529 college savings plans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of 529 college savings plans, where financial savvy meets educational dreams in a fusion of potential and opportunity.

What is a 529 college savings plan?

A 529 college savings plan is a tax-advantaged investment account designed to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions and offer various benefits to account holders.

Purpose and Benefits of a 529 plan

- One of the main purposes of a 529 plan is to save for qualified higher education expenses, such as tuition, fees, books, and room and board.

- Contributions to a 529 plan grow tax-deferred and withdrawals are tax-free when used for qualified educational expenses.

- Some states offer additional tax benefits for residents who invest in their own state’s 529 plan.

- 529 plans typically offer flexibility in terms of investment options and contribution amounts, making them accessible to a wide range of savers.

Types of 529 plans available

- Prepaid tuition plans: These plans allow you to prepay tuition at participating colleges and universities at today’s rates, helping to hedge against future tuition increases.

- College savings plans: With these plans, you can invest in a variety of mutual funds or other investment options to help your savings grow over time based on market performance.

- Education savings accounts (ESAs): While not technically a 529 plan, ESAs offer similar tax advantages for education savings, allowing for more flexibility in how the funds are used for educational expenses.

Tax benefits of a 529 college savings plan

Investing in a 529 college savings plan comes with several tax advantages that can help families save for education expenses in a more efficient way.

Tax advantages of a 529 plan

- Contributions to a 529 plan are made with after-tax dollars, meaning they are not tax-deductible on a federal level. However, some states offer tax deductions or credits for contributions made to their specific 529 plans.

- Earnings in a 529 plan grow tax-free, allowing your investments to compound over time without being subject to annual capital gains taxes.

- Withdrawals from a 529 plan for qualified education expenses are also tax-free at both the federal and state levels, making it a powerful tool to fund higher education costs.

Comparison with other investment options

- Unlike a traditional savings account or investment account, a 529 plan offers tax-free growth and withdrawals specifically for education expenses, providing a unique advantage for families saving for college.

- While other investment options may offer tax-deferred growth or tax advantages for specific purposes, the combination of tax-free growth and withdrawals in a 529 plan makes it a highly attractive choice for education savings.

Contributions and Limits

When it comes to saving for education with a 529 plan, understanding how contributions work and the limits involved is crucial for maximizing your savings potential.

How Contributions to a 529 Plan Work

- Contributions to a 529 plan are made with after-tax dollars, meaning you don’t get a federal tax deduction for your contributions.

- However, the earnings in the account grow tax-free, and withdrawals for qualified education expenses are also tax-free.

- You can choose how much and how often you want to contribute to your 529 plan, making it a flexible way to save for education.

Contribution Limits of a 529 Plan

- Each state sets its own maximum contribution limit for 529 plans, which can range from $235,000 to over $500,000 per beneficiary.

- Contributions that exceed the annual gift tax exclusion amount (currently $15,000 per individual or $30,000 for married couples filing jointly) may be subject to gift tax.

- Some states offer additional tax benefits for contributing to their own state’s 529 plan, so it’s essential to check the specific rules for the plan you choose.

Impact of Contribution Limits on Saving for Education

- While contribution limits can restrict the total amount you can save in a 529 plan, they are typically high enough to cover the cost of most college expenses.

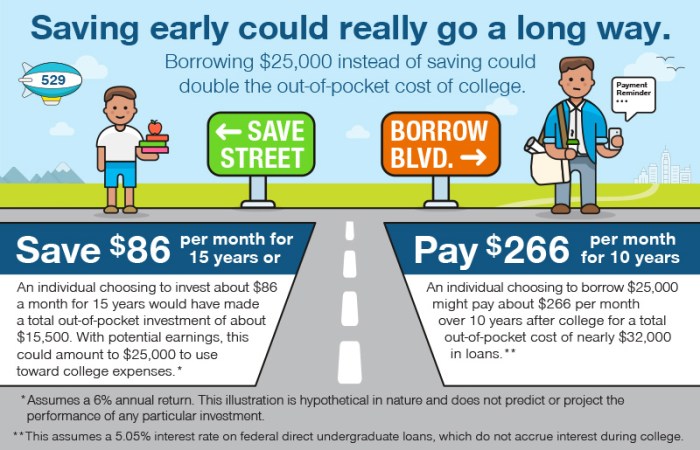

- It’s important to start saving early and regularly to maximize the benefits of a 529 plan and ensure you can reach your savings goals within the limits set by the plan.

- Understanding the contribution limits and planning your contributions accordingly can help you make the most of your 529 plan for education savings.

Investment options in a 529 plan

When it comes to investing in a 529 college savings plan, there are different options available to account holders. These options allow individuals to choose how their contributions are invested, with the goal of growing their savings over time to cover future education expenses.

Different Investment Options

- Pre-designed Portfolios: These are investment options created by the plan provider, typically based on the account holder’s risk tolerance and time horizon. They may include conservative, moderate, and aggressive portfolios.

- Individual Mutual Funds: Account holders can also select individual mutual funds to invest their contributions. These funds vary in risk and return potential, allowing for more customization in the investment strategy.

- Age-Based Portfolios: These portfolios automatically adjust the investment mix based on the beneficiary’s age, becoming more conservative as the child approaches college age.

Performance Comparison

- Historical Performance: Account holders can compare the historical performance of different investment options to evaluate their potential returns. This information is typically provided by the plan provider.

- Risk Factors: It’s essential to consider the risk associated with each investment option, as higher returns often come with higher risk. Understanding the risk-return trade-off is crucial for making informed investment decisions.

Flexibility of Changing Options

- Most 529 plans allow account holders to change their investment options twice per year or when changing beneficiaries. This flexibility ensures that individuals can adapt their investment strategy based on changing circumstances or goals.

- Changing Risk Tolerance: As the beneficiary grows older, account holders may choose to adjust their investment options to align with their changing risk tolerance and investment objectives.