Get ready to dive into the world of APR on loans like a boss. This crucial financial concept can make or break your borrowing experience, so buckle up for some real talk.

Now, let’s break it down and get to the nitty-gritty details of APR on loans.

Importance of Understanding APR on Loans

Understanding APR on loans is crucial for borrowers as it gives a clear picture of the total cost of borrowing money. APR includes not only the interest rate but also any additional fees or charges associated with the loan. This information helps borrowers make informed decisions and compare different loan options effectively.

How APR Affects the Total Cost of Borrowing

When it comes to borrowing money, the APR plays a significant role in determining the total cost of the loan. A lower APR means lower overall costs, while a higher APR can significantly increase the amount you have to repay. For example, a small difference in APR can result in substantial savings or additional expenses over the life of a loan.

Examples of How APR Impacts Loan Repayments

- Example 1: A $10,000 loan with a 5% APR for 5 years will have a total repayment amount of $11,322.50. However, if the APR is 10%, the total repayment amount increases to $12,748.80.

- Example 2: A credit card with a 15% APR that carries a balance of $1,000 for a year will accumulate $150 in interest. If the APR is 20%, the interest accrued will be $200 for the same balance.

Definition of APR

When it comes to loans, APR stands for Annual Percentage Rate. This is a crucial factor to consider when borrowing money as it represents the total cost of the loan, including interest and fees, expressed as a yearly percentage.

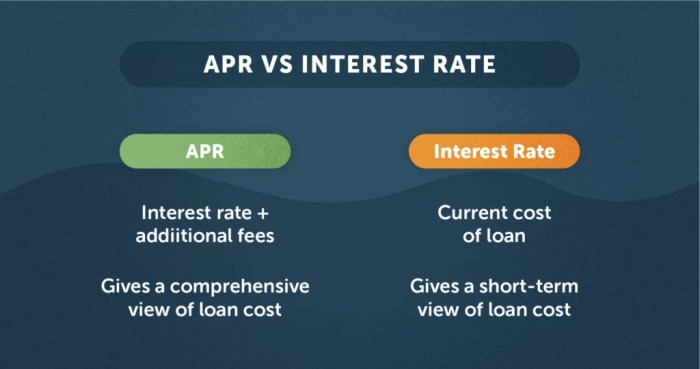

Difference Between APR and Interest Rate

Interest rate is simply the cost of borrowing money, expressed as a percentage of the principal loan amount. On the other hand, APR includes not only the interest rate but also any additional fees or charges associated with the loan. This makes APR a more accurate reflection of the total cost of borrowing.

- For example, let’s say you’re comparing two loans: Loan A has an interest rate of 5% and Loan B has an interest rate of 4.5% but also includes a $100 origination fee. In this case, Loan B would likely have a higher APR due to the added fee, even though the interest rate is lower.

- Another example would be a credit card with a 20% interest rate and an annual fee of $50. The APR on this credit card would be higher than just the interest rate alone.

Factors Influencing APR

When it comes to determining the Annual Percentage Rate (APR) on a loan, several key factors come into play. Understanding how credit score, loan term, and loan amount impact APR is crucial in making informed financial decisions. Lenders set APR based on risk assessment, considering these factors to calculate the interest rate that reflects the overall cost of borrowing.

Credit Score

Your credit score plays a significant role in determining the APR on a loan. Lenders use your credit score to assess your creditworthiness and the likelihood of repayment. A higher credit score typically results in a lower APR, as it signals to lenders that you are a responsible borrower. On the other hand, a lower credit score may lead to a higher APR, as lenders perceive you as a higher risk.

Loan Term

The loan term, or the length of time you have to repay the loan, also influences the APR. Generally, shorter loan terms tend to have lower APRs, as the lender is taking on less risk over a shorter period. Conversely, longer loan terms may have higher APRs to account for the extended repayment period and potential changes in economic conditions.

Loan Amount

The amount of the loan can impact the APR as well. Larger loan amounts may result in higher APRs, as lenders may view larger loans as riskier due to the increased potential loss. Smaller loan amounts, on the other hand, may have lower APRs since they pose less risk to the lender.

Comparing Fixed vs. Variable APR

When it comes to loans, understanding the difference between fixed and variable APR can have a significant impact on your financial decisions. Both types of APR have their own set of pros and cons, and knowing when to choose one over the other can save you money in the long run.

Fixed APR

Fixed APR remains the same throughout the life of the loan, providing predictability and stability in your monthly payments. This type of APR is ideal for borrowers who prefer consistency and want to avoid any surprises in their payment amounts. For example, if you have a fixed-rate mortgage, your monthly payments will remain unchanged regardless of any fluctuations in the market.

Variable APR

On the other hand, variable APR fluctuates based on changes in the market interest rates. While this type of APR may start lower than fixed APR, it can increase over time, potentially leading to higher monthly payments. Variable APR is suitable for borrowers who are willing to take on some risk in exchange for the possibility of lower initial rates. For instance, if you have a variable-rate student loan, your payments may vary depending on the market conditions.

Choosing the Right APR

When deciding between fixed and variable APR, consider your financial goals and risk tolerance. If you prefer certainty and want to budget effectively, a fixed APR may be the better choice. However, if you are comfortable with some level of uncertainty and believe that market rates will remain favorable, a variable APR could potentially save you money in the short term.

Understanding the APR Disclosure

When it comes to loans, understanding the APR disclosure is crucial for making informed financial decisions. This statement provides key information about the total cost of borrowing money and helps borrowers compare offers from different lenders.

Importance of the APR Disclosure

The APR disclosure statement is important because it gives borrowers a clear picture of the true cost of a loan. It includes not only the interest rate but also any additional fees or charges, making it easier to compare loan offers from various lenders. By understanding the APR disclosure, borrowers can avoid hidden costs and choose the most cost-effective option.

Information Included in the APR Disclosure

The APR disclosure typically includes the annual percentage rate (APR), which represents the total cost of borrowing over a year, including interest and fees. It also Artikels any prepayment penalties, closing costs, and other charges associated with the loan. Additionally, the disclosure may specify whether the APR is fixed or variable.

Tips for Interpreting and Comparing APR Disclosures

– Look beyond the interest rate: Consider all fees and charges included in the APR to get a complete picture of the cost of the loan.

– Compare similar loan terms: To make an accurate comparison, ensure that you are comparing APRs for loans with the same repayment period.

– Pay attention to the fine print: Read the APR disclosure carefully to understand all the terms and conditions associated with the loan.

– Use online tools: Utilize online calculators to compare APRs from different lenders and determine the most cost-effective option for your financial situation.

Impact of APR on Loan Affordability

When it comes to the affordability of a loan, the APR plays a crucial role in determining how much you will ultimately pay over the loan term. Understanding how APR affects your monthly payments and overall cost can help you make informed decisions when borrowing money.

How APR Affects Monthly Payments

APR directly impacts the cost of borrowing money. A lower APR means lower monthly payments, as you will pay less in interest over time. On the other hand, a higher APR results in higher monthly payments, increasing the total amount you repay on the loan.

Strategies to Lower APR on a Loan

There are several strategies you can use to lower the APR on a loan and make it more affordable:

- Improve your credit score: A higher credit score can help you qualify for lower APR rates.

- Shop around for the best rates: Compare APR offers from different lenders to find the most competitive option.

- Consider a co-signer: Having a co-signer with a strong credit history can help you secure a lower APR.

- Pay down debt: Lowering your overall debt can improve your credit score and potentially lead to a lower APR.