Hey there, ready to dive into the world of ethical investing? In today’s financial scene, it’s all about putting your money where your values are. Buckle up as we explore the ins and outs of ethical investing and how it’s shaping the future of finance.

Ethical investing isn’t just about profits, it’s about creating a positive impact on the world while securing your financial future. So, let’s break it down and see how you can be a part of this game-changing movement.

Definition of Ethical Investing

Ethical investing, also known as sustainable investing or socially responsible investing (SRI), is an investment approach that considers both financial return and social/environmental good. Investors who engage in ethical investing seek to support companies that align with their values and beliefs while avoiding those involved in activities deemed harmful to society or the environment.

Importance of Ethical Investing

Ethical investing is crucial in today’s financial landscape as it allows investors to make a positive impact on the world while still generating financial returns. By investing in companies that prioritize sustainability, diversity, and ethical practices, investors can drive positive change and promote corporate responsibility.

- Investors can align their investments with their values by supporting companies that promote social and environmental sustainability.

- Companies with strong ethical practices tend to be more resilient and better positioned for long-term success, reducing investment risks.

- Ethical investing can influence corporate behavior by rewarding companies that prioritize ethical practices and social responsibility.

Examples of Ethical Investment Strategies

Ethical investing can take various forms, each with its own set of criteria and goals. Some common examples of ethical investment strategies include:

- Screening: Investors screen out companies involved in industries such as tobacco, weapons, or fossil fuels, and focus on industries like renewable energy, healthcare, and education.

- Impact Investing: Investors actively seek out companies or projects that have a positive social or environmental impact, alongside financial returns.

- Shareholder Advocacy: Investors engage with companies through shareholder resolutions to promote changes in corporate policies related to sustainability, diversity, or governance.

Types of Ethical Investment Approaches

When it comes to ethical investing, there are several approaches that investors can take to align their investments with their values. These approaches include socially responsible investing, impact investing, and sustainable investing.

Socially Responsible Investing

Socially responsible investing involves selecting investments based on both financial return potential and the ethical or social values of the investor. This approach typically avoids investing in companies involved in activities such as tobacco, weapons manufacturing, or environmental degradation. Instead, socially responsible investors seek out companies with strong environmental, social, and governance (ESG) practices.

Impact Investing

Impact investing focuses on generating positive social or environmental impact alongside financial returns. Investors who follow this approach actively seek out opportunities to invest in projects or companies that address specific social or environmental challenges. The goal is to drive positive change while also achieving financial goals.

Sustainable Investing

Sustainable investing aims to invest in companies that prioritize sustainability in their operations. This approach considers factors such as environmental impact, social responsibility, and corporate governance practices. Investors who follow sustainable investing principles look for companies that are committed to long-term sustainability and responsible business practices.

In assessing the ethicality of an investment, criteria such as a company’s environmental impact, treatment of employees, diversity and inclusion practices, community engagement, and overall corporate governance are considered. By evaluating these factors, investors can make informed decisions that align with their ethical values while also aiming for financial returns.

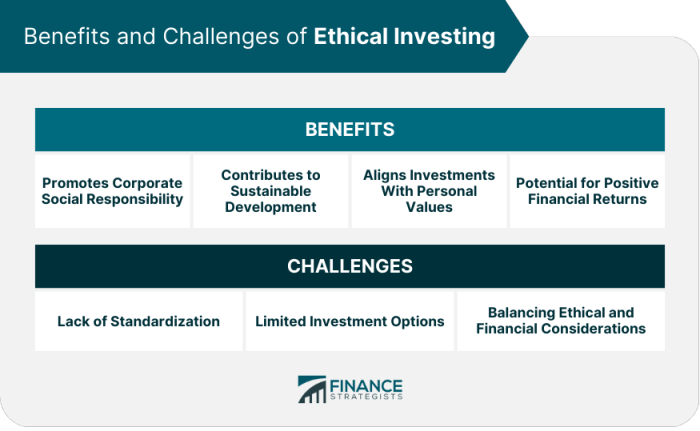

Benefits of Ethical Investing

Ethical investing offers numerous advantages for investors looking to align their values with their financial goals. By incorporating ethical considerations into investment decisions, individuals can make a positive impact on society and the environment while also potentially achieving financial returns.

Positive Impact on Companies

Ethical investing can lead to improved corporate behavior as companies strive to meet ethical standards set by investors. For example, companies that prioritize sustainability and social responsibility are more likely to attract ethical investors, leading to increased investment and better overall performance. This can result in long-term benefits for both the company and its stakeholders.

Consumer Trust and Loyalty

Investing in companies that uphold ethical practices can enhance consumer trust and loyalty. Consumers are increasingly conscious of where they spend their money and are more likely to support businesses that align with their values. By investing in ethical companies, investors can capitalize on this trend and potentially see increased demand for the products and services of these companies.

Contribution to Sustainable Future

Ethical investing plays a crucial role in promoting sustainability and addressing pressing global issues such as climate change, human rights violations, and environmental degradation. By directing capital towards companies that prioritize sustainability and ethical practices, investors can contribute to building a more sustainable future for generations to come. This not only benefits society and the environment but also ensures the long-term viability of investments.

Challenges and Risks of Ethical Investing

Ethical investing, while aligned with personal values and social responsibility, comes with its own set of challenges and risks that investors need to consider.

Challenges Faced by Ethical Investors

- Limited Investment Options: Ethical investors may have a narrower range of investment choices compared to traditional investors, which could impact portfolio diversification.

- Higher Costs: Implementing ethical screens and due diligence processes can result in higher management fees and operational costs.

- Lack of Transparency: It can be challenging to accurately assess the ethical practices of companies, leading to potential greenwashing or misrepresentation.

Risks Associated with Ethical Investing

- Market Performance Risk: Ethical investments may underperform traditional investments due to the exclusion of certain industries or companies from the portfolio.

- Reputational Risk: Investing in companies with questionable ethical practices can damage the reputation of ethical investors and their portfolios.

- Ethical Dilution Risk: As ethical investing gains popularity, there is a risk of dilution in ethical standards as more investors enter the space.

Strategies to Mitigate Risks

- Thorough Due Diligence: Conduct in-depth research and analysis to ensure that the companies in your portfolio align with your ethical values.

- Diversification: Spread investments across different asset classes and industries to reduce concentration risk and improve overall portfolio stability.

- Active Engagement: Engage with companies on environmental, social, and governance (ESG) issues to drive positive change and mitigate risks.

Impact Measurement and Reporting

When it comes to ethical investing, it’s crucial to measure the impact of your investments to ensure they align with your values and goals. By evaluating the effects of your investments, you can see the positive change you’re making in the world.

Importance of Transparent Reporting

Transparent reporting plays a key role in ethical investing as it allows investors to track and understand the impact of their investments. It provides clarity and accountability, ensuring that companies are held to ethical standards.

Key Performance Indicators for Ethical Investments

- Carbon footprint reduction: Measuring the amount of greenhouse gases emitted by companies in your investment portfolio.

- Diversity and inclusion metrics: Evaluating the representation of women, minorities, and other underrepresented groups in company leadership positions.

- Community impact assessment: Assessing the positive impact companies have on the communities in which they operate through initiatives like charitable giving and volunteer programs.

- Corporate governance practices: Examining how companies are managed and governed to ensure transparency, accountability, and ethical behavior.

Ethical Investment Trends

As the world becomes more conscious of environmental, social, and governance (ESG) issues, ethical investing is gaining traction across various sectors. Let’s delve into the current trends shaping the landscape of ethical investment.

ESG Integration

ESG integration involves incorporating environmental, social, and governance factors into investment decisions. Companies are increasingly evaluated based on their sustainability practices, diversity policies, and ethical governance structures. This trend is reshaping the way investors assess the long-term viability and impact of their investments.

Shareholder Advocacy

Shareholder advocacy refers to investors using their ownership rights to influence corporate behavior. Shareholders are leveraging their positions to push for greater transparency, accountability, and sustainability within companies. This trend is driving positive change by holding businesses accountable for their actions.

Green Bonds

Green bonds are financial instruments specifically earmarked for funding environmentally friendly projects. These bonds are issued by governments, municipalities, and corporations to raise capital for initiatives such as renewable energy, clean transportation, and sustainable infrastructure. The growing popularity of green bonds reflects a shift towards investments that prioritize environmental impact.

How to Start Ethical Investing

Investing ethically is a great way to align your financial goals with your values. Here’s a guide on how to start incorporating ethical considerations into your investment portfolio.

Research Ethical Investment Options

- Research different ethical investment approaches such as ESG (Environmental, Social, and Governance) criteria, impact investing, and socially responsible investing.

- Consider the values and causes that are important to you when selecting ethical investment options.

- Look for resources like ethical investing websites, reports, and articles to educate yourself on the available options.

Consult with a Financial Advisor

- Seek out a financial advisor who specializes in ethical investing to guide you through the process.

- Discuss your financial goals, risk tolerance, and ethical preferences with your advisor to create a customized investment strategy.

- Ask your advisor about specific ethical investment funds, companies, or industries that align with your values.

Diversify Your Ethical Portfolio

- Diversify your investments across different ethical sectors to reduce risk and maximize returns.

- Consider investing in a mix of stocks, bonds, mutual funds, and ETFs that meet your ethical criteria.

- Regularly review and adjust your portfolio to ensure it remains aligned with your values and financial goals.