Dive into the world of stock quotes with this guide that will unravel the mystery behind those numbers and symbols. Get ready for a wild ride through the ups and downs of the stock market, where knowledge is power and understanding is key.

Stock quotes may seem like a jumble of information at first glance, but fear not, by the end of this guide, you’ll be decoding them like a pro and making informed investment decisions.

Introduction to Stock Quotes

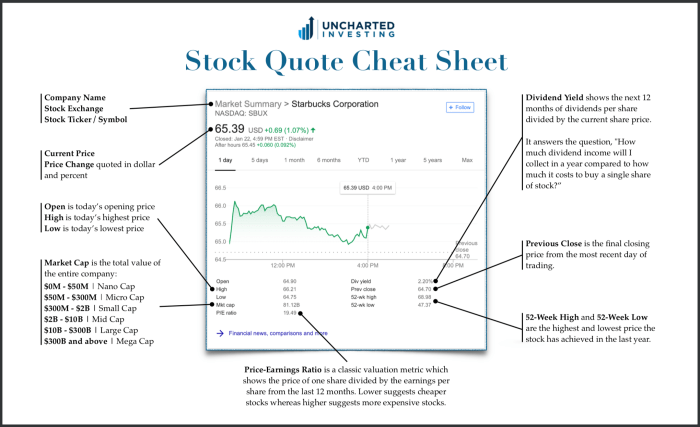

A stock quote is a snapshot of a stock’s current price and trading information on a particular stock exchange. It provides essential details for investors to make informed decisions about buying or selling stocks.

Components of a Stock Quote:

- The stock symbol: An abbreviation used to uniquely identify a particular stock on the exchange.

- Stock price: The current price at which the stock is trading on the exchange.

- Volume: The total number of shares traded in a specific time period, indicating the level of market activity.

- Market capitalization: The total value of a company’s outstanding shares, calculated by multiplying the stock price by the number of shares.

- 52-week high and low: The highest and lowest prices at which the stock has traded over the past year.

Importance of Understanding Stock Quotes:

Understanding stock quotes is crucial for investors as it helps them assess the performance of a stock, determine the market trends, and make informed decisions about their investment portfolios. By analyzing stock quotes, investors can track the financial health of companies, identify potential risks, and capitalize on investment opportunities.

Interpreting Stock Symbols

When it comes to interpreting stock symbols, they play a crucial role in identifying a company in the stock market. Each publicly traded company is assigned a unique stock symbol that represents the company on the stock exchange.

Significance of Stock Symbols

- Stock symbols are abbreviated codes used to uniquely identify publicly traded companies on the stock exchange.

- They make it easier for investors to search for and trade stocks of specific companies.

- Stock symbols are typically a combination of letters and sometimes numbers that represent the company’s name or industry.

Identifying a Company from its Stock Symbol

- For example, Apple Inc. is known by the stock symbol “AAPL” on the NASDAQ stock exchange.

- Similarly, Microsoft Corporation can be identified by the stock symbol “MSFT” on the NASDAQ.

- Each company’s stock symbol is unique and helps investors distinguish between different companies in the market.

Examples of Popular Stock Symbols

| Stock Symbol | Company |

|---|---|

| AAPL | Apple Inc. |

| AMZN | Amazon.com Inc. |

| GOOGL | Alphabet Inc. (Google) |

Understanding Stock Price

Stock price is the current value at which a share of a company’s stock is trading on the market. It plays a crucial role in a stock quote as it reflects the market’s perception of the company’s value.

There are several factors that can influence stock prices, including:

Factors Influencing Stock Prices

- Company Performance: Strong financial performance and positive news can lead to an increase in stock prices.

- Market Conditions: Overall market trends, economic indicators, and interest rates can impact stock prices.

- Investor Sentiment: The perception and emotions of investors can cause stock prices to fluctuate.

- Industry Trends: Developments within a specific industry can affect the stock prices of companies operating in that sector.

Fluctuations in stock prices can be interpreted in various ways:

Interpreting Fluctuations in Stock Prices

- Rising Stock Prices: An increase in stock prices may indicate positive news about the company, strong earnings reports, or increased investor confidence.

- Falling Stock Prices: A decrease in stock prices could be due to negative news, poor financial performance, or changes in market conditions.

- Volatility: Sudden and significant changes in stock prices can signal uncertainty in the market or investor reactions to new information.

Decoding Stock Market Indices

When it comes to the stock market, indices play a crucial role in providing a snapshot of the overall market performance. These indices are essentially benchmarks that help investors gauge the performance of a group of stocks or the market as a whole. Let’s dive into the world of stock market indices and decode their significance.

Major Stock Market Indices

- The S&P 500: This index tracks the performance of the 500 largest publicly traded companies in the U.S. It is considered a broad representation of the overall stock market due to its diverse range of companies across various sectors.

- Dow Jones Industrial Average: Commonly referred to as the Dow, this index consists of 30 large, publicly traded companies that are leaders in their respective industries. The Dow is often viewed as an indicator of the health of the U.S. economy.

- Nasdaq: The Nasdaq Composite Index includes more than 2,500 stocks, primarily in the technology and biotech sectors. It is known for its heavy weighting towards tech companies and is often used to track the performance of the tech industry.

Calculation and Significance of Stock Market Indices

Stock market indices are calculated using different methodologies, with each index having its own unique formula. Generally, indices are weighted based on factors like market capitalization or price. The significance of these indices lies in their ability to provide investors with a benchmark to compare their investments’ performance against the overall market.

Understanding stock market indices is crucial for investors to assess market trends and make informed decisions about their investment portfolios.

Analyzing Stock Volume

When it comes to analyzing stock quotes, understanding stock volume is crucial. Stock volume refers to the total number of shares of a particular stock that are traded during a specific period of time, typically a day.

Importance of Stock Volume

Stock volume is essential in analyzing market activity because it provides valuable insights into the level of interest or activity in a particular stock. High trading volume can indicate strong investor interest, while low trading volume may suggest a lack of interest or participation in the stock.

- High Volume: A significant increase in stock volume can signal a potential price movement, as it indicates a higher level of investor activity. It may suggest that a stock is gaining momentum or that a new trend is emerging.

- Low Volume: On the other hand, a decrease in stock volume may indicate a lack of conviction among investors or a period of consolidation. It could suggest that the stock is losing momentum or that the current trend is weakening.

Interpreting Changes in Stock Volume

Changes in stock volume can offer valuable insights into market sentiment and potential price movements. It is essential to pay attention to volume trends and how they correlate with stock price movements.

- Increasing Volume with Price Movement: If stock volume increases significantly along with a price movement in the same direction, it may confirm the strength of the trend. This alignment between volume and price movement can indicate a sustainable trend.

- Decreasing Volume with Price Movement: Conversely, if stock volume decreases while the price continues to move in a certain direction, it may suggest a weakening trend. This divergence between volume and price movement could indicate a potential reversal or a lack of conviction in the current trend.

Reading Stock Quote Tables

When it comes to making investment decisions in the stock market, understanding how to read a stock quote table is essential. A stock quote table provides a snapshot of a company’s stock performance at a given moment, allowing investors to assess the current market conditions and make informed choices.

Breakdown of a Typical Stock Quote Table

- The stock symbol: This is a unique series of letters assigned to a particular company’s stock for trading purposes. It helps investors easily identify the stock they are interested in.

- Bid price: The bid price is the highest price that a buyer is willing to pay for a stock at a given moment. It indicates the demand for the stock.

- Ask price: The ask price is the lowest price that a seller is willing to accept for a stock at a given moment. It reflects the supply of the stock.

- Last price: The last price is the most recent price at which the stock was traded.

- Volume: Volume represents the total number of shares traded for a particular stock during a specified period, typically a day.

Using a Stock Quote Table for Investment Decisions

- Assessing bid and ask prices: By comparing the bid and ask prices, investors can gauge the current market sentiment towards a stock. A narrower spread between the bid and ask prices indicates more liquidity and potentially lower transaction costs.

- Monitoring volume: High trading volume can indicate increased investor interest in a stock, potentially signaling a trend reversal or continuation. Low volume, on the other hand, may suggest a lack of conviction among investors.

- Interpreting last price movements: Analyzing changes in the last price can help investors identify short-term trends in a stock’s performance. For example, a consistent increase in the last price may indicate a bullish trend, while a series of declines could signal a bearish trend.