Step into the world of loan rates where the clash between fixed and variable rates takes center stage. Get ready for a rollercoaster of information presented in an american high school hip style that will keep you hooked throughout.

In the realm of loan agreements, fixed and variable rates play a crucial role in shaping borrowers’ financial decisions. Let’s dive into the intricacies of these contrasting options.

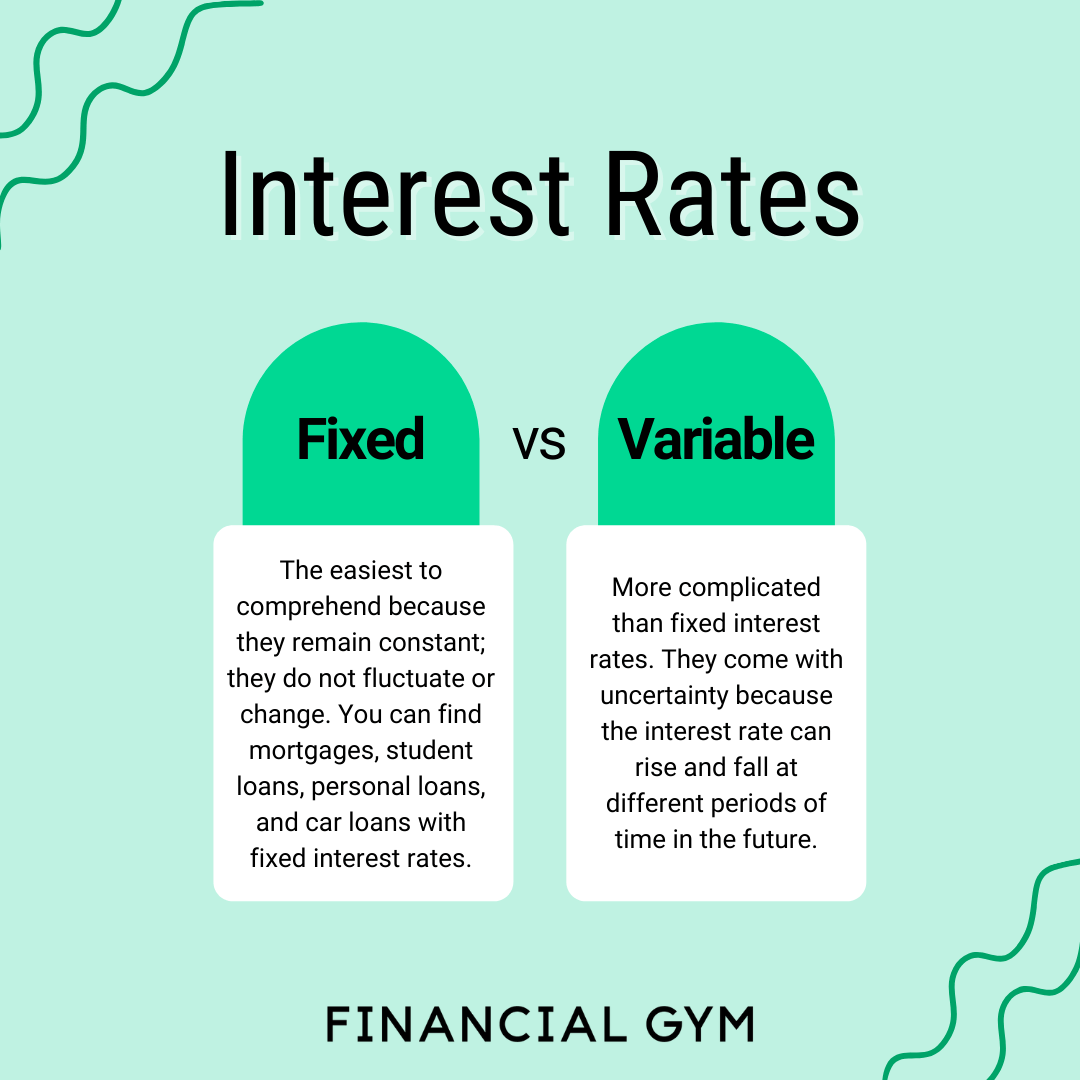

Fixed vs Variable Loan Rates

When it comes to loan rates, borrowers often have the option to choose between fixed and variable interest rates. Let’s explore the differences between the two and how they can impact your loan.

Fixed Interest Rates

Fixed interest rates remain the same throughout the life of the loan. This means that your monthly payments will not change, providing predictability and stability in budgeting. This type of rate is ideal for borrowers who prefer consistency and want to avoid any surprises in their payments.

Variable Interest Rates

Variable interest rates, on the other hand, fluctuate based on market conditions. Your monthly payments can go up or down, depending on the changes in the benchmark interest rate. While initially lower than fixed rates, variable rates come with the risk of increasing over time, potentially leading to higher payments.

Advantages and Disadvantages

Advantages of Fixed Rates:

- Stability and predictability in monthly payments

- Protection against rising interest rates

- Peace of mind for long-term planning

Disadvantages of Fixed Rates:

- Initial rates might be higher than variable rates

- No benefit from rate decreases in the market

Advantages of Variable Rates:

- Potential for lower initial rates

- Chance to benefit from rate decreases

Disadvantages of Variable Rates:

- Risk of rates increasing over time

- Uncertainty in monthly payments

Factors Influencing Fixed vs Variable Rates

When it comes to choosing between fixed and variable loan rates, several factors come into play. Economic conditions, market fluctuations, and borrower creditworthiness all play a significant role in determining the best option. Let’s delve deeper into these factors below.

Economic Factors Affecting Fixed Loan Rates

Fixed loan rates are directly influenced by the overall economic conditions. When the economy is stable or growing, fixed rates tend to be higher as lenders factor in potential inflation and rising costs. On the other hand, during economic downturns or periods of low inflation, fixed rates may decrease to stimulate borrowing and spending. It’s essential for borrowers to keep an eye on economic indicators like GDP growth, inflation rates, and unemployment numbers to predict the direction of fixed rates.

Market Conditions Impacting Variable Loan Rates

Variable loan rates, also known as adjustable-rate mortgages, are tied to market conditions such as the prime rate set by the Federal Reserve. When the economy is thriving, the Fed may increase the prime rate, leading to higher variable rates for borrowers. Conversely, during economic slowdowns, the Fed may lower the prime rate, resulting in lower variable rates. Borrowers opting for variable rates should closely monitor the Fed’s decisions and economic trends to anticipate changes in their loan payments.

Borrower Creditworthiness and Rate Choice

Another crucial factor in choosing between fixed and variable rates is the borrower’s creditworthiness. Lenders consider factors such as credit score, income stability, and debt-to-income ratio when determining the interest rate for a loan. Borrowers with excellent credit scores and strong financial profiles may qualify for lower rates, making fixed-rate loans more attractive. On the other hand, borrowers with less-than-perfect credit histories may benefit from the initial lower rates offered by variable loans but should be prepared for potential rate hikes in the future. It’s essential for borrowers to assess their financial situation and risk tolerance before deciding between fixed and variable rates.

Risks Associated with Fixed and Variable Rates

When it comes to choosing between fixed and variable loan rates, borrowers need to consider the risks associated with each option. Let’s delve into the specific risks faced by borrowers opting for fixed-rate loans and variable-rate loans, as well as compare the risk mitigation strategies for both.

Risks with Fixed-Rate Loans

Fixed-rate loans offer stability in terms of monthly payments, but they come with certain risks. One major risk is that if market interest rates decrease, borrowers with fixed-rate loans will miss out on potential savings. Additionally, borrowers may end up paying higher interest rates compared to variable-rate loans if market rates drop significantly.

Risks with Variable-Rate Loans

Variable-rate loans are subject to changes in market interest rates, which means borrowers face the risk of their monthly payments increasing if interest rates rise. This can lead to financial strain for borrowers who may not be able to afford higher payments. There is also the uncertainty of not knowing how much the interest rates will fluctuate over time, making it challenging to budget effectively.

Comparing Risk Mitigation Strategies

To mitigate the risks associated with fixed-rate loans, borrowers can consider refinancing their loans if market rates decrease significantly to take advantage of lower interest rates. On the other hand, borrowers with variable-rate loans can opt for a rate cap, which limits how much their interest rate can increase during a specific period, providing some level of protection against drastic rate hikes.

Flexibility and Stability

When it comes to loan rates, borrowers often consider the balance between flexibility and stability. Fixed rates offer stability, while variable rates provide flexibility in loan repayments.

Stability with Fixed Rates

Fixed rates provide borrowers with the comfort of knowing exactly how much they need to pay each month. This stability can be beneficial for individuals on a fixed income or those who prefer predictability in their financial obligations.

Flexibility with Variable Rates

Variable rates, on the other hand, can offer flexibility in loan repayments. These rates are tied to market fluctuations, meaning borrowers may benefit from lower rates when the market is favorable. This flexibility can result in potential savings for borrowers willing to take on a bit more risk.

Preference for Fixed or Variable Rates

Borrowers might prefer fixed rates when they prioritize stability and want to lock in a consistent monthly payment. On the other hand, those who are comfortable with fluctuating payments and seek potential savings may opt for variable rates. The choice between fixed and variable rates ultimately depends on individual financial goals and risk tolerance.