Diving into the world of budgeting techniques opens up a realm of financial empowerment and control. From traditional methods to advanced strategies, this guide will equip you with the knowledge and tools to navigate your personal finances with confidence.

As we delve deeper into the realm of budgeting techniques, we uncover the key principles and practices that can transform the way you manage your money.

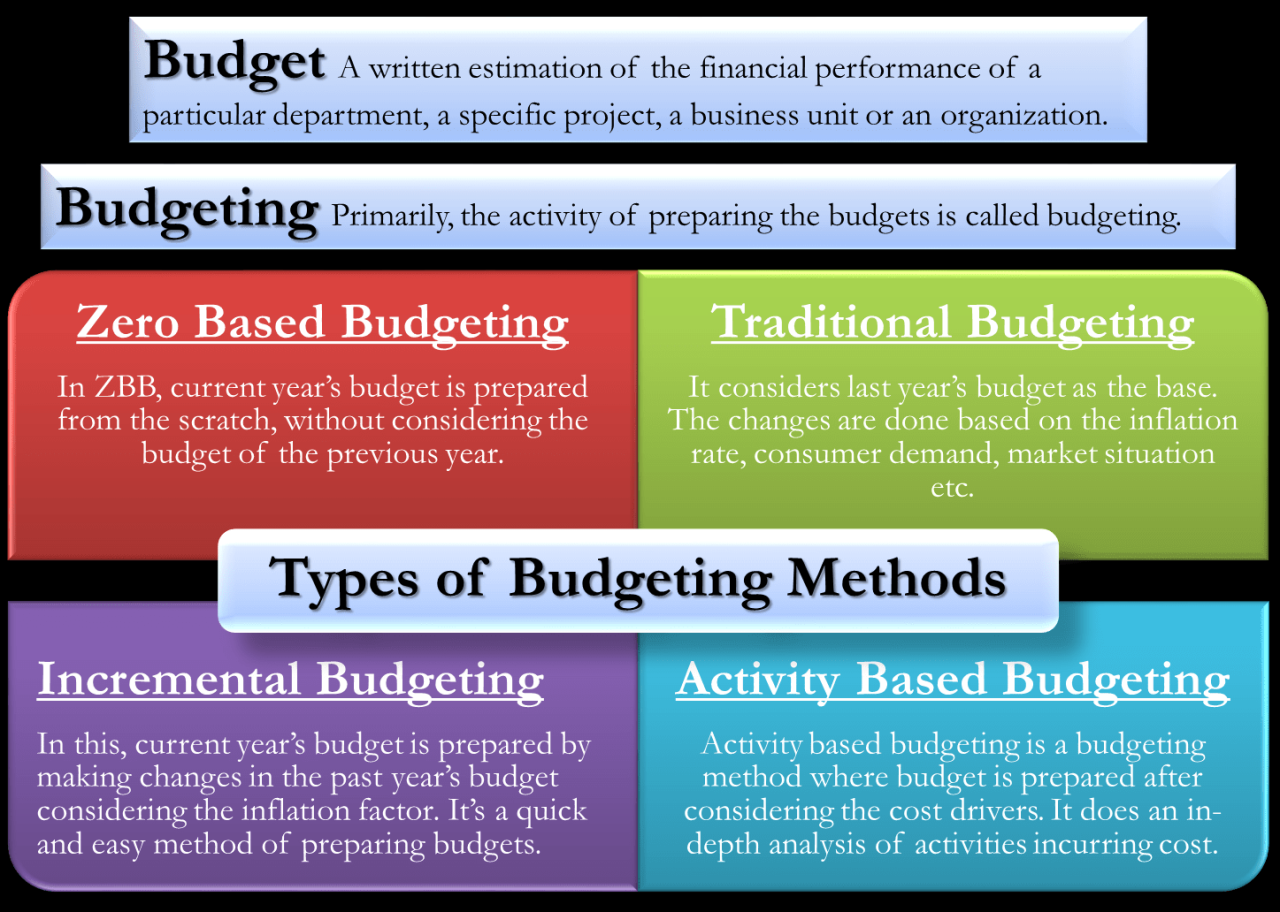

Budgeting Techniques Overview

Budgeting techniques are strategies or methods used to manage and allocate financial resources effectively. These techniques help individuals track their income, expenses, and savings to achieve financial goals.

The importance of budgeting techniques in personal finance cannot be overstated. By implementing these techniques, individuals can gain better control over their finances, avoid overspending, and save for future needs such as emergencies, retirement, or major purchases.

Types of Budgeting Techniques

- The 50/30/20 Rule: This technique involves allocating 50% of income to necessities, 30% to wants, and 20% to savings or debt repayment.

- Zero-Based Budgeting: With this technique, every dollar of income is allocated to specific expenses, savings, or debt payments, leaving zero leftover.

- Envelope System: In this method, cash is divided into envelopes for different spending categories to limit overspending and track expenses.

- Pay Yourself First: This technique involves prioritizing savings by setting aside a portion of income before paying other expenses.

Traditional Budgeting Methods

When it comes to managing your finances, traditional budgeting methods have been used for years to help individuals stay on track with their spending and saving goals. Let’s take a look at some of these tried and true techniques.

Envelope System for Budgeting

The envelope system is a classic budgeting method where you allocate a certain amount of cash to different categories, such as groceries, entertainment, and bills. You then place the designated cash amount in separate envelopes labeled with each category. This helps you visually see how much you have left to spend in each category and prevents overspending.

Zero-Based Budgeting Technique

Zero-based budgeting is a method where every dollar you earn is allocated to a specific category or expense, leaving zero dollars unassigned. This approach forces you to give every dollar a job, whether it’s going towards bills, savings, or discretionary spending. By accounting for every dollar, you ensure that your income is fully utilized and not wasted.

50/30/20 Budgeting Rule

The 50/30/20 budgeting rule is a popular method that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. This rule provides a simple guideline for balancing your expenses and ensuring that you prioritize saving for the future while also enjoying some discretionary spending. It’s important to note that this rule is just one of many traditional budgeting methods and may not work for everyone’s financial situation.

Advanced Budgeting Strategies

Budgeting is not just about tracking expenses and income; it’s also about making strategic decisions to reach your financial goals. Here are some advanced budgeting strategies to take your financial planning to the next level:

Value-Based Budgeting

Value-based budgeting focuses on aligning your spending with your values and priorities. Instead of simply tracking where your money goes, this approach involves allocating resources to the things that matter most to you. By prioritizing what brings you the most fulfillment, you can make sure your money is working towards your long-term happiness and well-being.

Rolling Budget

A rolling budget is a dynamic financial plan that is continuously updated throughout the year. Unlike traditional static budgets that are set for a specific period, a rolling budget allows for adjustments based on changing circumstances. By regularly reviewing and revising your budget, you can adapt to unexpected expenses, seize opportunities, and stay on track to meet your financial goals.

Priority-Based Budgeting Approach

Priority-based budgeting involves allocating your resources based on the most important goals and needs. By focusing on high-priority items first, such as paying off debt, saving for emergencies, or investing in your future, you can ensure that your money is being used effectively. This approach helps you make informed decisions about where to allocate your funds and prioritize what matters most in your financial journey.

Technology Tools for Budgeting

Budgeting in the digital age has become easier than ever with the wide array of technology tools available at our fingertips. From mobile apps to specialized software programs, there are numerous options to help individuals and families track their finances more effectively.

Popular Budgeting Apps and Software

- One popular budgeting app is Mint, which allows users to link their bank accounts, track expenses, set financial goals, and receive alerts for upcoming bills.

- Another well-known option is You Need A Budget (YNAB), which focuses on giving every dollar a job and helps users prioritize their spending.

- For those looking for more advanced features, Quicken is a comprehensive financial management tool that offers budgeting, investment tracking, and tax planning capabilities.

Automated vs. Manual Methods

- Automated budgeting tools like Mint and YNAB can save time and effort by syncing with bank accounts and categorizing expenses automatically.

- Manual methods, on the other hand, may be preferred by those who want more control over their budgeting process and are willing to input transactions and expenses manually.

- Ultimately, the choice between automated and manual methods depends on individual preferences and comfort levels with technology.

Utilizing Spreadsheets for Budgeting

Spreadsheets like Microsoft Excel or Google Sheets can be powerful tools for budget tracking and planning. Users can create customized budget templates, track expenses, and analyze spending patterns with ease. By inputting income, expenses, and savings goals into a spreadsheet, individuals can gain a clear overview of their financial health and make informed decisions to reach their financial goals.

Behavioral Economics in Budgeting

Understanding behavioral economics principles can greatly impact the way we approach budgeting decisions. It involves recognizing how human psychology and biases influence our financial choices.

Cognitive Biases in Budgeting

Cognitive biases can lead us to make irrational decisions when managing our budgets. These biases can affect our perception of risk, reward, and future outcomes, ultimately impacting our financial well-being.

- Confirmation Bias: People tend to seek out information that confirms their existing beliefs about budgeting, ignoring contradictory evidence.

- Loss Aversion: The fear of losing money can lead individuals to make overly conservative budgeting decisions, missing out on potential opportunities for growth.

- Anchoring Bias: Anchoring on past budgeting decisions or external reference points can limit our ability to adapt to changing financial circumstances.

Psychology in Successful Budget Management

Psychology plays a crucial role in successful budget management by understanding how emotions, habits, and mental shortcuts impact our financial choices.

- Behavioral Finance: Utilizing behavioral finance principles can help individuals create budgets that align with their values and long-term goals, leading to more sustainable financial habits.

- Reward Systems: Implementing reward systems in budgeting can motivate individuals to stick to their financial plans and achieve their savings goals.

- Automatic Savings: Setting up automatic transfers to savings accounts can leverage psychological inertia to help individuals save consistently without relying on willpower alone.