Yo, so you ever heard about compounding interest? It’s like this secret sauce that can seriously level up your money game. Buckle up as we dive into how this whole compounding thing works and why it’s a game-changer for your finances.

Get ready to learn how your money can make money for you over time. It’s about to get real interesting.

What is Compounding Interest?

When it comes to compounding interest, it’s all about making your money work harder for you over time. Unlike simple interest, which only calculates interest on the initial principal amount, compounding interest takes into account the interest earned and adds it back to the principal. This means that with each compounding period, you earn interest on both the initial amount and the interest that has already been added.

Illustrating Compounding Interest

- Let’s say you invest $1,000 in an account that offers 5% annual interest compounded annually. After the first year, you would earn $50 in interest, bringing your total to $1,050. In the second year, you would earn 5% interest on $1,050, not just on the initial $1,000.

- Now, if the interest is compounded quarterly instead of annually, you would earn interest four times a year. This means that your investment grows faster because you are earning interest more frequently.

Compounding Frequency Impact

- Increasing the compounding frequency can significantly impact your returns. For example, if you invest $1,000 at 5% interest compounded annually, you would have $1,276.28 after 5 years. But if the interest is compounded quarterly, you would have $1,283.35 after 5 years, because you are earning more interest more frequently.

- Remember, the more often interest is compounded, the more your money grows over time. So, it’s essential to consider the compounding frequency when choosing an investment or savings account.

Benefits of Compounding Interest

Compounding interest offers several advantages that can help your money grow significantly over time. By reinvesting the interest earned, you can generate earnings on both your initial investment and the accumulated interest, leading to exponential growth in your savings or investments.

Growth Potential Comparison

When comparing a savings account with compound interest to one without, the difference in growth potential becomes evident over time. With compound interest, your money grows faster due to the compounding effect, whereas in a simple interest account, you only earn interest on the initial principal amount.

- Compound Interest Account: With compounding, your earnings increase exponentially over time, allowing your savings to grow at a much faster rate compared to simple interest accounts.

- Simple Interest Account: On the other hand, without compounding, your earnings remain linear, resulting in slower growth of your savings.

Compound interest is like a snowball rolling downhill, picking up more snow and getting bigger as it goes. The longer you let it roll, the larger it becomes.

Power of Compounding Illustration

Let’s consider a hypothetical investment scenario to illustrate the power of compounding interest. Suppose you invest $1,000 in an account with an annual interest rate of 5%.

- After the first year, you would earn $50 in interest, bringing your total to $1,050.

- Instead of withdrawing the interest, you leave it in the account to compound. In the second year, you earn 5% interest on $1,050, resulting in $52.50 in interest.

- As you continue to reinvest the interest earned, your savings grow exponentially, demonstrating the significant impact of compounding over time.

Factors Affecting Compounding Interest

When it comes to compounding interest, several key factors play a crucial role in determining the growth of your investment over time. Understanding these factors can help you make informed decisions to maximize your returns.

Interest Rate

The interest rate is a significant factor that influences compounding interest. A higher interest rate means your investment will grow at a faster pace. Even a small increase in the interest rate can lead to substantial growth over time. For example, if you invest $1,000 at an interest rate of 5% annually, after 10 years, you will have $1,628.89. However, if the interest rate is increased to 7%, the amount after 10 years would be $1,967.15.

Time Period

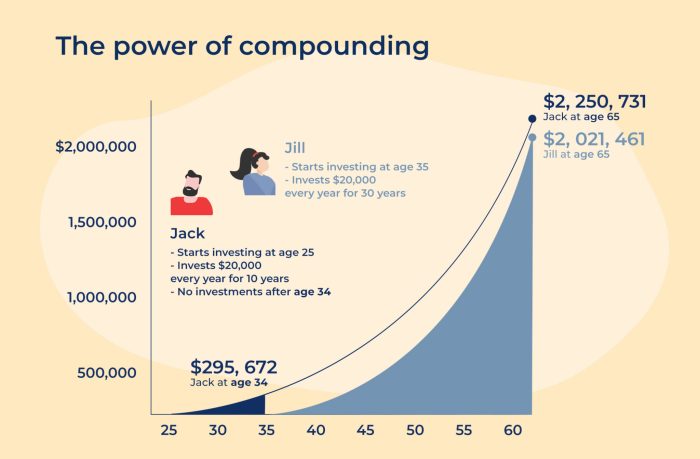

Time plays a crucial role in compounding interest. The longer you keep your money invested, the more it will grow due to compounding. This is why starting to invest early is essential to take advantage of the power of compounding. For instance, if you invest $1,000 at an interest rate of 6% annually, after 20 years, you will have $3,207.14, compared to $1,814.45 after 10 years.

Initial Investment Amount

The initial investment amount also impacts compounding growth. A larger initial investment will result in higher returns over time. For example, if you invest $2,000 at an interest rate of 4% annually, after 15 years, you will have $3,833.71, whereas an initial investment of $1,000 would only grow to $1,916.86.

Reinvesting interest earnings plays a crucial role in maximizing compounding benefits. By reinvesting the interest earned on your investment, you can accelerate the growth of your portfolio. This is known as compound interest on compound interest, leading to exponential growth over time.

Strategies to Maximize Compounding Interest

When it comes to maximizing compounding interest, there are several key strategies to consider that can help you make the most out of your investments. By implementing these tips and staying committed to your long-term financial goals, you can set yourself up for success and watch your money grow over time.

Regular Contributions

- Make regular contributions to your investment accounts to take full advantage of compounding interest.

- Set up automatic transfers from your bank account to ensure consistent contributions.

- Even small contributions can add up over time, thanks to the power of compounding.

Diversification

- Diversify your investment portfolio to reduce risk and maximize returns.

- Consider investing in a mix of stocks, bonds, mutual funds, and other assets to spread out your risk.

- Reinvest dividends and interest payments to further boost your compounding returns.

Compound More Frequently

- Choose investments that compound interest more frequently, such as daily or monthly.

- By compounding more often, you can accelerate the growth of your investments.

- Look for accounts or investments that offer compounding at a higher frequency for maximum returns.

Stay Committed for the Long Term

- Understand that compounding interest works best over an extended period, so stay committed to your investment strategy.

- Avoid withdrawing funds prematurely, as this can hinder the power of compounding.

- Patiently watch your investments grow over time and resist the temptation to make impulsive decisions based on short-term market fluctuations.