Ready to level up your financial game? We’re diving into the world of building credit – a crucial step for a solid financial foundation. From loan approvals to job opportunities, your credit score holds the key. So, buckle up and let’s explore the ins and outs of how to build credit like a pro.

Now, let’s break down the nitty-gritty details in the following paragraphs.

Importance of Building Credit

Building credit is crucial for maintaining good financial health. A good credit score can open doors to various opportunities such as loan approvals and lower interest rates. It can also impact other areas of life like renting an apartment or securing a job.

Impact on Loan Approvals and Interest Rates

Having a good credit score can significantly increase your chances of getting approved for loans, whether it’s for a car, a home, or a personal loan. Lenders use your credit score to assess your creditworthiness and determine the interest rate they will offer you. A higher credit score often leads to lower interest rates, saving you money in the long run.

Influence on Renting an Apartment and Job Opportunities

Landlords often check your credit history when you apply to rent an apartment. A good credit score can make you a more desirable tenant, while a poor credit score may result in your application being denied. Similarly, some employers may also review your credit report as part of the hiring process, especially for positions that involve financial responsibilities. A positive credit history can give you an edge in the job market.

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. These scores are crucial in determining the interest rates and loan terms individuals can secure.

Credit Scoring Models

There are various credit scoring models used by lenders to assess an individual’s credit risk. The two most common models are FICO Score and VantageScore. While both models range from 300 to 850, they may weigh factors differently, resulting in slight score variations.

Factors Affecting Credit Scores

- Payment History: Timely payments positively impact credit scores, while late payments or defaults can have a negative impact.

- Credit Utilization: Keeping credit card balances low relative to the credit limit can boost scores, whereas maxing out cards can lower scores.

- Length of Credit History: A longer credit history demonstrates experience managing credit responsibly, which can enhance scores.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively influence scores.

- New Credit Inquiries: Applying for multiple new credit accounts within a short period may signal financial distress and lower credit scores.

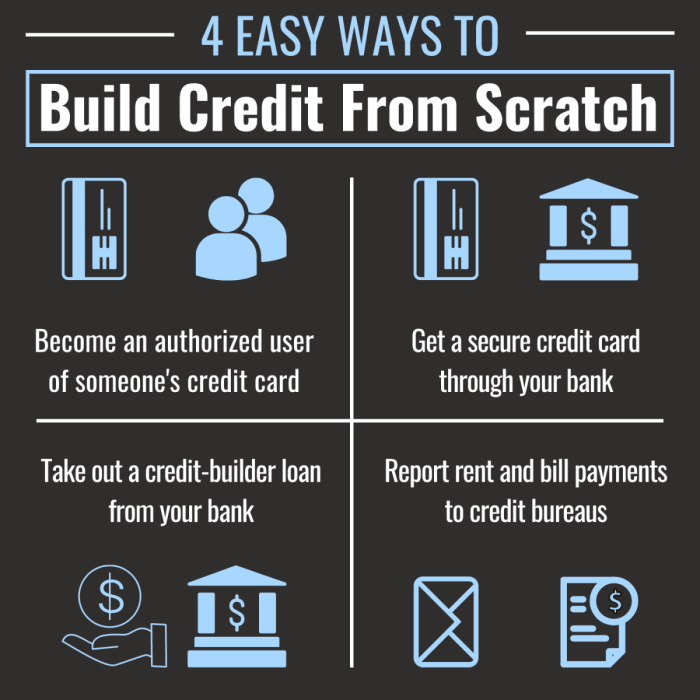

Ways to Build Credit

Building credit is essential for establishing a solid financial foundation. For individuals with no credit history, it can be a bit challenging to get started. However, there are strategies that can help kickstart the process and pave the way to a positive credit score.

Establishing Credit for Individuals with No Credit History

- Apply for a secured credit card: A secured credit card requires a cash deposit as collateral, making it easier to qualify for individuals with no credit history.

- Become an authorized user: Ask a family member or friend with good credit to add you as an authorized user on their credit card. This can help you build credit as their positive payment history will reflect on your credit report.

- Consider a credit-builder loan: Some financial institutions offer credit-builder loans designed to help individuals establish credit. These loans require you to make regular payments, which are reported to the credit bureaus, helping you build a positive credit history.

Importance of Making On-Time Payments

Making on-time payments is crucial for building and maintaining good credit. Late payments can negatively impact your credit score and stay on your credit report for up to seven years. It is essential to pay your bills on time, every time, to demonstrate responsible credit management and improve your credit score.

Tips on How to Use Credit Cards Responsibly

- Pay your balance in full: Avoid carrying a balance on your credit cards to prevent accumulating high-interest charges.

- Keep your credit utilization low: Aim to use only a small percentage of your available credit to show lenders that you can manage credit responsibly.

- Monitor your credit report: Regularly check your credit report for errors or signs of identity theft that could harm your credit score.

Monitoring and Managing Credit

Monitoring and managing your credit is crucial to maintaining a healthy financial profile. By staying on top of your credit reports and scores, you can ensure that you are in good standing with potential lenders and creditors.

Importance of Regularly Monitoring Credit Reports

Regularly monitoring your credit reports allows you to catch any errors or fraudulent activity early on. By reviewing your reports on a consistent basis, you can identify and address any issues that may be negatively impacting your credit score.

- Check your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion – at least once a year.

- Look for any inaccuracies, such as accounts that don’t belong to you, incorrect personal information, or fraudulent activity.

- If you find any errors, dispute them with the credit bureau by submitting a formal dispute letter along with any supporting documentation.

- Monitor your credit score regularly to track your progress and ensure that your efforts to build credit are paying off.

Disputing Errors on a Credit Report

If you discover any errors on your credit report, it’s important to take action to correct them as soon as possible. Here are the steps to dispute errors on your credit report:

- Obtain a copy of your credit report from the credit bureau that is reporting the error.

- Highlight the inaccurate information and gather any supporting documents that prove the error.

- Write a formal dispute letter to the credit bureau, explaining the error and providing evidence to support your claim.

- The credit bureau will investigate your dispute and either correct the error or inform you of their decision.

- Follow up with the credit bureau to ensure that the error has been resolved and that your credit report is updated accordingly.

Managing Credit Utilization Effectively

Credit utilization, or the ratio of your credit card balances to your credit limits, plays a significant role in determining your credit score. It’s important to keep your credit utilization low to maintain a good credit score.

- Aim to keep your credit utilization below 30% of your total credit limit across all of your accounts.

- Avoid maxing out your credit cards, as high credit utilization can negatively impact your credit score.

- Paying off your balances in full each month can help keep your credit utilization low and demonstrate responsible credit management to creditors.

- If you’re struggling with high credit card balances, consider consolidating your debt or creating a repayment plan to lower your credit utilization over time.