Unlock the secrets of financial statements in this guide packed with all the juicy details you need to know. From decoding balance sheets to analyzing income statements, get ready for a crash course in financial literacy like never before.

This guide will break down complex financial jargon into easy-to-understand concepts, giving you the confidence to navigate the world of finance with ease.

Understanding Financial Statements

Financial statements play a crucial role in business as they provide a snapshot of a company’s financial performance and position. These statements help stakeholders, such as investors, creditors, and managers, to make informed decisions based on the financial health of the organization.

Purpose of Financial Statements

- Income Statement: Shows the company’s revenue and expenses over a specific period, indicating profitability.

- Balance Sheet: Presents the company’s assets, liabilities, and equity at a given point in time, reflecting its financial position.

- Cash Flow Statement: Illustrates how cash flows in and out of the business, essential for assessing liquidity and solvency.

Importance of Analyzing Financial Statements

Financial statement analysis is crucial for decision-making as it helps in:

- Evaluating the company’s financial performance and identifying trends over time.

- Assessing the company’s ability to generate profits and manage its finances efficiently.

- Comparing the company’s financial performance with competitors and industry standards.

- Making informed investment decisions and predicting future financial outcomes.

Components of Financial Statements

Financial statements are crucial tools for analyzing the financial health of a company. They provide a snapshot of a company’s financial position, performance, and cash flow. Let’s delve into the key components of financial statements.

Balance Sheet

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. Key components of a balance sheet include:

- Assets: These are resources owned by the company, such as cash, inventory, property, and equipment.

- Liabilities: These are the company’s obligations, such as loans, accounts payable, and accrued expenses.

- Shareholders’ Equity: This represents the company’s net worth, calculated as the difference between total assets and total liabilities.

Income Statement

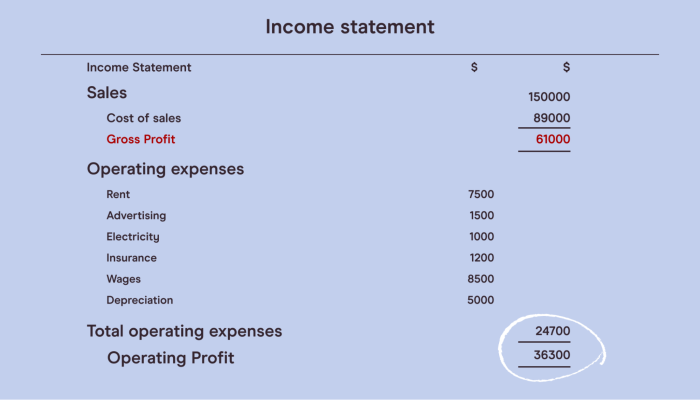

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and net income over a specific period. Elements included in an income statement are:

- Revenue: This is the total amount of money earned from sales of goods or services.

- Expenses: These are the costs incurred to generate revenue, including operating expenses, interest, and taxes.

- Net Income: This is the company’s total profit after deducting all expenses from revenue.

Cash Flow Statement

The cash flow statement shows how changes in balance sheet and income statement accounts affect cash and cash equivalents. It is divided into three main sections:

- Cash Flow from Operating Activities: This section shows the cash generated or used in the company’s core operations.

- Cash Flow from Investing Activities: This section details cash flow from the buying or selling of long-term assets.

- Cash Flow from Financing Activities: This section shows the cash flow from raising or repaying capital.

Reading a Balance Sheet

Understanding how to interpret a balance sheet is crucial for analyzing the financial health of a company. The balance sheet presents a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity.

Interpreting Assets, Liabilities, and Equity

- Assets: Assets represent what the company owns and include cash, inventory, property, equipment, and investments. These are resources that provide future economic benefits to the company.

- Liabilities: Liabilities are the company’s debts and obligations to external parties, such as loans, accounts payable, and bonds. They represent the company’s financial responsibilities.

- Equity: Equity is the difference between a company’s assets and liabilities. It represents the net worth of the company and is divided into retained earnings and shareholders’ equity.

Concept of Balance in a Balance Sheet

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet remains balanced, with total assets equaling total liabilities and equity. Any changes to one side of the equation must be accompanied by corresponding changes to maintain balance.

Common Items in a Balance Sheet

| Assets | Liabilities | Equity |

|---|---|---|

| Cash | Accounts Payable | Retained Earnings |

| Inventory | Loans Payable | Share Capital |

| Property | Accrued Expenses |

Analyzing an Income Statement

When analyzing an income statement, it is crucial to understand how to calculate and interpret profitability ratios, as well as the significance of revenue, expenses, and net income.

Calculating and Interpreting Profitability Ratios

- Profitability ratios are financial metrics used to assess a company’s ability to generate profit relative to its revenue, assets, and equity.

- Common profitability ratios include gross profit margin, operating profit margin, and net profit margin.

- To calculate gross profit margin, use the formula:

(Gross Profit / Revenue) x 100

- Operating profit margin is calculated as:

(Operating Profit / Revenue) x 100

- Net profit margin can be calculated as:

(Net Income / Revenue) x 100

Significance of Revenue, Expenses, and Net Income

- Revenue represents the total income generated from sales of goods or services and is a key indicator of a company’s performance.

- Expenses are the costs incurred by a company to generate revenue, including operating expenses, interest, and taxes.

- Net income is the residual amount after deducting all expenses from revenue and is a measure of profitability.

Comparing Different Periods

- Comparing income statements from different periods allows analysts to identify trends in revenue, expenses, and profitability over time.

- An increase in revenue and net income over consecutive periods indicates growth and improved performance.

- A decrease in profitability ratios or a rise in expenses relative to revenue may signal financial challenges or inefficiencies.

Interpreting a Cash Flow Statement

Understanding a company’s cash flow is crucial in assessing its financial health. Let’s delve into the key aspects of interpreting a cash flow statement.

Three Main Sections of a Cash Flow Statement

- The Operating Activities Section: This section shows the cash generated or spent from the company’s core business operations. It includes cash received from customers, payments to suppliers, and operating expenses.

- The Investing Activities Section: Here, you’ll find information about cash flow related to the purchase or sale of long-term assets, such as equipment or investments. It reflects the company’s investments in its future growth.

- The Financing Activities Section: This part details cash flow from activities like issuing or repurchasing stock, borrowing or repaying loans, and paying dividends. It shows how the company is funding its operations and expansion.

Importance of Cash Flow in Assessing Financial Health

The cash flow statement provides valuable insights into a company’s liquidity, solvency, and ability to meet its financial obligations. A positive cash flow indicates that the company is generating more cash than it’s spending, which is essential for long-term sustainability.

Examples of Cash Flow Activities

- Positive Operating Cash Flow: When a company receives more cash from its operations than it spends, it can reinvest in the business, pay off debts, or distribute dividends to shareholders.

- Negative Investing Cash Flow: If a company is heavily investing in new equipment or acquisitions, it may show a negative cash flow in the investing activities section. While this can be a sign of growth, it’s important to assess the impact on overall cash flow.

- Financing through Debt: Borrowing money to fund operations or expansion can result in a positive cash flow from financing activities. However, too much reliance on debt financing may raise concerns about the company’s financial stability.