Get ready to dive into the world of credit history reports where financial decisions hang in the balance. From loan approvals to creditworthiness, this topic is a game-changer you don’t want to miss.

Let’s break down the key components and explore how you can obtain and improve your credit history report for a brighter financial future.

Importance of Credit History Report

Having a good credit history report is crucial for making sound financial decisions. It serves as a record of your credit behavior and financial responsibility, providing lenders with valuable information to assess your creditworthiness.

Credit History and Loan Approvals

Your credit history report plays a significant role in determining whether you are approved for a loan. Lenders use this report to evaluate your risk level as a borrower. A positive credit history with timely payments and low credit utilization can increase your chances of loan approval.

Impact on Interest Rates

A strong credit history can also impact the interest rates you are offered on loans. Lenders typically offer lower interest rates to borrowers with good credit scores, as they are considered less risky. On the other hand, a poor credit history may result in higher interest rates or even loan denial.

Determining Creditworthiness

In addition to loan approvals and interest rates, your credit history report is crucial in determining your overall creditworthiness. It reflects your ability to manage debt responsibly and indicates to lenders how likely you are to repay borrowed funds. Maintaining a positive credit history is essential for building a solid financial foundation.

Components of a Credit History Report

Understanding the key elements included in a credit history report is essential for managing your financial reputation and creditworthiness.

Payment History

- Your payment history is one of the most crucial components of your credit report. It shows whether you have been making on-time payments for your credit accounts.

- Missed or late payments can significantly impact your credit score and indicate to lenders your reliability in repaying debts.

- Consistently paying bills on time can help improve your credit score over time.

Credit Utilization

- Credit utilization refers to the amount of credit you are using compared to the total amount available to you.

- High credit utilization can signal financial distress to lenders and negatively impact your credit score.

- Keeping your credit utilization low, ideally below 30%, can help maintain a healthy credit score.

Account Age

- The age of your credit accounts is another important factor in your credit history report.

- Longer credit history can demonstrate your experience in managing credit responsibly.

- Closing old accounts can shorten your credit history and potentially lower your credit score.

Negative Items Impact

- Negative items such as late payments, collections, bankruptcies, or foreclosures can have a significant negative impact on your credit score.

- These items can stay on your credit report for several years and make it harder to qualify for new credit or loans.

- Working to resolve negative items and establishing positive credit habits can help improve your credit score over time.

Obtaining a Credit History Report

When it comes to obtaining a credit history report, there are a few key steps individuals can take to access this important financial information.

To request a free credit history report, follow these steps:

1. Visit AnnualCreditReport.com, the only website authorized by the government to provide free credit reports from the three major credit reporting agencies – Equifax, Experian, and TransUnion.

2. Fill out the necessary information, including your name, address, Social Security number, and date of birth.

3. Select which credit reporting agency’s report you would like to view or choose to view all three reports.

4. Verify your identity by answering security questions based on your credit history.

5. Once verified, you can view and download your credit history report for free.

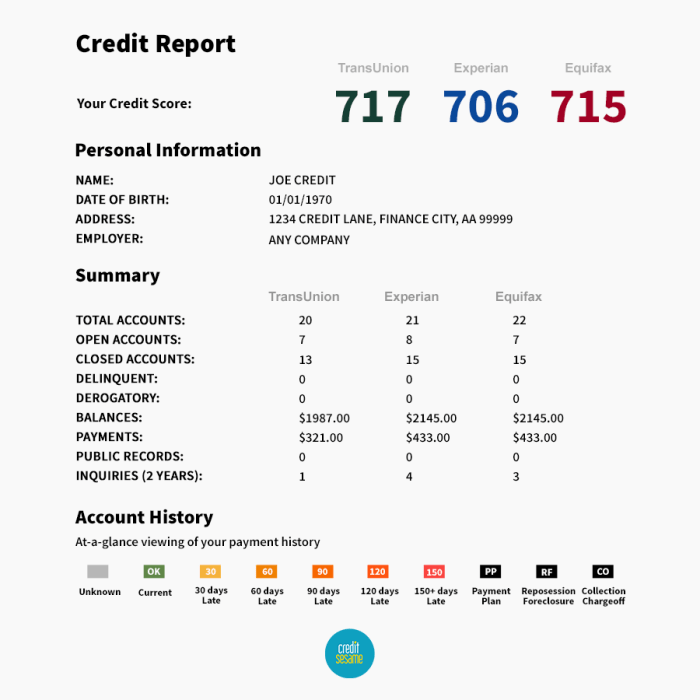

Comparing Different Credit Reporting Agencies

It’s important to note that each credit reporting agency may have slightly different information on your credit history report. Here is a brief comparison of the three major credit reporting agencies:

– Equifax: Known for providing detailed credit reports and scores, Equifax offers a wide range of credit monitoring services.

– Experian: Experian also provides comprehensive credit reports and scores, along with identity theft protection services.

– TransUnion: TransUnion offers credit reports and scores, as well as credit monitoring and identity theft protection.

Reviewing Frequency of Credit History Report

It is recommended to review your credit history report at least once a year to check for any errors, fraudulent activity, or signs of identity theft. Regularly monitoring your credit report can help you maintain a healthy credit score and financial well-being.

Improving Credit History

Improving your credit history is essential for financial stability and future opportunities. By taking proactive steps, you can gradually enhance your credit score and overall financial health.

Strategies to Improve a Poor Credit History

- Begin by reviewing your credit report for any errors or inaccuracies that may be negatively impacting your score.

- Develop a realistic budget to manage your finances effectively and ensure timely payments on all accounts.

- Consider consolidating high-interest debts or negotiating with creditors to establish more manageable repayment plans.

- Avoid opening new credit accounts unnecessarily and focus on paying down existing debt to lower your credit utilization ratio.

Impact of Timely Payments and Responsible Credit Utilization

- Timely payments demonstrate financial responsibility and can significantly improve your credit score over time.

- Maintaining a low credit utilization ratio shows lenders that you can manage credit wisely and are not overly reliant on borrowed funds.

- Consistently meeting payment deadlines and keeping credit card balances low can have a positive impact on your credit history.

Tips to Maintain a Positive Credit History

- Set up automatic payments or reminders to ensure you never miss a payment deadline.

- Regularly monitor your credit report to track your progress and address any issues promptly.

- Avoid closing old credit accounts, as they contribute to the length of your credit history and can positively impact your score.

- Limit new credit applications to prevent unnecessary inquiries that could lower your score.