Hey there, looking to level up your credit game? Dive into our guide on credit limit increase tips to discover how boosting your credit limit can open doors to financial opportunities you never knew existed. From enhancing your credit score to gaining more flexibility with your finances, we’ve got you covered. So, buckle up and let’s explore the world of credit limit increases together!

Importance of Credit Limit Increases

Having a higher credit limit can bring several benefits to individuals. Not only does it provide more purchasing power, but it can also positively impact credit scores and financial flexibility.

Positive Impact on Credit Scores

Increasing your credit limit can lower your credit utilization ratio, which is the amount of credit you’re using compared to the total credit available to you. A lower utilization ratio can boost your credit score as it shows responsible credit management.

Enhanced Financial Flexibility

With a higher credit limit, individuals have the flexibility to handle unexpected expenses or emergencies without maxing out their credit cards. This can prevent financial strain and help maintain a healthy financial profile.

Factors Influencing Credit Limit Increases

When it comes to determining whether you qualify for a credit limit increase, credit card companies consider several key factors.

Credit History and Payment Behavior

Your credit history plays a significant role in the decision-making process for a credit limit increase. Credit card companies will review your track record of making on-time payments, managing debt responsibly, and keeping your credit utilization low. A positive payment behavior and a history of responsible credit management can increase your chances of getting a credit limit adjustment.

Income Level

Your income level also plays a crucial role in whether you are approved for a credit limit increase. Credit card companies want to ensure that you have the financial means to handle a higher credit limit without falling into debt. A higher income level can demonstrate to the credit card issuer that you have the capacity to repay any additional debt incurred with a higher credit limit.

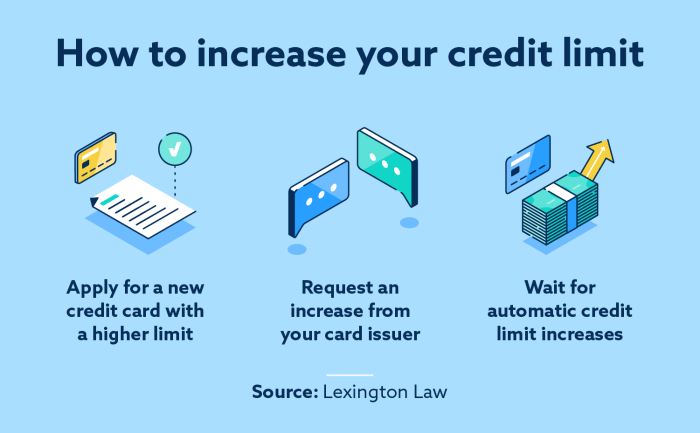

Tips for Requesting a Credit Limit Increase

When it comes to requesting a credit limit increase, there are some key tips to keep in mind to increase your chances of success. It’s important to be prepared, consider the timing of your request, and effectively communicate with credit card companies.

Best Practices for Preparing to Request a Credit Limit Increase

- Check your credit score: Make sure your credit score has improved since you first received your credit card.

- Pay on time: Show a history of responsible payments to demonstrate your creditworthiness.

- Reduce debt: Lowering your overall debt can also increase your chances of getting a credit limit increase.

Importance of Timing When Asking for a Credit Limit Increase

- Wait for a salary increase: If you recently received a raise, it might be a good time to request a credit limit increase.

- Avoid recent credit inquiries: Try to wait until any recent credit inquiries have had time to settle before asking for an increase.

- Consider your credit card company’s policies: Some companies have specific timeframes for when you can request a credit limit increase.

Effective Communication with Credit Card Companies to Request a Credit Limit Increase

- Call customer service: Reach out to your credit card company’s customer service to inquire about the process for requesting a credit limit increase.

- Explain your reasons: Clearly communicate why you are requesting a credit limit increase, such as for a large upcoming purchase or to improve your credit utilization ratio.

- Be polite and persistent: If your request is initially denied, politely ask if there are alternative options or steps you can take to increase your chances in the future.

Alternatives to a Credit Limit Increase

In some situations, getting a credit limit increase may not be the best option. Here are some alternatives to consider when managing your credit utilization and improving your credit score without solely relying on a credit limit increase.

Using Balance Transfer Cards

If you have high balances on one or more credit cards, consider transferring those balances to a balance transfer card with a lower interest rate. This can help you pay off your debt faster and improve your credit score without needing a credit limit increase.

Paying Off Debt Strategically

Focus on paying down your existing credit card debt strategically. By prioritizing high-interest debt or accounts with high credit utilization ratios, you can improve your credit score over time without constantly seeking credit limit increases.

Requesting a Lower Interest Rate

Instead of requesting a credit limit increase, consider reaching out to your credit card issuer to negotiate a lower interest rate. A lower interest rate can help you save money on interest payments and make it easier to manage your credit card debt effectively.

Using Credit Cards Responsibly

One of the best ways to avoid the need for frequent credit limit increases is to use your credit cards responsibly. Make timely payments, keep your credit utilization low, and avoid maxing out your cards to maintain a healthy credit profile.

Exploring Secured Credit Cards

If you’re struggling to get a credit limit increase on your existing cards, consider applying for a secured credit card. Secured cards require a cash deposit as collateral, making them easier to qualify for and a good option for building or rebuilding credit without the need for a credit limit increase.