio, is a more stringent measure of liquidity. It excludes inventory from current assets and focuses on the most liquid assets that can be quickly converted to cash to cover short-term liabilities.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Examples of Liquidity Ratio Analysis

- If a company has a current ratio of 2, it means that it has $2 in current assets for every $1 in current liabilities. This indicates that the company is in a strong position to meet its short-term obligations.

- On the other hand, if a company has a quick ratio of 1, it means that its current assets excluding inventory are equal to its current liabilities. This may suggest that the company could have difficulty meeting its short-term debts without selling off inventory.

Exploring Profitability Ratios

Profitability ratios are essential metrics used to assess a company’s ability to generate profits and manage expenses effectively. By analyzing these ratios, investors and stakeholders can gain insight into a company’s financial health and performance.

Gross Profit Margin

The gross profit margin is a key profitability ratio that indicates the percentage of revenue that exceeds the cost of goods sold. It is calculated by subtracting the cost of goods sold from total revenue and dividing the result by total revenue. A high gross profit margin signifies that a company is effectively managing its production costs.

Net Profit Margin

The net profit margin measures the percentage of revenue that remains as net income after deducting all expenses, including taxes. It is calculated by dividing net income by total revenue. A higher net profit margin indicates better profitability and efficient cost management.

Return on Equity (ROE)

Return on Equity (ROE) is a profitability ratio that evaluates a company’s ability to generate profits from its shareholders’ equity. It is calculated by dividing net income by shareholders’ equity. A high ROE indicates that a company is effectively utilizing its equity to generate profits for its shareholders.

Delving into Solvency Ratios

Solvency ratios are crucial metrics that measure a company’s ability to meet its long-term financial obligations. These ratios provide insights into whether a company has the financial stability to sustain itself over an extended period.

Debt to Equity Ratio

The debt to equity ratio is a solvency ratio that compares a company’s total debt to its shareholders’ equity. It indicates the proportion of debt and equity used to finance a company’s assets. A high debt to equity ratio may signal that a company is relying heavily on debt to fund its operations, which can increase financial risk.

Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to pay interest on its outstanding debt. It is calculated by dividing earnings before interest and taxes (EBIT) by the interest expense. A higher ratio indicates that a company is more capable of meeting its interest obligations, while a lower ratio may raise concerns about the company’s financial health.

Real-world examples of solvency ratios in action can be seen in the comparison of two companies in the same industry. Company A has a debt to equity ratio of 0.5, indicating a conservative financing approach with more equity funding. On the other hand, Company B has a debt to equity ratio of 2.0, suggesting a higher reliance on debt to finance its operations. Additionally, Company A’s interest coverage ratio of 5 signifies a strong ability to cover interest expenses, while Company B’s ratio of 2 raises concerns about its ability to meet interest payments.

Efficiency Ratios and Operational Performance

Efficiency ratios play a crucial role in evaluating how well a company utilizes its assets and resources to generate revenue. These ratios provide insights into the operational performance and effectiveness of a business.

Asset Turnover Ratio

The asset turnover ratio is a key efficiency ratio that measures the company’s ability to generate revenue from its assets. It is calculated by dividing net sales by average total assets. A higher asset turnover ratio indicates that the company is using its assets efficiently to generate sales.

Inventory Turnover Ratio

The inventory turnover ratio is another important efficiency ratio that evaluates how effectively a company manages its inventory. It is calculated by dividing the cost of goods sold by average inventory. A high inventory turnover ratio suggests that the company is selling its inventory quickly, which can prevent obsolete stock and improve cash flow.

Implications

Efficiency ratios like asset turnover and inventory turnover provide valuable insights into the overall operational performance of a company. By analyzing these ratios, investors and stakeholders can assess how well a company is utilizing its assets and resources to generate revenue. A high efficiency ratio indicates effective asset management and operational performance, while a low ratio may signal inefficiencies that need to be addressed.