Get ready to dive into the world of credit score improvement. It’s time to level up your financial game and discover the key strategies to boost your credit score like a pro.

Let’s break down the essentials of understanding credit scores, explore effective strategies for improvement, and learn how to monitor and manage your credit health for a brighter financial future.

Understanding Credit Scores

A credit score is a three-digit number that represents a person’s creditworthiness based on their credit history. It is calculated using information from credit reports and helps lenders assess the risk of lending to an individual.

Factors Influencing Credit Scores

Several factors influence a person’s credit score, including:

- Payment history: This accounts for the largest portion of a credit score and reflects whether payments are made on time.

- Amounts owed: This considers the total amount of debt owed and the utilization of available credit.

- Length of credit history: The longer the credit history, the better it is for the credit score.

- New credit: Opening multiple new accounts in a short period can negatively impact a credit score.

- Credit mix: Having a mix of different types of credit, like credit cards and loans, can be beneficial for a credit score.

It’s important to note that each factor carries a different weight in determining a credit score.

Importance of Good Credit Score

Having a good credit score is crucial for various financial transactions, such as obtaining loans, securing lower interest rates, renting an apartment, or even getting a job. A higher credit score can lead to better financial opportunities and savings in the long run.

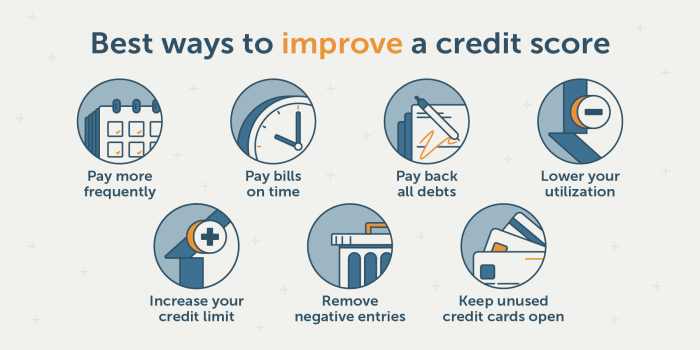

Strategies for Credit Score Improvement

Improving your credit score is crucial for financial health and stability. By following certain strategies, you can boost your credit score and open up opportunities for better loan terms and financial options.

Pay Bills on Time

One of the most impactful ways to enhance your credit score is by paying your bills on time. Late payments can significantly lower your score and stay on your credit report for years. Set up automatic payments or reminders to ensure you never miss a due date.

Reduce Credit Card Balances

Another effective strategy for improving your credit score is to reduce your credit card balances. High credit card balances relative to your credit limit can negatively impact your score. Aim to keep your credit utilization ratio below 30% by paying down balances or requesting a credit limit increase.

Monitoring and Managing Credit Scores

Monitoring and managing your credit score is crucial for maintaining financial health and ensuring access to favorable credit options.

Importance of Regular Monitoring

Regularly monitoring your credit score allows you to stay informed about your financial standing and detect any inaccuracies or fraudulent activity. It also helps you track your progress in improving your credit score over time.

- Check your credit score at least once a month to stay updated on any changes.

- Monitor for any sudden drops or increases in your credit score, which could indicate potential errors or identity theft.

- Regular monitoring can help you identify areas for improvement and take necessary actions to boost your credit score.

Ways to Manage and Track Changes

Managing and tracking changes in your credit score can be done through various methods, such as:

- Setting up credit monitoring services that provide regular updates on your credit score and any changes to your credit report.

- Reviewing your credit report from the three major credit bureaus (Equifax, Experian, TransUnion) at least once a year to ensure accuracy.

- Utilizing credit score tracking apps or websites that offer insights into factors impacting your credit score and personalized tips for improvement.

Tools and Resources for Monitoring

There are several tools and resources available to help you monitor your credit score effectively:

- Free credit monitoring services offered by financial institutions or credit card companies.

- Websites like Credit Karma or Credit Sesame that provide free access to your credit score and credit report.

- Credit monitoring apps that send real-time alerts for any changes in your credit score or suspicious activity.

Seeking Professional Help for Credit Repair

When facing challenges with improving your credit score, it might be beneficial to seek help from credit repair services. These professionals are equipped with the knowledge and expertise to assist you in navigating the complexities of credit management and repair.

Reputable Credit Counseling Agencies

Before engaging with any credit repair service, it is essential to research and identify reputable credit counseling agencies. These agencies offer valuable guidance on managing your finances and improving your credit score. Look for organizations that are accredited and have positive reviews from previous clients.

Risks and Benefits of Using Credit Repair Services

While credit repair services can provide assistance in boosting your credit score, there are potential risks and benefits to consider:

- Benefits:

- Expert Guidance: Credit repair professionals can offer personalized strategies to help you improve your credit score.

- Efficiency: With their knowledge and experience, they can expedite the credit repair process.

- Monitoring: Credit repair services can help you keep track of changes to your credit report and score.

- Risks:

- Cost: Some credit repair services may charge high fees for their assistance.

- Scams: Be cautious of fraudulent credit repair companies that may engage in unethical practices.

- No Guarantees: There is no guarantee that using a credit repair service will lead to a significant improvement in your credit score.