credit card interest explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the world of credit card interest with us as we unravel the complexities and shed light on the often confusing subject matter.

As we delve deeper, you’ll gain a comprehensive understanding of how credit card interest works, the factors that influence rates, and effective strategies for managing and comparing different types of interest rates on credit cards.

Understanding Credit Card Interest

Credit card interest is the cost you pay for borrowing money from a credit card issuer. It is typically expressed as an annual percentage rate (APR) and can vary based on your creditworthiness and the type of credit card you have.

How Credit Card Interest Works

Credit card interest is calculated based on your average daily balance and the APR associated with your card. The issuer will multiply the APR by the number of days in the billing cycle and then divide by 365 to determine the daily periodic rate. This rate is then applied to your average daily balance to calculate the interest charged for that billing cycle.

Examples of Calculating Credit Card Interest

Let’s say you have a credit card with an APR of 18% and an average daily balance of $1,000. To calculate the interest for a 30-day billing cycle:

Interest = Average Daily Balance x (APR / 365) x Number of Days in Billing Cycle

Interest = $1,000 x (0.18 / 365) x 30 = $14.79

APR vs. APY in Credit Card Interest

While APR represents the annual percentage rate, APY (annual percentage yield) takes compounding into account. APY reflects how much you will actually earn or pay when interest is compounded over a year. When it comes to credit card interest, the APR is the stated rate, while the APY gives a more accurate picture of the total cost of borrowing.

Factors Affecting Credit Card Interest Rates

When it comes to credit card interest rates, several key factors come into play. Credit card companies determine individual interest rates based on various aspects, with credit scores playing a significant role in the process.

Interest Rate Factors

- The Federal Reserve Rate: Credit card interest rates are influenced by the Federal Reserve’s benchmark interest rate. When the Federal Reserve raises or lowers rates, credit card interest rates often follow suit.

- Creditworthiness: Individuals with higher credit scores typically receive lower interest rates as they are seen as less risky borrowers. On the other hand, those with lower credit scores may face higher interest rates.

- Card Type: Different types of credit cards, such as rewards cards or secured cards, may have varying interest rates depending on the issuer and the cardholder’s credit profile.

- Market Competition: Credit card companies may adjust interest rates to remain competitive in the market, offering attractive rates to attract new customers or retain existing ones.

Credit Scores Impact on Interest Rates

- Credit scores play a crucial role in determining the interest rates on credit cards. A higher credit score indicates a history of responsible credit management, leading to lower interest rates.

- Individuals with excellent credit scores (usually above 800) are likely to qualify for the best interest rates offered by credit card companies.

- Conversely, individuals with poor credit scores may face higher interest rates or may even struggle to qualify for certain credit cards with competitive rates.

- It is essential for individuals to maintain good credit scores by making on-time payments, keeping credit card balances low, and managing credit responsibly to secure favorable interest rates in the future.

Managing Credit Card Interest

When it comes to managing credit card interest, it’s essential to be proactive and strategic in order to avoid high charges and pay off debt efficiently. Understanding how minimum monthly payments work is crucial to prevent interest accumulation.

Avoiding High-Interest Charges

- Avoid carrying a balance: Pay off your credit card balance in full each month to avoid accruing interest.

- Shop for low-interest cards: Consider switching to a credit card with a lower interest rate to reduce interest charges.

- Avoid cash advances: Cash advances typically come with high-interest rates and fees, so it’s best to avoid using this feature.

- Monitor your spending: Be mindful of your credit card usage and try to only charge what you can afford to pay off.

Paying Off Credit Card Debt Efficiently

- Create a repayment plan: Develop a strategy to pay off your credit card debt, focusing on high-interest balances first.

- Make more than the minimum payment: By paying more than the minimum amount due each month, you can reduce the overall interest paid.

- Consider a balance transfer: Transferring high-interest credit card debt to a card with a lower rate can help you save on interest charges.

- Avoid adding new charges: While working on paying off your debt, try to refrain from making new purchases on your credit card.

Minimum Monthly Payments and Interest Accumulation

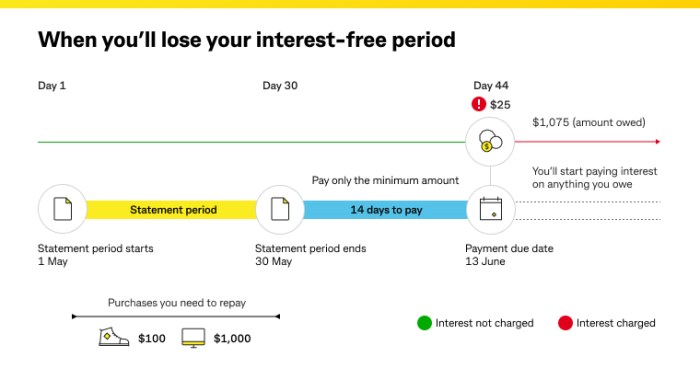

Minimum monthly payments are the lowest amount you must pay on your credit card bill each month to keep your account in good standing. However, making only the minimum payment can lead to interest accumulation and prolong the time it takes to pay off your debt.

By only paying the minimum, you are mostly covering interest charges and not making a significant dent in the principal balance, causing the debt to linger.

Comparing Fixed vs. Variable Interest Rates on Credit Cards

When it comes to credit card interest rates, there are two main types: fixed and variable. Understanding the differences between these two can help you make informed decisions about your credit card usage.

Fixed Interest Rates:

Fixed interest rates remain constant over time, providing predictable monthly payments for cardholders. This stability can be beneficial for budgeting purposes as you’ll always know exactly how much interest you’ll be paying.

Variable Interest Rates:

Variable interest rates, on the other hand, can fluctuate based on changes in the market or the prime rate. While these rates may start lower than fixed rates, they have the potential to increase over time, leading to higher interest charges.

Advantages and Disadvantages:

– Fixed rates offer predictability and stability, making it easier to plan your finances.

– Variable rates may initially be lower, but they carry the risk of rising unexpectedly, potentially leading to higher costs.

Examples of Scenarios:

1. If you prefer consistency and want to avoid surprises in your monthly payments, a fixed interest rate may be more suitable for you.

2. On the other hand, if you are comfortable with some level of risk and believe interest rates may decrease in the future, a variable rate could offer potential savings.

When Fixed Rates Are Better

- When you value stability and predictability in your finances.

- When you want to avoid sudden increases in interest charges.

- When you prefer the peace of mind that comes with knowing your interest rate won’t change.

When Variable Rates Are Better

- When you believe interest rates will decrease in the future.

- When you are willing to take on some risk for the potential of lower overall costs.

- When you plan to pay off your balance quickly to capitalize on lower initial rates.