With global investment trends at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling adventure filled with unexpected twists and insights.

Let’s dive into the world of global investment trends where we uncover key sectors, emerging markets, sustainable investing, and technological innovations shaping the game.

Overview of Global Investment Trends

In the current landscape of global investment trends, we see a dynamic and ever-evolving market driven by various factors. Key sectors experiencing significant investment growth include technology, healthcare, renewable energy, and e-commerce. These sectors have attracted substantial capital due to their potential for innovation, scalability, and long-term sustainability.

Impact of Geopolitical Events on Global Investment Patterns

Geopolitical events play a crucial role in shaping global investment patterns. Uncertainty surrounding trade agreements, political stability, and regulatory changes can significantly impact investor confidence and decision-making. For example, the ongoing trade tensions between major economies like the US and China have led to fluctuations in stock markets and investment flows. Additionally, geopolitical conflicts and sanctions can create risks and challenges for investments in certain regions, influencing diversification strategies and portfolio allocations.

Emerging Markets and Investment Opportunities

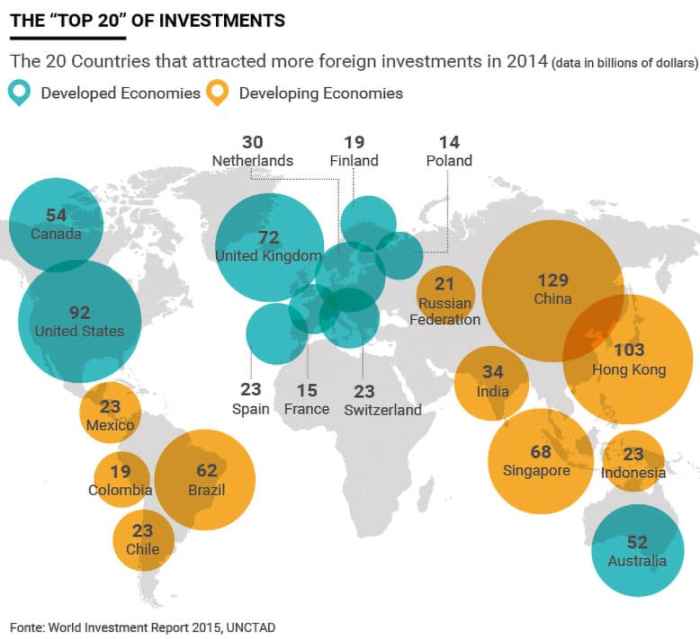

In today’s global economy, emerging markets present exciting investment opportunities for those looking to diversify their portfolios and potentially achieve high returns. These markets, located in countries with rapidly growing economies and increasing industrialization, offer unique advantages and challenges compared to investing in developed nations.

When considering investing in emerging markets, it’s important to weigh the risks and benefits carefully. While these markets can offer high growth potential and access to new and expanding consumer markets, they also come with higher volatility, political instability, and currency risks. On the other hand, investing in developed markets may provide more stability and established regulatory frameworks but may offer lower growth prospects.

Success Stories in Emerging Economies

- One successful investment example in an emerging economy is Alibaba Group Holding Limited, a Chinese e-commerce giant founded by Jack Ma. Despite facing competition and regulatory challenges, Alibaba has grown to become one of the world’s largest e-commerce companies.

- Another notable success story is Natura & Co, a Brazilian beauty and personal care company that has expanded globally and gained market share in the sustainable beauty segment.

- Investors have also found success in investing in Indian technology companies like Infosys and Wipro, which have capitalized on the country’s skilled workforce and growing IT sector.

Sustainable Investing and ESG Criteria

Sustainable investing has been on the rise in recent years, with investors focusing on not only financial returns but also the impact of their investments on the environment and society. This shift in mindset has led to the integration of Environmental, Social, and Governance (ESG) criteria into investment decisions.

Importance of ESG Criteria

- Environmental factors consider how a company performs as a steward of nature, including its carbon footprint, waste management, and resource use.

- Social factors assess how a company manages relationships with employees, suppliers, customers, and the communities in which it operates.

- Governance factors focus on the leadership, executive pay, audits, internal controls, and shareholder rights of a company.

Integration of ESG Factors

- Companies are increasingly recognizing the importance of ESG factors in their long-term sustainability and are incorporating them into their business strategies.

- Investors are demanding more transparency and accountability from companies regarding their ESG practices, which is driving further integration of these criteria.

- Research shows that companies with strong ESG performance tend to outperform their peers in the long run, indicating that considering these factors can lead to better investment outcomes.

Technological Innovations Shaping Investment Trends

Technology plays a crucial role in shaping the landscape of global investments. Innovations such as AI, blockchain, and big data are revolutionizing the way investment decisions are made. Fintech is also making waves in the industry, while robo-advisors and algorithmic trading are transforming traditional investment practices.

AI in Investment Decisions

Artificial Intelligence (AI) is being used to analyze vast amounts of data quickly and efficiently, helping investors make more informed decisions. AI algorithms can identify patterns and trends in the market, enabling investors to optimize their portfolios and minimize risks.

Blockchain Technology

Blockchain technology is revolutionizing the way transactions are conducted, providing transparency, security, and efficiency. In the investment world, blockchain is being used to streamline processes such as trade settlement, reducing the need for intermediaries and lowering transaction costs.

Big Data Analytics

Big data analytics is empowering investors to gain insights into market trends, consumer behavior, and economic indicators. By leveraging big data, investors can make data-driven decisions, identify investment opportunities, and manage risks more effectively.

The Role of Fintech

Fintech companies are disrupting traditional financial services by offering innovative solutions for investment management, lending, and payment processing. Fintech platforms provide investors with easy access to investment products, personalized advice, and seamless transactions, democratizing the investment landscape.

Robo-Advisors and Algorithmic Trading

Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on individual risk tolerance and financial goals. Algorithmic trading, on the other hand, involves the use of computer algorithms to execute trades at high speeds and frequencies, optimizing investment strategies.