Diving into Financial wellness programs, this introduction immerses readers in a unique and compelling narrative. From the importance of financial wellness in the workplace to the key components of effective programs, get ready to explore how these initiatives can benefit employees and organizations alike.

As we delve deeper, we’ll uncover the steps to implement these programs, the challenges that may arise, and how to measure their success. Let’s embark on this journey to financial well-being together.

Importance of Financial Wellness Programs

Financial wellness programs are crucial in the workplace to help employees manage their finances effectively and reduce stress related to money matters. These programs provide resources and tools to improve financial literacy, budgeting skills, and overall well-being.

Benefits of Financial Wellness Programs

- Increased Employee Productivity: When employees are less stressed about their finances, they can focus better on their work tasks and be more productive.

- Reduced Absenteeism: Financial wellness programs can help employees address financial issues proactively, reducing the need for taking time off work due to financial stress.

- Improved Job Satisfaction: By offering support for financial well-being, employers can show they care about their employees’ overall happiness and job satisfaction.

- Enhanced Retention Rates: Employees are more likely to stay with a company that invests in their well-being, including financial wellness programs.

Impact of Financial Stress on Employees

Financial stress can have a significant negative impact on employee productivity and overall well-being. It can lead to increased absenteeism, decreased job satisfaction, and even health issues. By implementing financial wellness programs, employers can help alleviate these stressors and create a healthier and more engaged workforce.

Components of Effective Financial Wellness Programs

Effective financial wellness programs consist of key components that are essential for success. These components include budgeting and saving strategies, financial education, and access to resources to help individuals make informed decisions about their finances.

Role of Budgeting and Saving

Budgeting is a crucial component of financial wellness programs as it helps individuals track their expenses, prioritize spending, and plan for future financial goals. By creating a budget, individuals can identify areas where they can cut costs and save money, ultimately improving their overall financial health. Saving is also important as it allows individuals to build an emergency fund, save for major expenses, and invest in their future.

Importance of Financial Education and Resources

Financial education plays a vital role in financial wellness programs as it helps individuals understand key financial concepts, such as budgeting, saving, investing, and managing debt. By providing financial education, individuals can make informed decisions about their finances and develop healthy financial habits. Access to resources, such as financial advisors, online tools, and workshops, can further support individuals in their financial journey by providing them with the knowledge and tools they need to succeed.

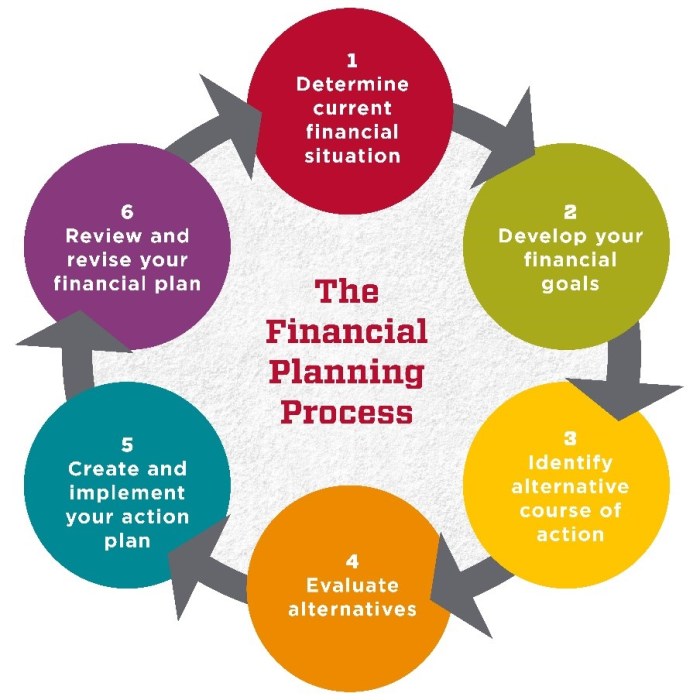

Implementing Financial Wellness Programs

Implementing a financial wellness program in a company involves several key steps to ensure its success. From planning and communication to evaluation and improvement, here are some best practices for organizations looking to promote financial wellness among employees.

Planning and Preparation

- Conduct a needs assessment to understand the financial challenges and goals of employees.

- Develop a comprehensive financial wellness program tailored to the needs identified.

- Secure buy-in from senior leadership to ensure support and resources for the program.

Promoting Employee Participation

- Communicate the benefits of the financial wellness program clearly and regularly to employees.

- Offer incentives or rewards for participation, such as financial education workshops or one-on-one coaching sessions.

- Create a supportive and inclusive environment that encourages open discussions about personal finances.

Challenges Faced by Organizations

- Resistance to change: Some employees may be hesitant to engage with financial wellness programs due to fear or lack of awareness.

- Lack of resources: Organizations may struggle to allocate budget and time for implementing and maintaining the program.

- Privacy concerns: Employees may be reluctant to share personal financial information, impacting the effectiveness of the program.

Measuring the Success of Financial Wellness Programs

Financial wellness programs are only effective if their impact can be measured accurately. By evaluating key performance indicators (KPIs), employers can assess the success of these programs and make necessary adjustments to improve outcomes for both employees and the organization as a whole.

Employee Engagement and Satisfaction

- Employee participation rates in financial wellness activities

- Feedback from employees on the usefulness of the program

- Improvement in employee stress levels related to financial matters

Financial Behavior Changes

- Savings rate increases among employees

- Decrease in the number of employees taking out loans or using high-interest credit

- Positive changes in spending habits and budgeting skills

Return on Investment (ROI)

- Reduction in healthcare costs due to improved financial wellness

- Decrease in absenteeism and presenteeism related to financial stress

- Increased productivity and job satisfaction