With how to calculate ROI at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

As we dive into the world of ROI calculations, get ready to unravel the secrets behind this crucial business metric.

What is ROI?

Return on Investment (ROI) is a financial metric used to evaluate the profitability of an investment. It is a ratio that compares the gain or loss from an investment relative to its cost.

Calculating ROI is crucial for businesses as it helps them determine the efficiency and success of their investments. By analyzing ROI, companies can make informed decisions about where to allocate resources and which projects to pursue.

Importance of Calculating ROI

- ROI provides a clear picture of the financial performance of an investment.

- It helps businesses prioritize projects with the highest potential returns.

- ROI analysis aids in budgeting and forecasting future investments.

- Allows companies to compare different investment opportunities to choose the most lucrative ones.

Examples of Why Businesses Need to Calculate ROI

- A company invests in a marketing campaign to increase sales. By calculating the ROI of the campaign, the business can assess if the investment generated enough revenue to justify the costs.

- When considering purchasing new equipment, a business can calculate the ROI to determine if the investment will lead to cost savings or increased productivity in the long run.

- For a software development project, ROI analysis helps in evaluating if the project will bring in enough revenue to cover development costs and generate profit.

Elements of ROI Calculation

When calculating ROI, there are key components that need to be considered in order to determine the return on investment. These elements play a crucial role in understanding the effectiveness of an investment and its impact on the overall profitability of a project or business.

Initial Investment

The initial investment is the amount of money put into a project or investment at the beginning. This includes all costs associated with the investment, such as purchase price, installation fees, and any other related expenses.

Net Profit

Net profit is the total revenue generated from the investment minus all expenses incurred. This includes revenue from sales, interest, dividends, and any other income, minus costs like operating expenses, taxes, and interest payments.

ROI Formula

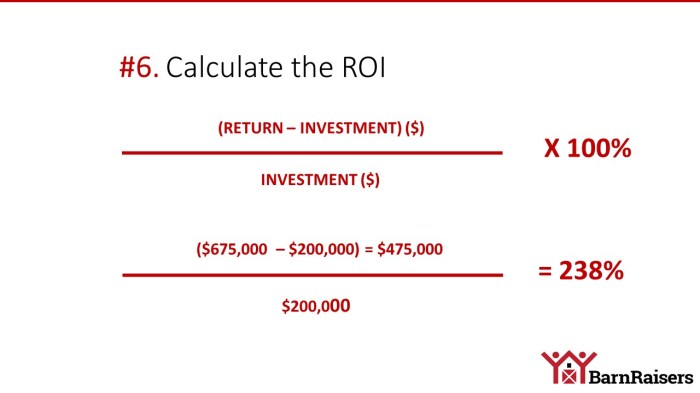

ROI is calculated using the following formula:

ROI = (Net Profit / Initial Investment) x 100

Steps to Calculate ROI

To calculate ROI, you need to follow a step-by-step process and gather the necessary data to ensure accurate results. Let’s dive into the details.

Gather Data

- Identify the initial investment: This includes all costs associated with the investment, such as purchase price, installation costs, and any other expenses incurred.

- Estimate the gain from the investment: Determine the total revenue generated or cost savings achieved as a result of the investment.

- Calculate the net profit: Subtract the initial investment from the total gain to find the net profit.

Calculate ROI

ROI = (Net Profit / Initial Investment) x 100

- Divide the net profit by the initial investment.

- Multiply the result by 100 to express the ROI as a percentage.

- Once you have the ROI value, you can assess the success of the investment and make informed decisions for the future.

Interpreting ROI Results

When it comes to interpreting ROI results, it’s essential to understand what the numbers are telling you about your investment. ROI is a key metric that helps you evaluate the profitability and efficiency of your investment over time. Let’s dive into how you can interpret ROI results and make informed decisions based on them.

Understanding Different ROI Values

- An ROI value greater than 1 indicates that the investment is profitable, with each dollar invested generating more than a dollar in return.

- An ROI value of 1 means that the investment has broken even, where the returns equal the initial investment.

- An ROI value less than 1 signifies that the investment is not profitable, as the returns are less than the initial investment.

Using ROI Results for Decision-Making

- High ROI values can indicate successful investments that are generating substantial returns, making them attractive for further investment.

- Low ROI values may signal underperforming investments that require reevaluation or reallocation of resources to improve profitability.

- Comparing ROI results across different investments can help prioritize projects and allocate resources effectively based on their potential returns.