Real estate vs stocks sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the world of investing, exploring the differences and similarities between real estate and stock market investments will reveal intriguing insights that can shape your financial decisions.

Real Estate vs Stocks

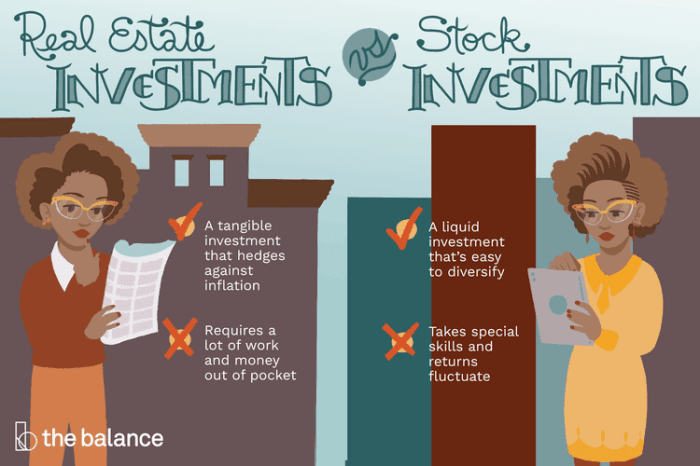

Real estate investing and stock market investments are two popular ways for individuals to grow their wealth over time. Real estate investing involves purchasing properties, such as residential homes or commercial buildings, with the goal of earning rental income or selling the property for a profit. On the other hand, stock market investments involve buying shares of publicly traded companies, with the potential to earn dividends and see the value of the shares appreciate over time.

Historical Performance

When comparing the historical performance of real estate investments to stocks, it is important to consider factors such as average annual returns, volatility, and overall market trends. Historically, stocks have generally outperformed real estate in terms of average annual returns. The stock market has seen higher average annual returns over long periods of time compared to real estate investments. However, real estate investments have the advantage of providing steady rental income, which can be a source of passive income for investors.

Liquidity

In terms of liquidity, stocks are generally more liquid than real estate investments. Stocks can be easily bought and sold on the stock market, providing investors with the ability to quickly access their funds. On the other hand, real estate investments can take longer to sell, as the process of finding a buyer and closing a sale can be more time-consuming. This lack of liquidity in real estate investments can make it difficult for investors to access their funds quickly in times of need.

Risk Factors

Both real estate and stocks come with their own set of risk factors. Real estate investments are subject to risks such as property depreciation, vacancies, and unexpected maintenance costs. On the other hand, stock market investments are exposed to market volatility, economic downturns, and company-specific risks. It is important for investors to carefully assess their risk tolerance and diversify their portfolios to minimize the impact of any potential risks in both real estate and stock investments.

Returns and Volatility

When it comes to investing in real estate versus stocks, understanding the differences in returns and volatility is crucial for making informed decisions.

Returns from Real Estate Investments

- Real estate investments typically generate returns through rental income, property appreciation, and potential tax benefits.

- Investors in real estate can also benefit from leveraging their investments through mortgages, which can amplify returns.

Returns from Stock Market Investments

- Stock market investments offer returns through capital gains, dividends, and potential stock splits.

- Investors in stocks can diversify their portfolios across different industries and sectors to potentially maximize returns.

Volatility of Real Estate Markets

Real estate markets tend to be less volatile compared to the stock market due to factors such as location, demand, and supply. While real estate values can fluctuate, they typically do so at a slower pace than stock prices.

Volatility of Stock Markets

Stock markets are known for their volatility, with prices constantly changing based on factors like company performance, economic indicators, and investor sentiment. This volatility can lead to significant fluctuations in stock prices in a short period of time.

Economic Factors Impacting Returns

- In real estate, factors like interest rates, housing market trends, and local economic conditions can influence returns on investments.

- For stocks, economic indicators such as GDP growth, inflation rates, and corporate earnings reports can impact stock prices and overall returns.

Potential for Long-Term Growth

- Real estate investments can provide steady long-term growth through property appreciation and rental income, making them a popular choice for investors looking for stability.

- Stock market investments, on the other hand, offer the potential for higher returns over the long term but come with higher volatility and risks.

Diversification and Risk Management

Investing in real estate can be a valuable addition to a diversified investment portfolio. Real estate assets typically have a low correlation with stocks and bonds, providing a buffer against market volatility. This can help spread risk and reduce the overall volatility of the portfolio.

Real Estate Diversification and Risk Management

When it comes to managing risks in real estate investing, there are several strategies that investors can employ. One common approach is diversifying across different types of properties, such as residential, commercial, and industrial real estate. This helps spread risk across various sectors of the real estate market and can help mitigate the impact of a downturn in any one sector.

Another risk management strategy is to invest in different geographic locations. By spreading investments across different markets, investors can reduce the risk of being heavily impacted by a downturn in a single market. Additionally, investing in real estate investment trusts (REITs) can provide exposure to real estate while also benefiting from the diversification and liquidity that comes with investing in publicly traded securities.

Impact of Market Downturns

During market downturns, real estate assets tend to be less volatile compared to stocks. While real estate values may decline during a downturn, they typically do not experience the same level of volatility as the stock market. This can provide stability to a portfolio and help cushion the impact of a broader market downturn.

Diversification in Real Estate and Stocks

Diversification is key to mitigating risks in both real estate and stock investments. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of a downturn in any one area of the market. This helps protect the overall portfolio from significant losses and provides a more stable long-term investment strategy.

Tax Implications and Financing

Investing in real estate or stocks involves different tax implications and financing options that can impact your overall returns and financial strategy. Let’s dive into the details below:

Tax Benefits of Real Estate vs Stocks

When it comes to tax benefits, real estate investments often offer more advantages compared to stocks. For example, real estate investors can take advantage of tax deductions such as mortgage interest, property taxes, depreciation, and even expenses related to property management. These deductions can help reduce taxable income and increase cash flow from real estate investments.

Financing Options for Real Estate vs Stocks

Financing options for investing in real estate include traditional mortgages, private loans, and even creative financing strategies like seller financing or partnerships. On the other hand, investing in stocks typically involves using personal funds or margin accounts provided by brokerage firms. The ability to leverage borrowed money for real estate investments can potentially lead to higher returns, but it also comes with higher risks compared to investing in stocks.

Impact of Interest Rates on Real Estate and Stock Market Investments

Interest rates play a crucial role in both real estate and stock market investments. Lower interest rates can make borrowing cheaper for real estate investors, leading to higher demand for properties and potentially driving up prices. Conversely, rising interest rates can make borrowing more expensive, reducing the affordability of real estate investments. In the stock market, interest rates can impact company earnings, borrowing costs, and overall market valuations.

The Role of Leverage in Real Estate vs Stock Market Investments

Leverage refers to using borrowed funds to increase the potential return on investment. In real estate, leverage is commonly used through mortgages to purchase properties with less personal capital. While leverage can amplify returns in a rising market, it can also magnify losses in a declining market. In contrast, leveraging in the stock market involves margin trading, where investors borrow funds to invest in stocks. The use of leverage in stocks can lead to higher profits but also increases the risk of significant losses if market conditions turn unfavorable.