Looking to spice up your investment game? Dive into the world of commodities with our guide on how to invest in these unique assets. From gold to oil, we’ve got you covered with everything you need to know to get started.

Commodities offer a different flavor to traditional investments, providing a tangible and often lucrative opportunity for savvy investors. Let’s explore the ins and outs of investing in commodities together.

Understanding Commodities

Commodities, in the investment context, refer to raw materials or primary agricultural products that can be bought and sold. These can include items like oil, gold, wheat, and coffee.

Types of Commodities

- Hard Commodities: These are natural resources that are mined or extracted, such as gold, silver, and oil.

- Soft Commodities: These are agricultural products like corn, wheat, and coffee that are grown rather than mined.

- Energy Commodities: These include oil, natural gas, and electricity.

Characteristics of Commodities as an Investment Asset

- Low correlation to traditional assets: Commodities often move independently of stocks and bonds, providing diversification to a portfolio.

- Inflation hedge: Commodities can act as a hedge against inflation, as their prices tend to rise when inflation increases.

- Volatility: Commodities can be more volatile than other asset classes, leading to the potential for higher returns but also higher risk.

- Physical delivery: Some commodity investments involve the actual delivery of the underlying asset, adding a unique aspect to trading them.

Benefits of Investing in Commodities

Investing in commodities can offer various advantages to investors looking to diversify their portfolios and hedge against inflation. Commodities are tangible assets that have unique characteristics that set them apart from traditional investments like stocks and bonds.

Diversification

- Commodities have a low correlation with other asset classes, such as stocks and bonds, making them an effective way to diversify an investment portfolio.

- Adding commodities to a portfolio can help reduce overall risk and volatility, especially during times of market uncertainty.

Inflation Hedge

- Commodities have historically shown a positive correlation with inflation, meaning their prices tend to rise when inflation increases.

- Investing in commodities can help protect the value of an investment portfolio during periods of high inflation, as the prices of commodities typically increase in such environments.

Liquid and Transparent Markets

- Commodities markets are highly liquid, allowing investors to buy and sell commodities easily without significant price impact.

- Commodities markets are also transparent, with publicly available pricing information that allows investors to make informed decisions.

Ways to Invest in Commodities

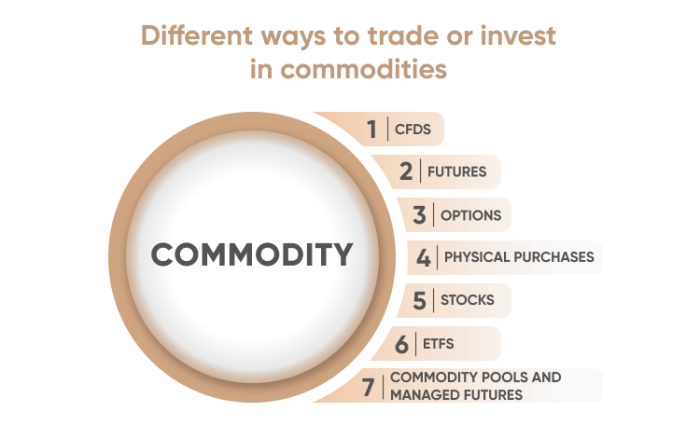

Investing in commodities can be done through various methods such as futures, options, ETFs, and physical assets. Each method has its own advantages and risks, so it’s important to understand how they work before making any investment decisions.

Popular Commodities for Investment

- Gold: Considered a safe haven asset, gold is often used as a hedge against inflation and economic uncertainty.

- Oil: One of the most widely traded commodities, oil prices are influenced by geopolitical events and supply-demand dynamics.

- Silver: Similar to gold, silver is also used as a store of value and has industrial applications.

- Corn: An agricultural commodity, corn prices are affected by factors such as weather conditions and global demand.

Risks Associated with Commodities Investing

Investing in commodities comes with certain risks that investors need to be aware of. These risks include:

Price Volatility: Commodities prices can be highly volatile, leading to potential losses for investors.

Market Speculation: Speculative trading in commodities can result in significant price fluctuations.

Regulatory Risks: Changes in regulations or government policies can impact the prices of commodities.

To mitigate these risks, investors can diversify their portfolio, conduct thorough research, and consider using risk management tools such as stop-loss orders. It’s important to carefully assess your risk tolerance and investment goals before venturing into commodities investing.

Factors to Consider Before Investing

When investing in commodities, there are several key factors that you should take into consideration to make informed decisions and maximize your returns.

Market Trends, Geopolitical Events, and Supply-Demand Dynamics

- Market Trends: Keep an eye on the current trends in the commodity market to anticipate potential price movements. Understanding market sentiment and the factors driving these trends can help you make strategic investment decisions.

- Geopolitical Events: Events such as political unrest, trade wars, or natural disasters can have a significant impact on commodity prices. Stay informed about global developments that could affect the supply and demand of commodities you are investing in.

- Supply-Demand Dynamics: Analyze the balance between supply and demand for the commodities you are interested in. A shift in this balance can lead to price fluctuations, so it’s essential to monitor these dynamics closely.

Role of Diversification

Diversification is crucial when investing in commodities to reduce risk and protect your investment portfolio. By spreading your investments across different types of commodities, you can minimize the impact of price volatility in any single market.

Evaluating the Performance of Commodities

- Monitor Price Movements: Regularly track the price movements of the commodities in your investment portfolio to assess their performance. Compare these movements against market trends and other relevant factors to make informed decisions.

- Risk Management: Evaluate the risk associated with each commodity investment and adjust your portfolio accordingly. Consider factors such as liquidity, volatility, and correlation with other asset classes to manage risk effectively.

- Review Historical Data: Analyze historical data of commodities to identify trends and patterns that can help you predict future price movements. Use this information to make strategic decisions and optimize your investment portfolio.