Get ready to dive into the world of ethical investing, where making money meets making a difference. Picture yourself navigating through the complexities of investing with a moral compass, ensuring your financial decisions align with your values.

In this article, we’ll explore the ins and outs of ethical investing, from defining its core principles to understanding its impact on society and the environment.

What is Ethical Investing?

Ethical investing, also known as socially responsible investing (SRI), is an investment approach that considers both financial returns and ethical or social values. It involves selecting investments based on criteria related to environmental, social, and governance (ESG) factors.

Importance of Ethical Investing

Ethical investing is important as it allows investors to align their personal values with their investment decisions. By supporting companies that are socially responsible and environmentally conscious, investors can contribute to positive change in the world. This approach also encourages companies to operate ethically and sustainably, leading to a more sustainable and equitable society.

- Investors can support companies that promote diversity and inclusion in the workplace, leading to a more equitable society.

- By investing in environmentally-friendly companies, investors can contribute to the fight against climate change and promote sustainability.

- Ethical investing can also help investors avoid supporting industries that engage in unethical practices, such as child labor or human rights violations.

Examples of Companies or Industries in Ethical Investing

- Renewable energy companies, such as solar and wind power companies, that focus on reducing carbon emissions and promoting clean energy sources.

- Socially responsible banks that prioritize ethical lending practices and support community development projects.

- Companies with strong corporate governance policies that prioritize transparency, accountability, and ethical decision-making.

Principles of Ethical Investing

When it comes to ethical investing, there are several key principles that guide investors in making decisions that align with their values and beliefs. By incorporating these principles into their investment strategies, individuals can positively impact society and the environment.

Socially Responsible Investing

Socially responsible investing focuses on investing in companies that have a positive social impact. This involves considering factors such as human rights, labor practices, and community involvement when making investment decisions.

Environmental Sustainability

Investing in companies that prioritize environmental sustainability is another key principle of ethical investing. By supporting businesses that are committed to reducing their carbon footprint and implementing eco-friendly practices, investors can contribute to a healthier planet.

Corporate Governance

Ethical investors also pay attention to the corporate governance practices of the companies they invest in. This includes factors such as board diversity, executive compensation, and transparency in financial reporting. By supporting companies with strong corporate governance, investors can promote accountability and ethical business practices.

Community Impact

Investing in companies that have a positive impact on the communities in which they operate is another important principle of ethical investing. This involves supporting businesses that prioritize philanthropy, volunteerism, and community development initiatives.

Types of Ethical Investment Strategies

When it comes to ethical investing, there are various strategies that investors can utilize to align their financial goals with their values. Let’s explore some of the most common types of ethical investment strategies below.

ESG Investing

ESG investing focuses on Environmental, Social, and Governance factors when making investment decisions. Companies are evaluated based on their performance in these areas, with the goal of promoting sustainability and ethical business practices. Investors who engage in ESG investing believe that companies that prioritize ESG factors are better positioned for long-term success.

Impact Investing

Impact investing involves investing in companies or projects that generate positive social or environmental impact alongside financial returns. This approach goes beyond simply avoiding harmful industries and actively seeks out opportunities to make a difference in areas such as clean energy, healthcare, education, and poverty alleviation. Impact investors measure the success of their investments based on the tangible impact they have on society or the environment.

Comparison and Contrast

While ESG investing focuses on evaluating companies based on their ESG performance, impact investing takes a more proactive approach by seeking out investments with the intention of creating positive change. Both strategies aim to align investments with ethical values, but impact investing goes a step further by prioritizing impact alongside financial returns.

Examples of Successful Ethical Investment Strategies

One example of a successful ethical investment strategy is the Calvert Impact Capital Community Investment Note, which allows investors to support community development projects while earning a financial return. Another example is the Pax Ellevate Global Women’s Leadership Fund, which invests in companies with strong gender diversity and promotes women’s leadership in the corporate world.

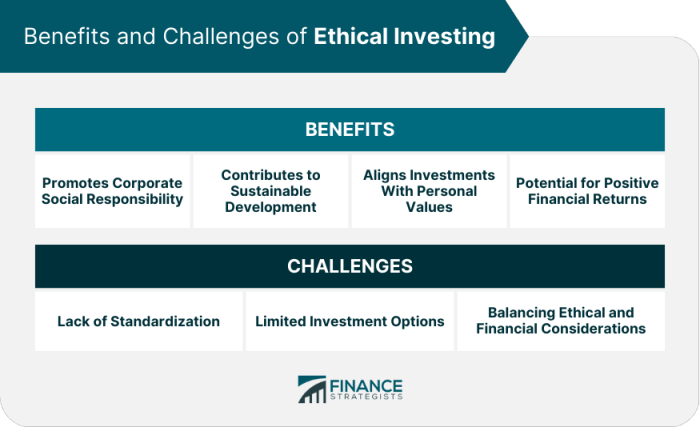

Benefits of Ethical Investing

Investing ethically offers a variety of advantages that go beyond just financial returns. By aligning your investments with your values, you can make a positive impact on society and the environment while potentially earning long-term financial gains.

Positive Impact on Society

- Supporting companies with strong ethical practices

- Promoting social responsibility and sustainability

- Encouraging positive change in industries

Long-Term Financial Gains

- Companies with ethical practices may be more resilient in the face of crises

- Increased consumer trust and loyalty can lead to higher revenues

- Potential for long-term growth as ethical practices become more valued

Risk Mitigation

- Some ethical investments may have lower risk due to strong governance and transparency

- Avoiding companies with poor environmental or social practices can reduce exposure to legal and reputational risks

- However, ethical investing can still face challenges such as lower diversification or limited investment options

How to Start Ethical Investing

Interested in starting to invest ethically? Here’s a step-by-step guide to help you get started on your ethical investing journey.

Researching Ethical Investment Opportunities

Before you begin investing ethically, it’s important to research and identify the right opportunities. Here are some resources and tools you can use:

- Look for ethical investment platforms and websites that provide information on companies with strong ethical practices.

- Consult with financial advisors who specialize in ethical investing for personalized guidance.

- Join online forums and communities to learn from experienced ethical investors and stay updated on the latest trends.

Evaluating Ethical Performance of Companies

Once you’ve identified potential investment opportunities, it’s crucial to evaluate the ethical performance of companies. Here are some tips to help you assess their ethical practices:

- Review the company’s sustainability reports and corporate social responsibility initiatives to gauge their commitment to ethical standards.

- Check if the company has been involved in any controversies or ethical violations in the past to ensure they align with your values.

- Consider using ethical rating agencies and tools that provide scores based on environmental, social, and governance criteria.

Impact of Ethical Investing on Corporate Behavior

Ethical investing plays a crucial role in influencing corporate behavior and decision-making. Companies are increasingly feeling the pressure to align their practices with ethical standards due to the growing demand for socially responsible investments.

Role of Shareholder Activism

Shareholder activism is a key driver in promoting ethical practices within companies. Shareholders who are ethically conscious use their influence to push for changes in corporate policies and practices. They may file resolutions, engage in dialogues with management, or vote on important issues to hold companies accountable for their actions.

- Shareholder resolutions: Activist investors often propose resolutions at annual meetings to address concerns related to environmental impact, diversity and inclusion, executive compensation, and other ethical issues.

- Engagement with management: Shareholders engage in discussions with company executives to advocate for changes in practices that align with ethical principles and sustainability goals.

- Voting power: Shareholders have the power to vote on important decisions, such as electing board members or approving corporate strategies, influencing the direction of the company towards more ethical practices.

Examples of Companies Responding to Ethical Investment Pressure

Companies across various industries have changed their practices in response to ethical investment pressure. One notable example is Nike, which faced criticism for its labor practices in overseas factories. Following pressure from ethical investors and consumer boycotts, Nike implemented changes to improve working conditions and labor rights within its supply chain.

“Ethical investing has the power to drive positive change within companies and hold them accountable for their social and environmental impact.”