Yo, let’s talk about investment portfolio management, where we dive into the world of making that money work for you. It’s all about growing your wealth and securing your financial future, so buckle up and let’s ride this wave of investment strategies together.

Now, let’s break down the different types of investment portfolios, discuss the importance of diversification, and explore asset allocation strategies to help you make those money moves.

Introduction to Investment Portfolio Management

Investment portfolio management refers to the process of overseeing and making decisions about an investor’s collection of assets, such as stocks, bonds, real estate, and other financial instruments. It involves strategically balancing risk and return to achieve the investor’s financial goals.

Effective management of an investment portfolio is crucial for maximizing returns while minimizing risks. By diversifying investments across various asset classes and industries, investors can reduce the impact of market fluctuations on their overall portfolio performance. Additionally, actively monitoring and adjusting the portfolio can help capitalize on opportunities and mitigate potential losses.

Importance of Managing an Investment Portfolio

- Ensures optimal allocation of resources to achieve financial objectives

- Helps in mitigating risks by diversifying investments

- Allows investors to adapt to changing market conditions and opportunities

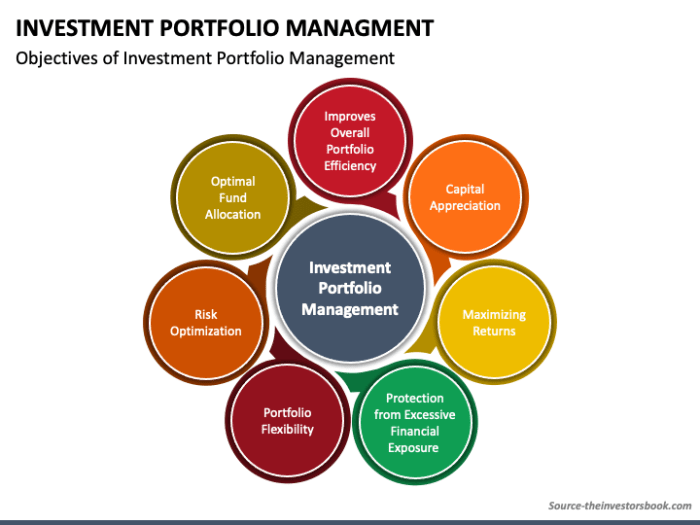

Goals of Investment Portfolio Management

- Maximizing returns: The primary goal is to generate the highest possible returns given the level of risk tolerance.

- Minimizing risks: By diversifying investments and monitoring performance, the aim is to reduce the impact of market volatility.

- Preserving capital: Protecting the initial investment amount is essential to ensure long-term financial stability.

Types of Investment Portfolios

When it comes to investment portfolios, there are several types that investors can choose from based on their financial goals and risk tolerance. Each type of portfolio has its own characteristics and risk levels, which can affect the overall performance of the investments.

Growth Portfolio:

A growth portfolio is focused on capital appreciation and aims to achieve long-term growth by investing in high-growth companies or sectors. These portfolios typically include stocks of companies with strong growth potential but may also include some high-risk investments. The risk level associated with growth portfolios is higher compared to other types, as they are more susceptible to market fluctuations.

Income Portfolio:

An income portfolio is designed to provide a steady stream of income through dividends, interest payments, and other sources. This type of portfolio usually includes bonds, dividend-paying stocks, and other income-generating assets. Income portfolios are considered less risky than growth portfolios, as they prioritize income generation over capital appreciation.

Balanced Portfolio:

A balanced portfolio combines elements of both growth and income portfolios to create a well-rounded investment strategy. It typically includes a mix of stocks, bonds, and other assets to achieve a balance between growth and income. Balanced portfolios aim to provide moderate growth while also generating a steady income stream. The risk level associated with balanced portfolios is moderate, as they offer a mix of both high-growth and income-generating assets.

Overall, the risk levels associated with different types of investment portfolios vary based on the investment strategy and asset allocation. It is essential for investors to consider their financial goals, risk tolerance, and investment horizon when choosing the right type of portfolio to achieve their desired outcomes.

Diversification in Investment Portfolio Management

Diversification is a strategy used in investment portfolio management to spread out investments across different assets to reduce risk. By not putting all your eggs in one basket, diversification aims to lower the overall risk of the portfolio.

Importance of Diversification

Diversification is crucial because it helps protect investors from significant losses that could occur if one particular investment underperforms. It allows investors to minimize risk without sacrificing potential returns by investing in a variety of assets.

- Diversification helps reduce volatility in the portfolio by offsetting potential losses in one asset class with gains in another.

- It can also improve the overall performance of the portfolio by capturing the growth opportunities of different asset classes.

- By spreading investments across various sectors, industries, and geographic regions, diversification can help minimize the impact of adverse events that may affect a specific market.

Benefits of Diversifying an Investment Portfolio

Diversifying an investment portfolio offers several benefits that can help investors achieve their financial goals.

- Lowering Risk: Diversification reduces the overall risk of the portfolio by spreading investments across different assets, thereby minimizing the impact of market fluctuations.

- Enhancing Returns: By investing in a mix of assets with varying levels of risk and return potential, diversification can improve the overall performance of the portfolio.

- Protecting Capital: Diversification helps protect the capital invested by reducing the likelihood of significant losses from a single investment or asset class.

Examples of How Diversification Reduces Risk

Diversification can be illustrated through examples of how spreading investments across different asset classes can help mitigate risk.

| Asset Class | Performance |

|---|---|

| Stocks | Volatility due to market fluctuations |

| Bonds | Stable income but lower returns |

| Real Estate | Long-term growth potential with market cycles |

Asset Allocation Strategies

Asset allocation is a crucial concept in investment portfolio management that involves dividing your investment portfolio among different asset classes to achieve a balance between risk and return. By diversifying across various asset classes, you can reduce the overall risk of your portfolio.

Different Asset Classes

- Stocks: Stocks represent ownership in a company and offer the potential for high returns but also come with higher risk.

- Bonds: Bonds are debt securities issued by governments or corporations, providing regular interest payments and lower risk compared to stocks.

- Real Estate: Real estate investments include properties like residential, commercial, or industrial real estate, offering potential income through rent and appreciation in value.

Asset Allocation Strategies

When creating an asset allocation strategy, it is essential to consider your risk tolerance and investment goals. Here are some common asset allocation strategies based on different risk profiles:

- Conservative Portfolio: A conservative investor may allocate a higher percentage of their portfolio to bonds and cash equivalents to prioritize capital preservation over high returns.

- Moderate Portfolio: A moderate investor may have a balanced allocation between stocks and bonds to achieve a mix of growth and stability.

- Aggressive Portfolio: An aggressive investor may allocate a significant portion of their portfolio to stocks to maximize growth potential, accepting higher volatility and risk.

It’s important to regularly review and adjust your asset allocation strategy to ensure it aligns with your changing financial circumstances and goals.

Monitoring and Rebalancing

Regularly keeping an eye on your investment portfolio is crucial to ensure that it aligns with your financial goals and risk tolerance. Monitoring allows you to make informed decisions and adjustments based on market conditions and changes in your personal circumstances.

Rebalancing your investment portfolio involves realigning your asset allocation back to its original targets. This is necessary because market fluctuations can cause your portfolio to deviate from your desired risk level. By rebalancing, you are essentially selling high-performing assets and buying underperforming ones to maintain your desired asset mix.

Importance of Monitoring

Regular monitoring helps you stay on track with your financial objectives. It allows you to identify when adjustments are needed due to changes in your risk tolerance, time horizon, or market conditions. Monitoring also helps you avoid unnecessary risks or missed opportunities.

- Review your portfolio periodically to ensure it reflects your current goals and risk tolerance.

- Monitor the performance of individual assets and overall portfolio to identify any underperforming or overperforming investments.

- Stay informed about market trends and economic developments that may impact your investments.

Process of Rebalancing

Rebalancing involves selling assets that have exceeded their target allocation and buying assets that have fallen below their target. This process helps maintain your desired risk level and prevents your portfolio from becoming too skewed towards one asset class.

Buy low, sell high – a key principle in rebalancing your investment portfolio.

- Set specific triggers or thresholds for rebalancing based on your asset allocation targets.

- Regularly review your portfolio to identify deviations from your target allocations.

- Determine which assets need to be bought or sold to bring your portfolio back in line with your targets.

Best Practices for Monitoring and Rebalancing

- Establish a schedule for monitoring and rebalancing your portfolio, such as quarterly or annually.

- Consider using automated tools or working with a financial advisor to help with monitoring and rebalancing.

- Stay disciplined and avoid emotional decision-making when rebalancing your portfolio.

- Document your monitoring and rebalancing activities to track your progress and decision-making process.

Performance Evaluation

When it comes to evaluating the performance of an investment portfolio, there are several key factors to consider. By analyzing these metrics, investors can determine how well their investments are doing and make informed decisions about their portfolio strategy.

Key Performance Metrics

- Return on Investment (ROI): This metric calculates the profitability of an investment by comparing the gain or loss from an investment relative to its cost.

- Sharpe Ratio: The Sharpe Ratio measures the risk-adjusted return of an investment, taking into account the volatility of the portfolio.

- Alpha: Alpha measures the excess return of an investment compared to the return predicted by a benchmark index.

It is essential to consider a combination of these metrics to get a comprehensive view of the performance of an investment portfolio.

Tools and Techniques for Performance Evaluation

- Portfolio Management Software: Utilizing specialized software can help investors track and analyze the performance of their portfolios in real-time.

- Comparative Analysis: By comparing the performance of their portfolio against relevant benchmarks and peers, investors can gain valuable insights into how well their investments are performing.

- Risk Assessment Tools: Tools that assess the risk levels of different investments within a portfolio can help investors make informed decisions about risk management.