Diving into the world of Roth IRAs, get ready to explore the key advantages and features of this retirement savings option. From tax benefits to contribution rules, we’ve got you covered with all the essential info you need to know.

Let’s break down the nitty-gritty details of Roth IRAs and why they might be the right choice for your financial future.

What is a Roth IRA?

A Roth IRA is a type of individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get a tax deduction for your contributions upfront.

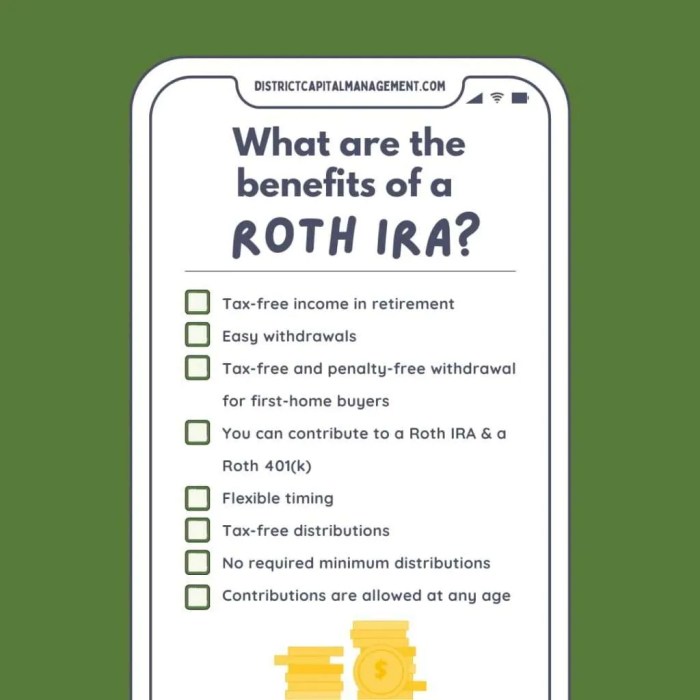

Key Features and Benefits of a Roth IRA

- Roth IRAs allow your investments to grow tax-free, which can result in significant savings over time.

- Withdrawals from a Roth IRA in retirement are tax-free, providing you with a source of tax-free income.

- Roth IRAs have no required minimum distributions (RMDs) during the account holder’s lifetime, unlike traditional IRAs.

- You can withdraw your contributions (but not earnings) from a Roth IRA penalty-free at any time, making it a flexible savings vehicle.

Differences between Roth IRA and Traditional IRA

- In a traditional IRA, contributions are typically tax-deductible, but withdrawals in retirement are taxed as ordinary income. In a Roth IRA, contributions are not tax-deductible, but withdrawals are tax-free.

- Traditional IRAs have RMDs starting at age 72, while Roth IRAs do not have RMDs during the account holder’s lifetime.

- Roth IRAs are a better option for individuals who expect to be in a higher tax bracket in retirement, as they can benefit from tax-free withdrawals.

Tax Advantages of a Roth IRA

When it comes to retirement savings, a Roth IRA offers some significant tax benefits that can help you grow your nest egg more effectively. Let’s dive into the tax advantages associated with a Roth IRA and how they differ from a traditional IRA.

Tax Treatment of Contributions and Withdrawals

In a Roth IRA, contributions are made with after-tax dollars, meaning you don’t get a tax deduction upfront. However, the real magic happens when you start making withdrawals. Unlike a traditional IRA where withdrawals are taxed as ordinary income, qualified withdrawals from a Roth IRA are completely tax-free. This means you get to enjoy all your hard-earned savings without Uncle Sam taking a cut.

Tax-Free Growth and Withdrawals

One of the key benefits of a Roth IRA is the ability to grow your investments tax-free. This means that any capital gains, dividends, or interest earned within the account are not subject to capital gains tax each year. Additionally, when you start taking withdrawals in retirement, you won’t owe any taxes on the money you withdraw, as long as the withdrawals are considered qualified.

Overall, the tax advantages of a Roth IRA can make a significant impact on your retirement savings strategy, allowing you to maximize your earnings and enjoy a tax-free retirement income stream. So, if you’re looking to supercharge your retirement savings with some tax perks, a Roth IRA might be the way to go.

Contribution Rules and Limits

When it comes to contributing to a Roth IRA, there are specific rules and limits that you need to be aware of. Understanding these guidelines can help you make the most of this retirement savings account.

Contribution Limits for Roth IRAs

- Roth IRA contribution limits for 2021 are $6,000 for individuals under 50 years old and $7,000 for those 50 and older.

- These limits may change annually, so it’s essential to stay updated on the current contribution limits.

Income Limits for Contributing to a Roth IRA

- Individuals with a modified adjusted gross income (MAGI) above a certain threshold may not be eligible to contribute to a Roth IRA.

- For 2021, single filers with a MAGI of $140,000 or more and married couples filing jointly with a MAGI of $208,000 or more are not eligible to contribute to a Roth IRA.

- It’s crucial to check the current income limits to determine if you qualify for Roth IRA contributions.

Benefits of Contributing to a Roth IRA Even with a Retirement Plan at Work

- Contributing to a Roth IRA can provide additional tax diversification in retirement, as withdrawals are tax-free in retirement.

- Roth IRAs offer flexibility in retirement planning, allowing for tax-free withdrawals of contributions at any time without penalties or taxes.

- Even if you have a retirement plan at work, such as a 401(k), contributing to a Roth IRA can be advantageous due to its tax benefits and flexibility.

Withdrawal Rules and Penalties

When it comes to withdrawing funds from a Roth IRA, there are specific rules and penalties that you need to be aware of in order to avoid any financial setbacks.

Early Withdrawal Penalties

- If you withdraw earnings from your Roth IRA before you reach age 59 ½, you may be subject to a 10% early withdrawal penalty.

- This penalty is in addition to any income taxes that you may owe on the withdrawn amount.

- It’s important to note that this penalty only applies to the earnings portion of your withdrawals, not the contributions you’ve made.

Exceptions to Early Withdrawal Penalties

- One advantage of a Roth IRA is that there are exceptions to the early withdrawal penalties in certain circumstances.

- These exceptions include using the funds for a first-time home purchase, qualified education expenses, unreimbursed medical expenses, or if you become disabled.

- Additionally, you can withdraw contributions (but not earnings) penalty-free at any time for any reason, since you’ve already paid taxes on that money.