Get ready to dive into the world of family budgeting, where financial planning meets household management in a dynamic fusion of money matters and family dynamics. As we explore the intricacies of budgeting for a family, you’ll discover the keys to unlocking financial stability and achieving your family’s dreams.

From creating a comprehensive budget to teaching children about money management, this guide will equip you with the tools and knowledge needed to navigate the realm of family finances with confidence and success.

Importance of Budgeting for a Family

Budgeting for a family is crucial for managing finances effectively. It helps families track their income and expenses, plan for future expenses, and work towards achieving their financial goals.

Benefits of Budgeting for a Family

- Control Over Finances: A budget allows families to have better control over their money by tracking where it goes each month.

- Saving for Emergencies: With a budget in place, families can allocate funds for unexpected expenses or emergencies, reducing financial stress.

- Debt Management: Budgeting helps families prioritize debt payments and avoid accumulating more debt, leading to financial stability.

- Setting Financial Goals: By creating a budget, families can set specific financial goals such as saving for a house, education, or retirement, and work towards achieving them.

Achieving Financial Goals through Budgeting

Budgeting plays a key role in helping families achieve their financial goals. By tracking income and expenses, families can identify areas where they can cut back on spending and allocate more towards their goals. Whether it’s saving for a vacation, buying a new car, or planning for retirement, a budget provides a roadmap for reaching these milestones. Additionally, budgeting instills discipline in managing money and promotes healthy financial habits for the entire family.

Creating a Family Budget

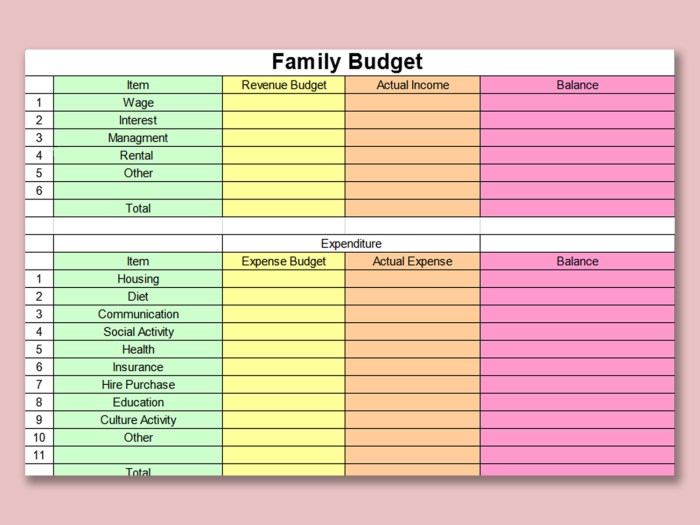

Budgeting for a family involves careful planning and organization to ensure financial stability and meet the needs of all family members. Here are the steps involved in creating a comprehensive family budget:

Different Budgeting Methods

- Zero-Based Budgeting: This method requires assigning every dollar a specific purpose, ensuring that all income is allocated towards expenses, savings, or debt payments.

- Envelope System: With this method, you allocate cash into different envelopes for different spending categories, helping you stay within budget and avoid overspending.

Setting Realistic Financial Goals

- Identify Priorities: Determine your family’s short-term and long-term financial goals, such as saving for a vacation, buying a house, or funding your children’s education.

- Track Expenses: Monitor your spending habits to understand where your money is going and identify areas where you can cut back to reach your goals faster.

- Create a Budget: Develop a detailed budget that includes all sources of income, fixed expenses, variable expenses, savings contributions, and debt payments.

- Review Regularly: Regularly review your budget to ensure you are staying on track with your financial goals and adjust as needed.

Managing Family Expenses

When it comes to managing family expenses, it’s important to take a closer look at where your money is going and find ways to cut down on unnecessary costs. By tracking expenses and adjusting your budget accordingly, you can ensure that your family’s financial health stays on track.

Identifying Common Family Expenses

- Housing costs: This includes rent or mortgage payments, property taxes, homeowners insurance, and maintenance expenses.

- Utilities: Monthly bills for electricity, water, gas, internet, and phone services.

- Food: Groceries and dining out expenses should be accounted for in your budget.

- Transportation: Car payments, insurance, fuel, maintenance, and public transportation costs.

- Childcare and education: Costs associated with daycare, school fees, supplies, and extracurricular activities.

- Healthcare: Insurance premiums, copayments, prescriptions, and medical expenses.

Strategies for Cutting Down on Unnecessary Expenses

- Create a shopping list and stick to it to avoid impulse purchases.

- Comparison shop for big-ticket items and look for sales or discounts.

- Cut down on dining out by meal prepping and cooking at home.

- Cancel unused subscriptions or services to free up extra cash.

- Set a limit on entertainment expenses and find low-cost or free activities to enjoy as a family.

Importance of Tracking Expenses and Adjusting the Budget

Tracking expenses allows you to see where your money is going and identify areas where you can make adjustments to stay within your budget. By regularly reviewing your spending habits and making changes as needed, you can ensure that your family’s financial future is secure.

Saving and Investing within a Family Budget

Saving and investing play crucial roles in a family’s financial planning. By setting aside money for savings and making smart investments, families can secure their future, build wealth, and achieve their financial goals.

Tips for Allocating Funds for Savings and Investments

- Set clear financial goals: Determine what you are saving and investing for, whether it’s buying a house, funding your children’s education, or retirement.

- Create a separate savings account: Having a dedicated account for savings can help you track your progress and prevent you from dipping into those funds for daily expenses.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts each month to ensure consistency.

- Reduce unnecessary expenses: Cut back on non-essential spending to free up more money for savings and investments.

Different Saving and Investment Options for Families

There are various saving and investment options suitable for families, depending on their risk tolerance and financial goals.

| Saving Options | Investment Options |

|---|---|

| Savings Account: Offers safety and liquidity but lower returns. | Stocks: Higher risk but potential for higher returns over the long term. |

| Certificate of Deposit (CD): Fixed interest rate for a specific term. | Mutual Funds: Diversified investment portfolios managed by professionals. |

| High-Yield Savings Account: Higher interest rates than regular savings accounts. | Real Estate: Tangible asset with potential for appreciation and rental income. |

Teaching Children about Money Management

Teaching children about money management is crucial for their long-term financial well-being. By instilling good money habits at a young age, parents can help their children develop a healthy relationship with money and budgeting.

Importance of Financial Literacy for Children

It is essential to teach children about budgeting and financial literacy to ensure they have the necessary skills to manage their money effectively as they grow older. By educating children about the value of money and how to budget wisely, parents can empower them to make informed financial decisions in the future.

Age-Appropriate Ways to Involve Children in Family Budget Discussions

- Start with basic concepts: For younger children, introduce simple money concepts like saving, spending, and sharing. Use clear examples and visuals to help them understand.

- Allow them to make choices: Give children a small allowance and encourage them to make decisions on how to spend or save their money. This hands-on experience will teach them about budgeting and prioritizing expenses.

- Involve them in family budget planning: As children get older, include them in family budget discussions. Show them how to create a budget, track expenses, and set financial goals. This involvement will help them develop a sense of financial responsibility.

Long-Term Benefits of Teaching Children about Money Management

- Financial independence: Children who learn about money management early on are more likely to become financially independent adults. They will have the skills to budget effectively, save for the future, and make smart financial decisions.

- Reduced financial stress: By teaching children how to manage money responsibly, parents can help them avoid financial pitfalls in the future. Children who are financially literate are better equipped to handle unexpected expenses and financial challenges.

- Generational impact: Instilling good money habits in children can have a positive impact on future generations. When children grow up with a strong foundation in money management, they are more likely to pass on these skills to their own children, creating a cycle of financial responsibility.