Diving deep into the world of Understanding economic cycles, this introduction sets the stage for an enlightening exploration that will leave readers intrigued and informed.

In the following paragraphs, we will uncover the intricacies of economic cycles, shedding light on their impact and significance in the ever-changing economic landscape.

What are Economic Cycles?

Economic cycles refer to the recurring patterns of growth and decline in an economy over time. These cycles are characterized by alternating periods of expansion, peak, contraction, and trough. Understanding economic cycles is crucial as they impact various aspects of the economy, including employment, inflation, interest rates, and overall economic activity.

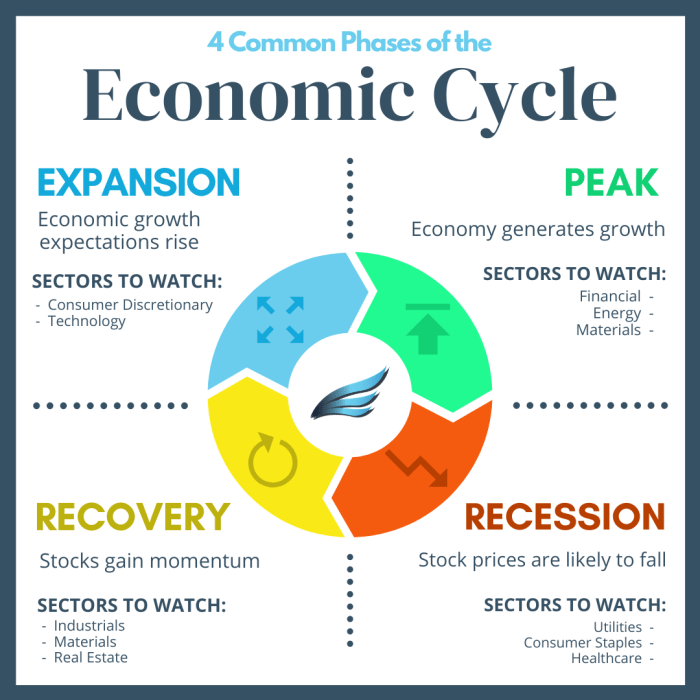

Phases of Economic Cycles

- The expansion phase is marked by increasing economic activity, rising employment, and growing consumer spending. Businesses experience higher profits during this phase.

- The peak phase is the point where the economy reaches its highest level of activity before starting to slow down. Inflation may start to rise during this phase.

- The contraction phase, also known as a recession, is characterized by a decline in economic activity, rising unemployment, and reduced consumer spending. Businesses may struggle during this phase.

- The trough phase is the lowest point of the economic cycle, where economic activity is at its weakest. Unemployment is high, and consumer confidence is low.

Key Indicators of Economic Cycle Transitions

- Gross Domestic Product (GDP) growth rates are crucial indicators of economic cycle transitions. A declining GDP growth rate can signal an upcoming recession.

- Unemployment rates tend to rise during the contraction phase of the economic cycle, indicating a slowdown in economic activity.

- Inflation rates can provide insights into the peak phase of the economic cycle, as rising inflation may lead to a tightening of monetary policy.

Impact of Economic Cycles

- Businesses may adjust their production levels, investment decisions, and hiring practices based on the phase of the economic cycle to navigate through periods of growth and contraction.

- Consumers may alter their spending habits, saving patterns, and borrowing behavior in response to changes in the economic cycle, affecting overall demand in the economy.

- Policymakers, such as central banks and government agencies, may implement monetary and fiscal policies to mitigate the impacts of economic cycles and stabilize the economy during periods of volatility.

Factors Influencing Economic Cycles

Interest rates, inflation, employment, government policies, global events, technological advancements, external shocks like pandemics or financial crises all play a crucial role in shaping economic cycles.

Interest Rates

Interest rates set by central banks impact borrowing costs for businesses and consumers, influencing spending and investment decisions. Lower rates can stimulate economic growth, while higher rates can slow it down.

Inflation

Inflation, the rate at which prices rise, affects consumer purchasing power and overall economic stability. High inflation can erode savings and reduce consumer spending, leading to economic downturns.

Employment

Employment levels indicate the health of an economy, with higher employment leading to increased consumer spending and economic growth. Rising unemployment can signal a recession or economic slowdown.

Government Policies and Global Events

Government fiscal and monetary policies, as well as global events such as trade wars or geopolitical tensions, can impact the duration and intensity of economic cycles. Stimulus measures or regulatory changes can influence economic activity.

Technological Advancements

Technological advancements can drive productivity growth, innovation, and efficiency, impacting economic cycles. Industries that adopt new technologies can experience rapid growth, while others may face challenges.

External Shocks

External shocks like pandemics or financial crises can disrupt economic cycles, leading to recessions or depressions. These events can have far-reaching consequences on businesses, financial markets, and consumer confidence.

Understanding Business Cycles

Business cycles refer to the recurring fluctuations in economic activity over a period of time. These cycles consist of alternating periods of expansion and contraction in economic growth. It’s important to note that business cycles are a subset of broader economic cycles, focusing specifically on fluctuations in business activity.

Stages of a Typical Business Cycle

- Expansion: This phase is characterized by increased economic activity, rising employment rates, and growing consumer spending. Businesses experience higher demand for goods and services during this period.

- Peak: The peak marks the highest point of economic activity in the cycle. It is a period of maximum growth before the economy starts to slow down.

- Contraction: Also known as a recession, this stage involves a decrease in economic activity, rising unemployment, and reduced consumer spending. Businesses may face challenges during this phase.

- Trough: The trough is the lowest point of the cycle, where economic activity is at its weakest. It is followed by a recovery phase.

The typical business cycle consists of four main stages:

Industries Affected by Business Cycles

- Construction: Demand for new construction projects tends to decline during economic contractions.

- Automotive: Sales of vehicles can drop significantly during recessions as consumers cut back on big-ticket purchases.

- Retail: Consumer spending patterns change during different phases of the business cycle, impacting retail sales.

Some industries or sectors are more susceptible to the effects of business cycles:

Strategies for Navigating Business Cycles

- Diversification: Investing in a diverse range of products or markets can help reduce the impact of economic fluctuations on a business.

- Cost-cutting: Implementing cost-saving measures during economic downturns can help maintain profitability.

- Agility: Being able to quickly adapt to changing market conditions can give businesses a competitive edge during uncertain times.

Businesses can adopt various strategies to navigate through different phases of the business cycle:

Economic Cycle Theories

Economic cycle theories play a crucial role in understanding the fluctuations in the economy. Let’s delve into prominent economic theories like Keynesian economics, Monetarism, and supply-side economics in the context of economic cycles.

Keynesian Economics

Keynesian economics, proposed by John Maynard Keynes, emphasizes the role of government intervention in stabilizing the economy. According to this theory, during economic downturns, the government should increase spending to stimulate demand and boost economic activity. Conversely, during periods of inflation, the government should reduce spending to prevent overheating of the economy.

Monetarism

Monetarism, championed by economists like Milton Friedman, focuses on the role of money supply in influencing economic cycles. According to this theory, fluctuations in the money supply by the central bank can impact economic growth and inflation. Monetarists advocate for a stable growth rate in the money supply to maintain price stability and sustainable economic growth.

Supply-Side Economics

Supply-side economics, associated with economists like Arthur Laffer, emphasizes the importance of supply factors in driving economic cycles. This theory argues that reducing taxes and regulations can incentivize businesses to invest, innovate, and expand production, leading to long-term economic growth. Supply-siders believe that policies aimed at enhancing the supply side of the economy can result in increased productivity and overall economic prosperity.

Each of these economic theories offers a unique perspective on the causes and consequences of economic cycles. While Keynesian economics focuses on demand-side interventions, Monetarism emphasizes the role of money supply, and supply-side economics underscores the significance of supply factors in shaping economic outcomes.

In the modern economic landscape, these theories continue to influence policy decisions and debates on how to address economic fluctuations. However, each theory has its strengths and limitations in explaining and predicting economic cycles. Keynesian economics provides a framework for government intervention but may lead to fiscal imbalances. Monetarism offers insights into the impact of monetary policy but may oversimplify complex economic dynamics. Supply-side economics highlights the importance of supply factors but may neglect demand-side considerations.

Overall, a comprehensive understanding of these economic cycle theories can provide valuable insights into the mechanisms behind economic fluctuations and inform policy responses to ensure economic stability and growth.