Get ready to dive into the world of financial decision making, where every choice you make can have a lasting impact on your future. From exploring external factors to understanding cognitive biases, this topic is a goldmine of knowledge waiting to be uncovered. So, buckle up and let’s explore the ins and outs of making sound financial decisions.

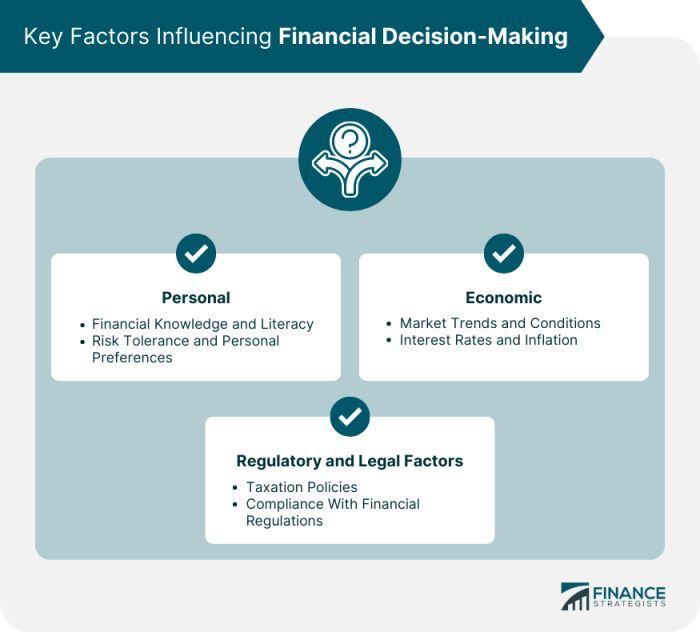

Factors Influencing Financial Decision Making

When it comes to making financial decisions, there are various external factors that can greatly impact the choices individuals make. These factors can range from personal beliefs and values to societal norms, all of which play a crucial role in shaping our financial decisions.

Personal Beliefs and Values

Personal beliefs and values can have a significant influence on how individuals make financial choices. For example, someone who values experiences over material possessions may be more inclined to spend money on travel or dining out rather than on buying expensive items. On the other hand, individuals who prioritize saving for the future may be more conservative in their spending habits and investment decisions.

Societal Norms

Societal norms also play a key role in shaping financial decisions. For instance, in a society where conspicuous consumption is highly valued, individuals may feel pressured to spend money on luxury goods to maintain a certain social status. On the contrary, in a community that emphasizes frugality and saving, individuals may be more inclined to make decisions that align with these values, such as budgeting carefully and investing wisely.

Cognitive Biases in Financial Decision Making

When it comes to making financial decisions, our brains can sometimes play tricks on us. Cognitive biases are systematic patterns of deviation from norm or rationality in judgment, and they can significantly impact our financial choices.

Confirmation Bias

Confirmation bias is the tendency to search for, interpret, favor, and recall information that confirms our preexisting beliefs or hypotheses. In the context of financial decision making, this bias can lead individuals to seek out information that supports their initial investment decisions while ignoring contradictory data. For example, if someone believes a certain stock will perform well, they may only focus on news articles or opinions that align with their belief, disregarding any negative indicators.

Loss Aversion

Loss aversion is the concept that people prefer avoiding losses over acquiring equivalent gains. In financial decision making, this bias can manifest as individuals holding onto losing investments for too long in the hope that they will eventually recover. This reluctance to take a loss can result in missed opportunities to reallocate funds to more profitable ventures.

Anchoring Bias

Anchoring bias occurs when individuals rely too heavily on the first piece of information they receive (the “anchor”) when making decisions. In finance, this bias can influence how individuals perceive the value of investments. For example, if an investor hears a price target for a stock from an analyst, they may fixate on that target as a reference point, even if new information suggests the target is no longer realistic.

Strategies for Effective Financial Decision Making

When it comes to making sound financial decisions, there are several strategies that can help individuals navigate the complex world of finance. By following these tips and guidelines, you can make informed choices that will positively impact your financial well-being.

Conducting a Cost-Benefit Analysis

Before making any financial decision, it is crucial to conduct a cost-benefit analysis to weigh the pros and cons of your choices. This involves evaluating the potential costs and benefits associated with each option to determine which one offers the best value.

- Identify all the potential costs involved, including upfront costs, ongoing expenses, and any hidden fees.

- Consider the benefits of each option, such as potential returns, long-term savings, and other advantages.

- Compare the costs and benefits of each option to determine which one aligns best with your financial goals and priorities.

Setting Realistic Financial Goals

Setting realistic financial goals is essential for effective decision-making. By establishing clear objectives, you can prioritize your spending, savings, and investment strategies to achieve your desired outcomes.

- Start by identifying your short-term and long-term financial goals, such as saving for a major purchase, building an emergency fund, or planning for retirement.

- Break down your goals into smaller, manageable milestones to track your progress and stay motivated.

- Regularly review and adjust your financial goals to reflect changes in your circumstances, priorities, and financial situation.

Seeking Advice from Financial Experts

When facing complex financial decisions or situations, seeking advice from financial experts can provide valuable insights and guidance. Whether it’s consulting with a financial advisor, accountant, or investment specialist, professional advice can help you make informed choices.

Remember, financial experts have the knowledge and experience to offer personalized recommendations based on your unique financial circumstances and goals.

Emotional Intelligence and Financial Decision Making

Emotional intelligence plays a crucial role in shaping individuals’ financial decision-making processes. By understanding and managing emotions effectively, people can make better choices when it comes to managing their finances. Self-awareness, emotional regulation, and empathy are key components of emotional intelligence that can impact financial decisions significantly.

Self-awareness and Financial Choices

Self-awareness involves recognizing and understanding one’s emotions, strengths, weaknesses, and values. When it comes to financial decision-making, individuals with high self-awareness are more likely to assess their financial goals, risk tolerance, and spending habits accurately. For example, someone who is self-aware may recognize that they have a tendency to overspend when stressed and take steps to address this behavior, such as creating a budget or seeking support from a financial advisor.

Emotional Regulation and Impulsive Decisions

Emotional regulation refers to the ability to manage and control emotions, especially in challenging or high-pressure situations. In the context of financial decision-making, emotional regulation can help individuals avoid making impulsive decisions based on temporary emotions like fear or excitement. By staying calm and rational, people can make more strategic choices that align with their long-term financial goals. For instance, someone who has developed strong emotional regulation skills may resist the urge to make a spontaneous, high-risk investment during a market downturn and instead focus on a diversified, long-term investment strategy.