Diving into the world of Understanding mutual funds, we embark on a journey that demystifies the complexities of these investment vehicles, shedding light on their inner workings and benefits. Brace yourself for an enlightening exploration!

As we delve deeper, we’ll uncover the nuances of mutual funds, from how they operate to the risks and rewards they entail. Get ready to expand your financial knowledge and make informed investment decisions.

What are mutual funds?

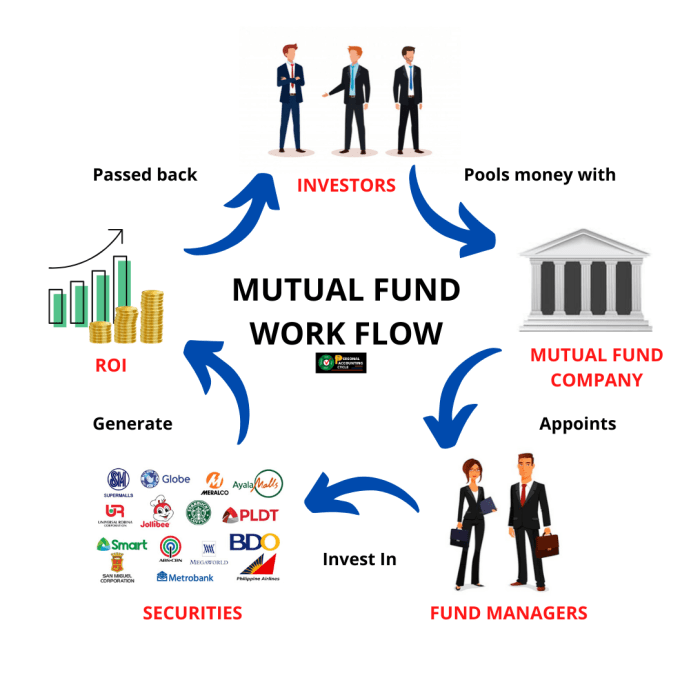

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in mutual funds, individual investors can access a diversified investment portfolio managed by professional fund managers.

Types of mutual funds

- Equity Funds: These mutual funds primarily invest in stocks, offering potential for high returns but also higher risk.

- Bond Funds: These funds invest in government or corporate bonds, providing regular income but with lower potential returns compared to stocks.

- Money Market Funds: These funds invest in low-risk, short-term securities, offering stability and liquidity.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500.

- Balanced Funds: These funds invest in a mix of stocks and bonds to provide a balanced approach to investment.

Pooling money for investment purposes

Mutual funds pool money from individual investors to create a larger fund that is managed by professional investment managers. This pooling of funds allows investors to access a diversified portfolio that they may not be able to create on their own. The fund manager makes investment decisions on behalf of the investors, aiming to achieve the fund’s investment objectives and generate returns.

Benefits of investing in mutual funds

Investing in mutual funds offers several advantages over individual stock picking. Mutual funds provide diversification benefits, professional management, and convenience for investors.

Diversification Benefits

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets such as stocks, bonds, and other securities. This diversification helps spread risk across different investments, reducing the impact of volatility on the overall portfolio.

Professional Fund Management

Mutual funds are managed by experienced professionals who make investment decisions on behalf of investors. These fund managers conduct research, analyze market trends, and actively manage the portfolio to achieve the fund’s investment objectives. Their expertise can help optimize returns and manage risks effectively.

Convenience and Accessibility

Investing in mutual funds is convenient and accessible for individual investors. With mutual funds, investors can gain exposure to a diversified portfolio of securities without the need to research and select individual stocks or bonds. Additionally, mutual funds offer liquidity, allowing investors to buy or sell their shares on any business day at the fund’s current net asset value (NAV).

Risks associated with mutual funds

Investing in mutual funds comes with certain risks that investors should be aware of to make informed decisions. These risks can impact the performance and value of the investments in various ways.

Potential Risks

- Market Risk: The value of mutual fund investments can fluctuate based on market conditions, economic factors, and geopolitical events. This risk is inherent in all types of investments and can lead to losses if the market takes a downturn.

- Interest Rate Risk: Mutual funds that invest in fixed-income securities are vulnerable to changes in interest rates. When interest rates rise, bond prices fall, affecting the fund’s overall performance.

- Liquidity Risk: Some mutual funds may face liquidity issues, especially during turbulent market conditions. If a fund cannot sell its assets quickly enough to meet redemption requests, it may have to sell at a loss or suspend redemptions temporarily.

Factors Affecting Performance

- Management Risk: The performance of a mutual fund can be influenced by the decisions made by its fund managers. Poor investment choices, high fees, or lack of diversification can impact the fund’s returns.

- Operating Expenses: High expense ratios can eat into the returns generated by a mutual fund, reducing the overall profitability for investors.

Market Fluctuations Impact

- During periods of market volatility, the value of mutual fund investments can experience sudden and significant changes. Investors may see the value of their holdings decrease rapidly, leading to potential losses if they decide to sell during a downturn.

- Investors should be prepared for market fluctuations and have a long-term investment horizon to ride out short-term market movements.

How to invest in mutual funds

Investing in mutual funds can be a great way to grow your wealth over time. Here is a step-by-step guide on how to invest in mutual funds:

Choosing the right mutual fund

When investing in mutual funds, it’s important to choose the right fund that aligns with your investment goals and risk tolerance. Consider factors such as the fund’s investment objective, past performance, and fees.

- Research different mutual funds and their investment strategies.

- Consider seeking advice from a financial advisor to help you choose the right fund.

- Ensure that the fund’s investment objective matches your financial goals.

- Check the fund’s past performance to assess its track record.

- Compare the fees and expenses associated with the fund.

It’s crucial to do your due diligence and research before investing in any mutual fund.

Purchasing mutual fund shares

After selecting the right mutual fund, you can purchase shares in different ways. Here are some common methods investors can use to buy mutual fund shares:

- Through a mutual fund company directly.

- Through a financial advisor who can help you navigate the investment process.

- Through an online brokerage platform that offers access to a variety of mutual funds.

Choose a method that best suits your preferences and comfort level with investing.

Setting investment goals

Before investing in mutual funds, it’s essential to set clear investment goals. Establishing your goals can help you determine the right mutual fund to invest in and stay on track with your financial objectives.

- Determine your financial objectives, whether it’s saving for retirement, buying a house, or funding your child’s education.

- Set a timeline for achieving your investment goals.

- Assess your risk tolerance to ensure that the mutual fund you choose aligns with your comfort level.

Setting investment goals is crucial for building a well-rounded investment portfolio tailored to your needs.

Understanding mutual fund fees

When investing in mutual funds, it’s essential to understand the various fees associated with them. These fees can have a significant impact on the overall return of your investments. Therefore, comparing fees is crucial when choosing a mutual fund to invest in.

Types of Fees in Mutual Funds

- Expense Ratio: This is the annual fee charged by the mutual fund company to manage the fund. It is expressed as a percentage of the fund’s assets.

- Load Fees: These are sales charges that investors may have to pay when buying or selling mutual fund shares.

- Transaction Fees: Some mutual funds charge fees for buying or selling shares within the fund.

Impact of Fees on Returns

- High fees can eat into your returns over time, reducing the overall profitability of your investment.

- Even seemingly small differences in fees can compound over time and significantly affect the growth of your investment.

Importance of Comparing Fees

- By comparing fees of different mutual funds, you can choose one that offers competitive fees and potentially higher returns.

- Lower fees generally lead to higher net returns for investors, making it important to consider fee structures when making investment decisions.