Diving into the world of financial hedging strategies, we’re about to uncover the secrets to managing risks like a pro. From defining these strategies to exploring their importance, get ready for a rollercoaster ride through the world of finance.

Get your seat belts fastened because this is going to be one informative and exciting journey through the realm of financial hedging strategies.

Overview of Financial Hedging Strategies

Financial hedging strategies are techniques used by businesses and investors to protect themselves against potential losses due to market fluctuations. These strategies are crucial in risk management as they help mitigate the impact of adverse movements in asset prices, interest rates, or currency exchange rates.

The primary objectives of implementing financial hedging strategies include reducing exposure to risk, stabilizing cash flows, and protecting profits. By using various financial instruments, individuals and organizations can effectively manage their risk exposure and maintain financial stability even in uncertain market conditions.

Types of Financial Instruments Used in Hedging

- Forward Contracts: These agreements allow parties to lock in a future price for an asset, reducing the risk of price fluctuations.

- Options: These contracts give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a set timeframe.

- Swaps: These agreements involve exchanging cash flows or assets based on predetermined terms, helping to manage interest rate or currency risks.

- Futures Contracts: Similar to forward contracts, futures allow parties to buy or sell assets at a future date at a predetermined price.

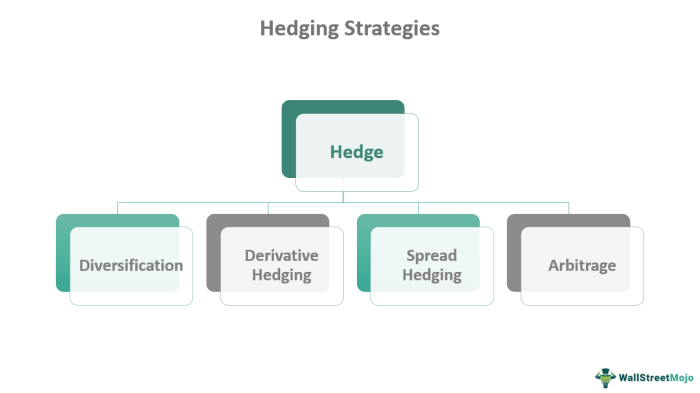

Types of Financial Hedging Strategies

When it comes to financial hedging strategies, there are several common types that are frequently used by investors to manage risk and protect their investments. Let’s dive into some of the most popular ones:

Forward Contracts

Forward contracts are agreements between two parties to buy or sell an asset at a specified price on a future date. This type of hedging strategy is commonly used to lock in a future price for an asset, protecting against price fluctuations in the market. For example, a company that knows it will need to purchase a large quantity of a commodity in the future may enter into a forward contract to secure a favorable price.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. This type of financial hedging strategy provides flexibility for investors to hedge against price movements without being locked into a specific transaction. For instance, an investor holding a stock may purchase a put option to protect against a potential decrease in the stock’s value.

Swaps

Swaps involve the exchange of cash flows or assets between two parties, typically to manage interest rate or currency risk. This type of hedging strategy allows investors to customize their exposure to different types of risk by swapping one set of cash flows for another. For example, a company with a variable interest rate loan may enter into an interest rate swap to convert it into a fixed rate loan.

Speculative vs. Non-Speculative Hedging Strategies

It’s important to note the distinction between speculative and non-speculative hedging strategies. Speculative strategies are used to generate profit from price movements, while non-speculative strategies are focused on protecting against losses. Investors need to carefully consider their risk tolerance and investment goals when deciding which type of hedging strategy to employ.

Suitability of Financial Hedging Strategies

Each type of financial hedging strategy has its own unique benefits and considerations, making them suitable for different situations. Forward contracts are ideal for companies looking to secure future prices, options provide flexibility for investors managing risk, and swaps allow for customization of risk exposure. It’s crucial for investors to assess their specific needs and goals to determine the most appropriate hedging strategy to use.

Factors Influencing the Choice of Hedging Strategies

When it comes to selecting the right hedging strategies, several key factors come into play. These factors can significantly impact the effectiveness of the hedging approach and ultimately determine the level of risk mitigation achieved.

Market Conditions

Market conditions play a crucial role in choosing the appropriate hedging strategies. Volatility, interest rates, currency fluctuations, and overall economic outlook can all influence the effectiveness of different hedging instruments. For example, in a highly volatile market, options or futures contracts may be more suitable for hedging against price fluctuations.

Industry Trends

Industry-specific trends also impact the choice of hedging strategies. Different industries face unique risks and challenges that require tailored hedging approaches. For instance, commodity producers may use forward contracts to hedge against price fluctuations, while exporters may utilize currency swaps to manage foreign exchange risk.

Financial Goals

Financial goals play a significant role in determining the appropriate hedging strategies. Whether the goal is to protect profits, ensure cash flow stability, or minimize losses, the chosen hedging instruments should align with these objectives. For instance, a company focused on preserving capital may opt for conservative hedging strategies with lower risk exposure.

Risk Tolerance and Time Horizon

Considering risk tolerance and time horizon is crucial when designing hedging strategies. Different companies and investors have varying levels of risk appetite and investment timeframes. It’s essential to align the hedging approach with these factors to achieve the desired risk-return profile. For example, investors with a long-term horizon may choose hedging strategies that provide protection over an extended period, while those with a shorter time horizon may opt for more short-term hedging solutions.

Implementation of Financial Hedging Strategies

Implementing a financial hedging strategy involves several key steps to ensure its success. By following a structured approach, companies can effectively manage risks and protect their financial positions.

Steps in Implementing a Financial Hedging Strategy

- Evaluate Risk Exposure: Identify the specific risks that need to be hedged, such as currency fluctuations, interest rate changes, or commodity price volatility.

- Set Clear Objectives: Define the goals of the hedging strategy, whether it’s to minimize losses, stabilize cash flows, or protect profit margins.

- Choose Appropriate Instruments: Select the right hedging instruments, such as futures contracts, options, swaps, or forwards, based on the identified risks and objectives.

- Develop a Hedging Plan: Create a detailed plan outlining the timing, quantities, and terms of the hedging transactions to be executed.

- Monitor and Adjust: Continuously monitor the effectiveness of the hedging strategy and make adjustments as needed to optimize results and mitigate risks.

Case Study: Successful Implementation of a Hedging Strategy

Company XYZ, a multinational manufacturer, implemented a currency hedging strategy to protect against adverse exchange rate movements. By using forward contracts to lock in favorable rates for future transactions, the company was able to mitigate the impact of currency fluctuations and maintain stable profit margins.

Role of Financial Experts in Implementing Hedging Strategies

Financial experts or advisors play a crucial role in assisting companies with the implementation of hedging strategies. They provide valuable insights, expertise, and guidance throughout the process, helping businesses navigate complex financial markets and make informed decisions. Additionally, they can offer customized solutions tailored to the specific needs and risk profiles of each company, ensuring effective risk management and optimal outcomes.