Investing in healthcare stocks opens the door to a world of possibilities, where the heartbeat of the market pulses with innovation and opportunity. This captivating journey delves into the realm of healthcare stocks, offering insights that blend sophistication with a touch of rebellious flair.

As we navigate through the intricacies of this dynamic sector, we uncover the hidden gems and untapped potential that lie within the realm of healthcare investments.

Understanding Healthcare Stocks

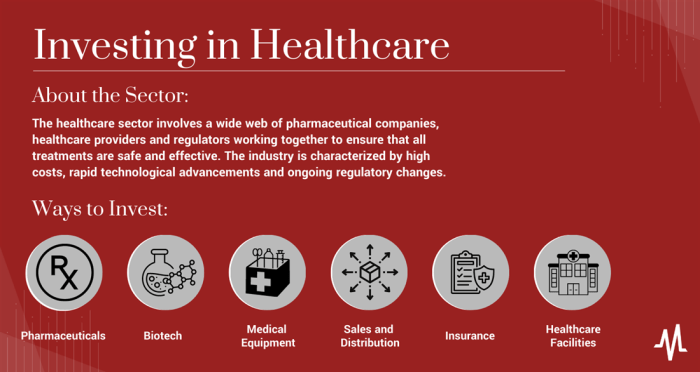

Investing in healthcare stocks involves purchasing shares of companies operating in the healthcare industry. These companies can range from pharmaceutical firms to medical device manufacturers to healthcare providers.

Key Factors Influencing Healthcare Stock Prices

- Regulatory Environment: Changes in healthcare regulations can significantly impact stock prices. For example, drug approvals, insurance policies, or healthcare reforms can affect the profitability of healthcare companies.

- Technological Advancements: Innovation in healthcare, such as new treatments or medical devices, can drive stock prices up for companies leading the way in these advancements.

- Market Demand: Demographics, population growth, and health trends play a role in determining the demand for healthcare services and products, influencing stock prices accordingly.

Benefits and Risks of Investing in Healthcare Stocks

- Benefits:

- Potential for Growth: Healthcare is a vital industry with constant innovation, offering opportunities for companies to expand and increase stock value.

- Diversification: Investing in healthcare stocks can provide diversification to a portfolio, as the sector is less correlated with others.

- Defensive Nature: Healthcare stocks tend to be less volatile during economic downturns, providing a degree of stability to an investment portfolio.

- Risks:

- Regulatory Risks: Changes in regulations or healthcare policies can negatively impact stock prices and the overall performance of healthcare companies.

- Clinical Trials: Pharmaceutical companies heavily rely on successful clinical trials for new drugs, which can be risky and unpredictable, affecting stock prices.

- Competition: The healthcare industry is competitive, and companies need to constantly innovate to stay ahead, posing risks to investors if a company fails to adapt.

Research and Analysis

When investing in healthcare stocks, conducting thorough research and analysis is crucial to making informed decisions and maximizing returns. By understanding the healthcare industry, different sectors, and staying updated on the latest news, investors can identify promising opportunities and mitigate risks.

Strategies for Researching Healthcare Companies

- Utilize financial statements and ratios to assess the company’s financial health.

- Explore the company’s products, services, and competitive advantages in the market.

- Analyze industry trends, regulations, and potential growth drivers impacting the company.

- Consider the company’s management team and their track record in the healthcare sector.

Comparing Different Healthcare Sectors for Investment

- Pharmaceuticals: Evaluate drug pipelines, patent expirations, and regulatory approvals.

- Biotechnology: Assess research and development pipelines, clinical trial results, and potential breakthrough innovations.

- Healthcare Services: Look into demographics, reimbursement trends, and market competition.

- Medical Devices: Consider technological advancements, regulatory approvals, and market demand.

Importance of Staying Updated on Healthcare Industry News

- Market Developments: Stay informed on mergers, acquisitions, and regulatory changes impacting healthcare companies.

- Clinical Trials: Monitor updates on drug approvals, clinical trial results, and potential market opportunities.

- Economic Indicators: Understand how macroeconomic factors can influence the healthcare industry and stock prices.

- Global Health Events: Be aware of pandemics, epidemics, and other health crises that can affect healthcare stocks.

Financial Metrics

In analyzing healthcare stocks, it is crucial to understand the financial metrics that drive the performance of healthcare companies. By examining key financial ratios and metrics, investors can gain valuable insights into the financial health and stability of these companies.

Analyzing Financial Statements

Financial statements provide a comprehensive view of a healthcare company’s financial performance. Investors should pay close attention to the following aspects when analyzing financial statements:

- Revenue: Revenue represents the total income generated by a healthcare company through its core operations. Increasing revenue over time indicates growth and potential profitability.

- Earnings: Earnings, also known as net income, reflect the company’s profitability after deducting all expenses. Positive earnings are essential for sustainable growth and shareholder returns.

- Cash Flow: Cash flow measures the amount of cash coming in and going out of the business. Positive cash flow ensures that the company has enough liquidity to cover its expenses and invest in future growth.

Key Financial Ratios

When evaluating healthcare stocks, investors should consider the following key financial ratios to assess the company’s financial performance and valuation:

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares the company’s stock price to its earnings per share. A low P/E ratio may indicate an undervalued stock, while a high P/E ratio could suggest an overvalued stock.

- Debt-to-Equity Ratio: The debt-to-equity ratio measures the company’s leverage and financial risk. A high ratio may indicate that the company relies heavily on debt to finance its operations.

- Return on Equity (ROE): ROE measures the company’s profitability relative to its shareholders’ equity. A higher ROE indicates that the company is generating more profits with less equity investment.

Regulatory Environment

In the world of healthcare stocks, the regulatory environment plays a crucial role in shaping the performance of companies in this sector. Changes in healthcare regulations can have a significant impact on stock prices, making it essential for investors to stay informed and adapt their strategies accordingly.

Impact of Changing Healthcare Regulations

Government policies and regulations can directly influence the financial health of healthcare companies. For example, new regulations may increase compliance costs for companies, impacting their profitability. On the other hand, favorable regulations can create opportunities for growth and expansion. As a result, investors need to closely monitor regulatory changes and assess their potential impact on the companies they are investing in.

Government Policies and Company Performance

Government policies, such as changes in reimbursement rates or drug approval processes, can have a direct impact on healthcare companies’ performance. For instance, a policy change that limits reimbursement for certain medical procedures can negatively affect the revenue of companies operating in those areas. On the other hand, policies that promote innovation or increase access to healthcare services can benefit companies in the long run.

Monitoring Regulatory Risks

When investing in healthcare stocks, it is crucial to consider regulatory risks as part of your investment thesis. By understanding the regulatory landscape and staying informed about potential changes, investors can better assess the risks and rewards associated with each investment. This proactive approach can help mitigate the impact of regulatory changes on stock prices and improve overall investment outcomes.

Growth Potential

Investing in healthcare stocks offers significant growth potential due to several key factors driving the industry forward. Technological advancements, emerging markets, and regulatory changes all play a role in shaping the growth trajectory of healthcare companies.

Technological Advancements

Technological innovations such as telemedicine, artificial intelligence, and precision medicine are revolutionizing the healthcare industry. These advancements improve patient outcomes, increase operational efficiency, and drive revenue growth for healthcare companies. For example, the use of telemedicine allows healthcare providers to reach a wider patient base, leading to increased demand for related services and products.

Emerging Markets

The healthcare industry is expanding rapidly in emerging markets such as China, India, and Brazil. Rising disposable incomes, increasing healthcare awareness, and government initiatives to improve healthcare infrastructure are driving the growth of healthcare companies in these regions. Investing in healthcare stocks with exposure to emerging markets provides investors with access to high-growth opportunities and diversification benefits.

Regulatory Changes

Regulatory changes, such as the approval of new drugs and medical devices, can significantly impact the growth potential of healthcare companies. Positive regulatory developments can lead to increased sales and market share for companies operating in the healthcare sector. Conversely, negative regulatory changes can create challenges for healthcare companies, affecting their growth prospects. Staying informed about regulatory trends and their potential impact on healthcare stocks is essential for investors looking to capitalize on growth opportunities in the industry.