Diving into the world of Understanding the Federal Reserve, get ready for a wild ride through the intricate web of economic power and influence. This topic is no joke, so buckle up and prepare to expand your mind as we explore the inner workings of the Federal Reserve system.

Now, let’s break it down and uncover the secrets behind one of the most crucial institutions in the American economy.

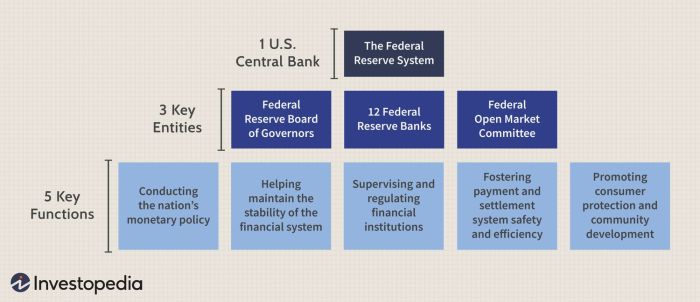

Overview of the Federal Reserve

The Federal Reserve, also known as the Fed, is the central banking system of the United States. It plays a crucial role in the nation’s economy by conducting monetary policy, supervising and regulating financial institutions, and maintaining the stability of the financial system.

Structure of the Federal Reserve System

The Federal Reserve System is composed of three main components:

- The Board of Governors: Located in Washington, D.C., it consists of seven members appointed by the President and confirmed by the Senate. The Chair of the Board is considered the most influential position within the Federal Reserve.

- 12 Regional Federal Reserve Banks: These banks are spread throughout the country and serve as the operating arms of the Federal Reserve. They provide banking services to financial institutions in their respective regions and participate in monetary policy decisions.

- The Federal Open Market Committee (FOMC): This committee is responsible for setting monetary policy by determining interest rates and managing the money supply. It is made up of the seven members of the Board of Governors, the President of the Federal Reserve Bank of New York, and four rotating presidents from the other regional Federal Reserve Banks.

Functions of the Federal Reserve

The Federal Reserve performs several key functions to support the economy, including:

- Controlling the nation’s money supply and interest rates to achieve stable prices and full employment.

- Supervising and regulating banks to ensure the safety and soundness of the financial system.

- Acting as a lender of last resort to provide liquidity during financial crises.

- Conducting research and analysis to inform monetary policy decisions and promote economic growth.

History of the Federal Reserve

The Federal Reserve, often referred to as the Fed, was established in 1913 as a response to the financial panics that frequently occurred in the late 19th and early 20th centuries. Its main purpose was to provide the United States with a safer, more flexible, and more stable monetary and financial system.

Origins of the Federal Reserve

The idea of a central banking system in the U.S. dates back to the early days of the country. However, it wasn’t until the National Banking Act of 1863 that a more formal structure began to take shape. The Panic of 1907 further highlighted the need for a central bank to prevent future financial crises.

- The Aldrich Plan: Proposed in 1910 by Senator Nelson Aldrich, this plan laid the foundation for the Federal Reserve Act.

- Creation of the Federal Reserve Act: Signed into law by President Woodrow Wilson on December 23, 1913, the Federal Reserve Act established the Fed as the central banking system of the U.S.

Key Events Shaping the Creation of the Federal Reserve

The Federal Reserve Act was a result of years of debate and several key events that highlighted the need for a centralized banking system.

- Panic of 1907: A financial crisis that led to bank failures and a severe economic downturn, prompting calls for banking reform.

- Creation of the Federal Reserve System: The establishment of the Federal Reserve marked a significant shift in the U.S. financial system, giving the government more control over monetary policy.

Evolution of the Federal Reserve Over Time

Since its creation, the Federal Reserve has undergone several changes and adaptations to meet the evolving needs of the U.S. economy.

The Federal Reserve’s role expanded during the Great Depression and World War II, leading to changes in monetary policy and banking regulations.

| Year | Event |

|---|---|

| 1977 | Creation of the Federal Open Market Committee (FOMC) to oversee open market operations. |

| 2008 | The Federal Reserve implements unconventional monetary policy measures in response to the financial crisis. |

Monetary Policy

Monetary policy plays a crucial role in influencing the economy by controlling the money supply, interest rates, and credit availability.

Definition of Monetary Policy

Monetary policy refers to the actions taken by a central bank, in this case, the Federal Reserve, to manage the money supply and achieve macroeconomic goals such as controlling inflation, promoting economic growth, and ensuring stability in the financial system.

Implementation by the Federal Reserve

The Federal Reserve implements monetary policy through three main tools: open market operations, the discount rate, and reserve requirements.

Tools Used by the Federal Reserve

- Open Market Operations: This involves buying or selling government securities to influence the amount of money in the banking system. When the Fed buys securities, it injects money into the system, leading to lower interest rates and increased borrowing and spending. Conversely, selling securities reduces the money supply, raising interest rates and decreasing borrowing and spending.

- Discount Rate: The discount rate is the interest rate at which banks can borrow from the Federal Reserve. By changing this rate, the Fed can encourage or discourage banks from borrowing, thereby affecting the money supply and interest rates in the economy.

- Reserve Requirements: Banks are required to hold a certain percentage of their deposits as reserves. By adjusting these reserve requirements, the Fed can influence the amount of money that banks can lend out, impacting the overall money supply and credit availability.

Role of the Federal Reserve in Banking

The Federal Reserve plays a crucial role in supervising and regulating banks, acting as the backbone of the U.S. banking system.

Federal Reserve’s Supervision and Regulation of Banks

- The Federal Reserve monitors banks to ensure they comply with regulations and maintain financial stability.

- It conducts regular examinations to assess the financial health and risk management practices of banks.

- By setting capital requirements and conducting stress tests, the Federal Reserve aims to prevent bank failures and protect depositors.

Federal Reserve as the Lender of Last Resort

- In times of financial distress, the Federal Reserve acts as the lender of last resort to provide liquidity to banks facing funding shortages.

- By offering short-term loans through its discount window, the Federal Reserve helps banks meet their liquidity needs and prevent systemic disruptions.

- This role is crucial in maintaining confidence in the banking system and preventing bank runs.

Impact of the Federal Reserve’s Actions on the Banking Industry

- The Federal Reserve’s monetary policy decisions, such as interest rate changes, directly influence banks’ profitability and lending practices.

- Changes in reserve requirements and open market operations also impact banks’ liquidity levels and ability to lend to businesses and consumers.

- Overall, the Federal Reserve’s actions play a significant role in shaping the overall health and stability of the banking industry.

Economic Indicators and the Federal Reserve

The Federal Reserve closely monitors various economic indicators to make informed decisions and shape monetary policy.

Key Economic Indicators

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in the economy.

- Unemployment Rate: Reflects the percentage of the labor force that is unemployed and actively seeking employment.

- Inflation Rate: Tracks the rate at which prices for goods and services rise over time.

- Consumer Price Index (CPI): Measures changes in the prices paid by consumers for goods and services.

Utilizing Economic Indicators

The Federal Reserve analyzes these indicators to assess the overall health of the economy, identify trends, and determine whether intervention is necessary.

Relationship with Federal Reserve Policy

-

Economic indicators influence Federal Reserve policy decisions, such as adjusting interest rates to control inflation or stimulate economic growth.

- For example, a high unemployment rate may prompt the Fed to lower interest rates to encourage borrowing and spending, thereby stimulating the economy.

- Conversely, if inflation is rising rapidly, the Fed may raise interest rates to curb excessive spending and stabilize prices.