Get ready to dive into the world of Financial literacy for kids where money talk meets cool vibes. From piggy banks to savvy spending, this topic is all about setting our young ones up for financial success. Let’s break it down together!

We’ll explore the importance of teaching financial literacy, introduce basic concepts, delve into essential resources, and uncover the secrets to developing good financial habits. So, grab your backpack and let’s hit the financial education trail!

Importance of Teaching Financial Literacy to Kids

Teaching financial literacy to kids is crucial in preparing them for a successful future. By instilling financial knowledge at a young age, children can develop essential skills that will benefit them in the long run.

Long-Term Benefits of Early Financial Education

- Teaches kids the value of money and how to budget effectively.

- Helps children understand the importance of saving and investing for the future.

- Equips kids with the skills to make informed financial decisions as they grow older.

Positive Impact on Future Financial Decisions

- Children who are financially literate are more likely to avoid debt traps and make wise spending choices.

- Early financial education can lead to better money management skills and financial independence later in life.

Real-Life Situations Requiring Financial Literacy Skills

- Understanding the concept of interest rates when taking out loans or using credit cards.

- Learning how to create a budget and stick to it to achieve financial goals.

- Recognizing scams and fraudulent schemes to protect their finances.

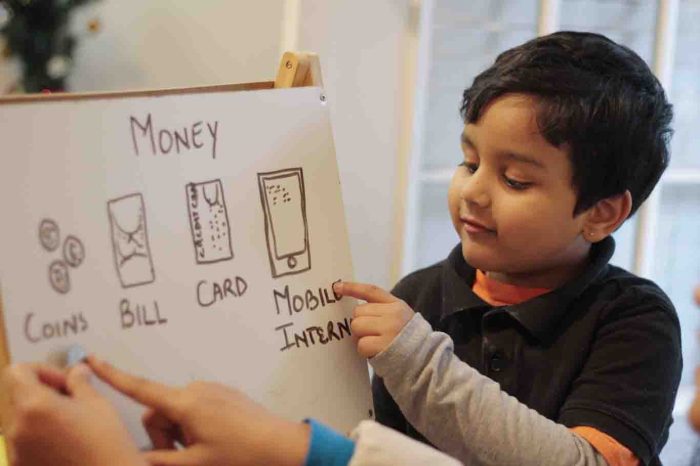

Basic Concepts to Introduce

Introducing basic financial concepts to children at a young age can set them up for a lifetime of financial success. Teaching kids about saving, budgeting, and spending wisely can help them develop good money habits early on.

Saving Money

Teaching kids the importance of saving money can be done through activities like setting up a piggy bank or a savings jar. Encourage children to save a portion of their allowance or any money they receive as gifts. Discuss the concept of saving for short-term goals like buying a toy or long-term goals like college education.

Budgeting

Introducing kids to budgeting can be done by creating a simple budget with their allowance or earnings. Help children understand the difference between needs and wants and allocate money accordingly. Teach them to track their expenses and adjust their budget as needed.

Spending Wisely

Teach kids about making smart spending choices by discussing the value of money and comparison shopping. Encourage children to think before making impulse purchases and prioritize their spending based on their needs and goals.

Earning Money and Setting Goals

Introduce the concept of earning money through tasks like chores, selling items, or setting up a small business. Help kids set financial goals, whether it’s saving for a specific item or donating to a cause they care about. Encourage them to create a plan to reach their goals.

Making Learning Fun

Make learning about money engaging by incorporating games, activities, and real-life examples. Use board games like Monopoly or online financial literacy apps to teach kids about money management in a fun and interactive way. Organize a pretend store at home where children can practice making purchases and calculating change.

Resources and Tools for Teaching Financial Literacy

Teaching kids about financial literacy can be made easier with the help of various resources and tools. These educational materials can provide valuable information and practical lessons to help children understand the importance of money management from an early age.

Educational Resources

- Books: “The MoneySmart Family System” by Steve & Annette Economides, “Growing Money: A Complete Investing Guide for Kids” by Gail Karlitz, and “Alexander, Who Used to Be Rich Last Sunday” by Judith Viorst are great books to introduce financial concepts to children.

- Websites: Websites like MoneyConfidentKids.com, PracticalMoneySkills.com, and MoneyAsYouGrow.org offer interactive games, activities, and resources to teach kids about money.

- Apps: Apps like Green$treets: Unleash the Loot! and P2K Money provide fun and engaging ways for kids to learn about saving, budgeting, and investing.

Role of Parents, Schools, and Financial Institutions

Parents can teach financial literacy by involving kids in household budgeting, setting savings goals, and discussing money decisions openly. Schools can incorporate financial literacy into the curriculum through programs, workshops, and guest speakers. Financial institutions can provide educational materials, workshops, and accounts specifically designed for children to learn about money management.

Everyday Activities for Financial Learning

- Take kids grocery shopping and discuss budgeting, comparison shopping, and the importance of making smart purchasing decisions.

- Give children a piggy bank or a clear jar to save loose change and encourage them to set savings goals for things they want to buy.

- Involve kids in planning family outings or vacations, setting a budget, and making choices based on available funds.

Developing Good Financial Habits

It is crucial to instill good financial habits in children from a young age to set them up for success in the future. By teaching them the importance of saving, responsible spending, and goal-setting early on, parents and educators can help children develop a strong financial foundation that will benefit them throughout their lives.

Strategies for Helping Children Develop Saving and Spending Habits

Teaching children the value of money and the importance of saving is essential. Encourage them to set savings goals, whether it’s for a toy they want or for college in the future. Help them create a savings jar or piggy bank where they can deposit money regularly. Teach them to distinguish between needs and wants, and involve them in budgeting decisions when appropriate.

The Role of Allowances, Chores, and Goal-Setting

Allowances can be a great way to teach children about financial responsibility. By tying allowances to chores, kids learn the connection between work and money. This can instill a strong work ethic and help them understand the value of earning money. Encourage goal-setting by helping children identify what they want to save for and setting achievable milestones along the way.

Success Stories of Kids Benefitting from Early Financial Education

There are numerous success stories of children who have benefitted from early financial education. From teenagers who start their own successful businesses to young adults who are able to manage their finances responsibly, the impact of teaching financial literacy early on is undeniable. By equipping children with the knowledge and skills to make sound financial decisions, they are better prepared to navigate the complexities of the modern economy.