Diving into the realm of financial planning software, this intro sets the stage for a deep dive into its advantages and functionalities. Get ready to explore how this tool can revolutionize the way we manage our finances!

In the following paragraph, we will uncover the key aspects of financial planning software that are crucial for both individuals and businesses.

Importance of Financial Planning Software

Financial planning software plays a crucial role in managing personal finances by providing tools and resources to help individuals and businesses make informed decisions about their money. It allows users to organize and analyze their financial information, create budgets, track expenses, set financial goals, and plan for the future.

Key Features of Financial Planning Software

- Expense Tracking: Financial planning software enables users to monitor their spending habits, identify areas where they can cut costs, and stay within budget.

- Budgeting Tools: Users can create detailed budgets, allocate funds to different categories, and track their progress towards financial goals.

- Goal Setting: The software helps individuals and businesses set achievable financial goals, such as saving for a major purchase, paying off debt, or planning for retirement.

- Forecasting: Users can forecast future income and expenses, analyze different scenarios, and make adjustments to their financial plans accordingly.

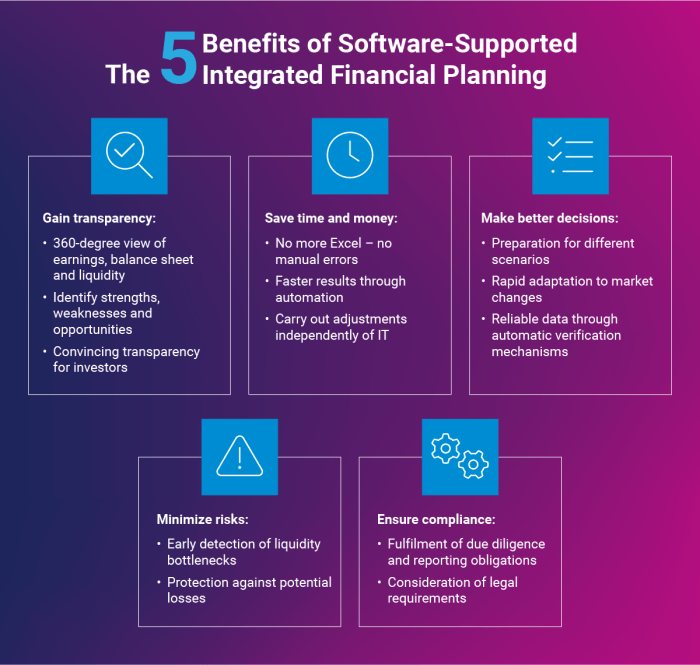

Benefits of Financial Planning Software

- Improved Financial Management: By providing a comprehensive overview of one’s finances, financial planning software helps users make informed decisions and take control of their money.

- Efficiency: Automating tasks like budgeting, expense tracking, and goal setting saves time and reduces the risk of errors associated with manual calculations.

- Financial Awareness: Users gain a better understanding of their financial health, enabling them to make smarter financial choices and plan for the future with confidence.

Advantages for Individuals

Financial planning software can be a game-changer for individuals looking to take control of their finances and plan for the future. By utilizing this tool, individuals can create personalized budgets, monitor expenses and income effectively, and make informed decisions regarding retirement planning and investment management.

Creating Personalized Budgets

- Financial planning software allows individuals to input their income sources and expenses to create a detailed budget tailored to their specific needs and goals.

- Users can set spending limits for different categories, track their progress, and receive alerts when they are nearing their budget limits.

- By having a clear overview of their financial situation, individuals can make adjustments as needed to ensure they are on track to meet their financial goals.

Monitoring Expenses and Income

- With financial planning software, individuals can easily track their expenses and income by linking their accounts or manually inputting transactions.

- Users can categorize expenses, identify spending patterns, and analyze where their money is going to make more informed financial decisions.

- Having a real-time view of their financial transactions helps individuals stay organized, avoid overspending, and plan for future expenses.

Retirement Planning and Investment Management

- Financial planning software often includes tools for retirement planning, such as calculators to estimate retirement savings needs and analyze different scenarios.

- Users can set retirement goals, track their progress, and adjust their savings strategy accordingly to ensure a comfortable retirement.

- Additionally, individuals can utilize the investment management features of the software to research investment options, track portfolio performance, and make informed investment decisions.

Benefits for Businesses

Financial planning software is not only beneficial for individuals but also for businesses. It plays a crucial role in aiding businesses in financial analysis and decision-making processes. By utilizing financial planning software, businesses can streamline their financial operations, improve efficiency, and make informed decisions based on accurate data.

Improved Cash Flow Management

Financial planning software can significantly improve cash flow management for companies by providing real-time insights into their financial health. Businesses can track their income and expenses more effectively, identify areas where costs can be reduced, and optimize their cash flow to ensure smooth operations. By having a clear view of their financial status, businesses can make strategic decisions to allocate resources wisely and avoid cash flow shortages.

Enhanced Forecasting and Strategic Planning

Financial planning software enables businesses to create accurate financial forecasts and develop strategic plans for the future. By analyzing historical data and trends, businesses can predict potential financial outcomes and make informed decisions to achieve their long-term goals. This software also helps businesses in scenario planning, allowing them to assess the impact of different strategies on their financial performance and adjust their plans accordingly.

Efficient Financial Analysis

Financial planning software provides businesses with powerful tools for financial analysis, allowing them to generate detailed reports, analyze key performance indicators, and conduct variance analysis. This enables businesses to identify strengths and weaknesses in their financial performance, make data-driven decisions, and take corrective actions to improve their profitability and sustainability.

Efficiency and Accuracy

Financial planning software plays a crucial role in enhancing efficiency and accuracy in managing finances. By automating financial calculations and reporting, software solutions streamline processes and enable individuals and businesses to make informed decisions.

Enhanced Efficiency

- Automated calculations: Financial planning software automates complex calculations, saving time and reducing the risk of human error.

- Quick data processing: Software solutions help in processing large amounts of financial data at a faster pace, allowing for quicker analysis and decision-making.

- Integration capabilities: Many financial planning software tools can integrate with other systems, such as accounting software, to streamline workflows and eliminate manual data entry.

Importance of Accuracy

- Minimizing errors: Accuracy is crucial in financial planning to ensure that decisions are based on reliable data. Financial planning software helps in minimizing errors by automating calculations and ensuring data consistency.

- Compliance requirements: Accurate financial reporting is essential for regulatory compliance and business transparency. Software solutions help in maintaining accurate records and generating compliant reports.

- Risk mitigation: Accurate financial planning reduces the risk of making costly mistakes or poor investment decisions, ultimately safeguarding the financial health of individuals and businesses.

Automation for Productivity

- Improved productivity: Automation in financial planning software eliminates manual tasks, allowing individuals and businesses to focus on strategic planning and analysis.

- Real-time insights: Software solutions provide real-time data updates and insights, enabling proactive decision-making and adjustments to financial strategies.

- Scalability: Automated processes in financial planning software make it easier to scale operations as businesses grow, without compromising efficiency or accuracy.