Diving into the world of loan interest calculation, get ready to explore the ins and outs of how interest on loans is determined. From different types of loans to understanding the impact of factors like principal amount and interest rates, this topic will take you on a journey of financial knowledge like never before.

Get ready to crunch some numbers and gain a deeper understanding of loan interest calculation.

Introduction to Loan Interest Calculation

When you take out a loan, you not only have to pay back the amount you borrowed but also interest on top of that. Understanding how loan interest is calculated is crucial in managing your finances and making informed decisions. Let’s dive into the concept of loan interest calculation and its importance.

Types of Loans with Interest Calculation

- Personal Loans: These are unsecured loans with fixed or variable interest rates.

- Mortgages: Home loans with interest rates that can be fixed or adjustable.

- Auto Loans: Loans taken out to purchase a vehicle with varying interest rates.

Interest is typically calculated based on the principal amount borrowed, the interest rate, and the loan term.

Importance of Understanding Loan Interest Calculation

- Helps in budgeting: Knowing how much interest you’ll pay helps in planning your finances.

- Comparing loan offers: Understanding interest calculation allows you to compare different loan options.

- Affects total repayment: The way interest is calculated can significantly impact the total amount you repay.

Factors Affecting Loan Interest Calculation

When it comes to calculating loan interest, several key factors play a crucial role in determining the total amount of interest paid. These factors include the principal amount, interest rate, loan term, and compounding frequency.

Principal Amount

The principal amount of a loan is the initial sum borrowed from the lender. The higher the principal amount, the more interest will accrue over time. This is because interest is typically calculated as a percentage of the principal. Therefore, a larger principal amount will result in a higher total interest paid.

Interest Rate

The interest rate is the percentage charged by the lender for borrowing the principal amount. A higher interest rate will lead to a greater amount of interest being paid over the life of the loan. Borrowers should be mindful of the interest rate offered, as even a small difference can have a significant impact on the total interest paid.

Loan Term

The loan term refers to the length of time over which the loan is repaid. A longer loan term may result in a higher total interest paid, as interest accrues over a longer period. On the other hand, a shorter loan term can lead to lower overall interest costs, but higher monthly payments.

Compounding Frequency

Compounding frequency refers to how often the interest is calculated and added to the principal amount. The more frequently interest is compounded, the more interest will accrue. For example, a loan with monthly compounding will accumulate more interest compared to a loan with annual compounding, all else being equal.

Common Methods for Calculating Loan Interest

When it comes to calculating loan interest, there are several common methods used by lenders. Understanding these methods is essential for borrowers to make informed financial decisions. Two popular methods for calculating loan interest are simple interest and compound interest.

Simple Interest

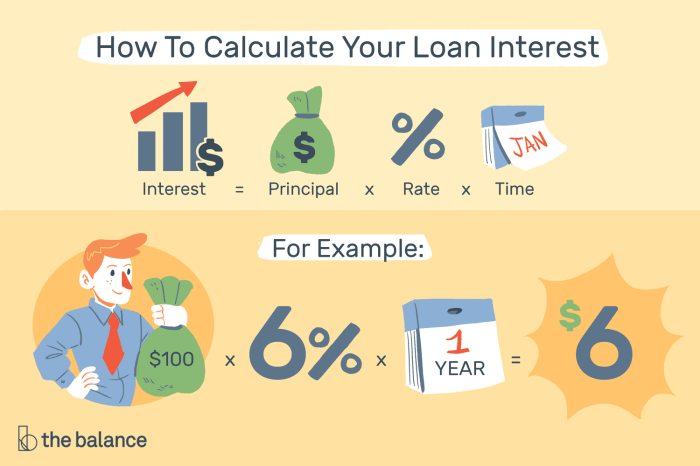

Simple interest is calculated based on the principal amount of the loan and the interest rate. The formula for calculating simple interest is:

Simple Interest = Principal Amount x Interest Rate x Time

For example, if you borrow $1,000 at an interest rate of 5% for 2 years, the simple interest would be calculated as:

Simple Interest = $1,000 x 0.05 x 2 = $100

Compound Interest

Compound interest takes into account the accumulated interest from previous periods along with the principal amount. This means that the interest is calculated not only on the initial loan amount but also on the interest that has been added to the balance. The formula for compound interest is:

Compound Interest = Principal Amount x (1 + Interest Rate)^n – Principal Amount

Where ‘n’ is the number of compounding periods. For example, if you borrow $1,000 at an interest rate of 5% compounded annually for 2 years, the compound interest would be calculated as:

Compound Interest = $1,000 x (1 + 0.05)^2 – $1,000 = $102.50

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant throughout the life of the loan, making it easier for borrowers to predict their monthly payments. On the other hand, variable interest rates can fluctuate based on market conditions, which can result in changes to the monthly payment amount.

Calculating Loan Interest

To calculate loan interest, follow these steps:

- Identify the principal amount borrowed.

- Determine the interest rate charged by the lender.

- Choose between simple interest or compound interest calculation based on the terms of the loan.

- Calculate the interest using the appropriate formula.

By understanding these common methods for calculating loan interest, borrowers can make informed decisions when taking out a loan.

Importance of Understanding Loan Amortization

Understanding loan amortization is crucial when it comes to managing your finances and making informed decisions about borrowing money. Loan amortization refers to the process of paying off a loan with regular payments over time, where each payment goes towards both the principal amount borrowed and the accrued interest.

An amortization schedule plays a key role in helping borrowers comprehend how their payments are divided between paying off the principal balance and covering the interest charges. This schedule Artikels the breakdown of each payment, showing the portion that goes towards reducing the principal amount and the portion allocated to paying the interest. By having a clear view of how their payments are distributed, borrowers can track their progress in repaying the loan and understand the impact of different payment amounts or schedules on the overall cost of borrowing.

Impact of Loan Amortization Schedules

An amortization schedule can have a significant impact on the total interest paid over the life of a loan. Different types of amortization schedules, such as fixed-rate or adjustable-rate schedules, can affect the distribution of payments and the total interest cost. For example, a shorter loan term with a higher monthly payment may result in lower total interest paid compared to a longer loan term with lower monthly payments, even if the interest rate is the same.

- Fixed-Rate Amortization: In a fixed-rate amortization schedule, the monthly payment remains the same throughout the loan term. This type of schedule ensures consistent payments towards both principal and interest, making it easier for borrowers to budget and plan for their payments. However, the interest cost may be higher compared to other types of schedules due to the longer repayment period.

- Adjustable-Rate Amortization: With an adjustable-rate schedule, the interest rate can fluctuate over time, leading to changes in the monthly payment amount. While these schedules may initially offer lower payments, there is a risk of increasing interest costs if rates rise in the future.