Looking to secure a personal loan? Well, you’re in luck! This guide is your ticket to understanding the ins and outs of obtaining a personal loan, presented in a fresh and engaging manner that resonates with the American high school hip style.

From researching different loan types to managing repayments effectively, this comprehensive guide has got you covered.

Researching Personal Loans

When considering a personal loan, it’s crucial to research your options thoroughly to ensure you get the best deal possible. Here are some key points to keep in mind:

Types of Personal Loans

- Secured Personal Loans: These loans require collateral, such as a car or house, which reduces the lender’s risk and typically results in lower interest rates.

- Unsecured Personal Loans: These loans do not require collateral, but often come with higher interest rates to compensate for the increased risk to the lender.

- Fixed-Rate Personal Loans: These loans have a set interest rate that remains the same throughout the loan term, providing predictability in monthly payments.

- Variable-Rate Personal Loans: These loans have interest rates that can fluctuate based on market conditions, potentially resulting in lower initial rates but higher risk of payment changes.

Comparing Interest Rates

- Request Loan Quotes: Obtain quotes from multiple lenders to compare interest rates, fees, and terms before making a decision.

- Consider APR: The Annual Percentage Rate (APR) includes both the interest rate and any additional fees, providing a more accurate picture of the total cost of the loan.

- Check for Prepayment Penalties: Some lenders charge fees for paying off a loan early, so be sure to inquire about prepayment penalties when comparing offers.

Checking Your Credit Score

Before applying for a personal loan, it’s essential to check your credit score to understand your creditworthiness. A higher credit score typically translates to lower interest rates and better loan terms. You can request a free credit report from major credit bureaus like Equifax, Experian, and TransUnion to review your credit history and address any discrepancies that may affect your loan application.

Applying for a Personal Loan

When it comes to applying for a personal loan, there are certain requirements you need to meet in order to qualify for the loan. Understanding these requirements and following a step-by-step guide can help increase your chances of approval.

Typical Requirements for Applying for a Personal Loan

- Good credit score: Lenders typically look for a credit score of 600 or higher.

- Stable income: You need to have a steady source of income to show that you can repay the loan.

- Low debt-to-income ratio: Lenders want to see that you have enough income to cover your existing debts as well as the new loan payments.

- Cosigner (if necessary): If your credit score is not strong enough, you may need a cosigner with good credit to increase your chances of approval.

- Valid identification: You will need to provide proof of identity, such as a driver’s license or passport.

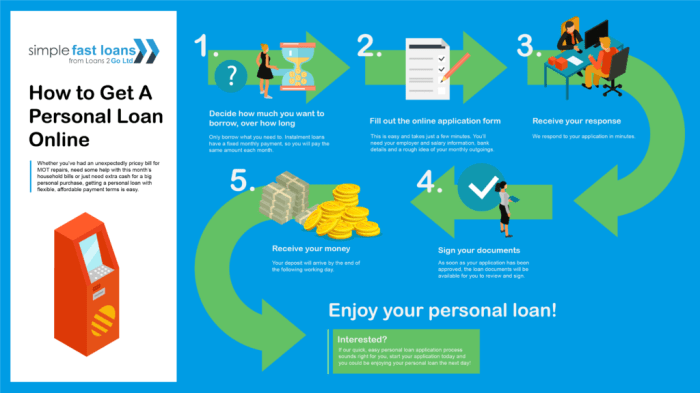

Step-by-Step Guide on How to Fill Out a Personal Loan Application

- Gather necessary documents: Collect documents such as pay stubs, bank statements, and identification.

- Choose a lender: Research different lenders and compare interest rates and terms.

- Complete the application: Fill out the application form accurately and provide all required information.

- Submit documents: Upload or submit any necessary documents along with your application.

- Wait for approval: Once you submit your application, wait for the lender to review and approve your loan.

Tips to Increase Your Chances of Approval for a Personal Loan

- Improve your credit score: Pay off debts and make timely payments to boost your credit score.

- Reduce your debt-to-income ratio: Pay down existing debts to show lenders you can handle more debt.

- Shop around: Compare offers from different lenders to find the best terms for your personal loan.

- Consider a cosigner: If your credit is not strong, a cosigner with good credit can help you qualify for a loan.

- Provide accurate information: Double-check your application to ensure all information is correct and up-to-date.

Understanding Loan Terms and Conditions

When taking out a personal loan, it’s essential to understand the terms and conditions associated with it. Here are some key terminologies and factors to consider:

APR (Annual Percentage Rate)

- The APR represents the annual cost of borrowing, including interest and fees, expressed as a percentage.

- It’s crucial to compare APRs when shopping for loans to get an accurate picture of the total cost.

- A lower APR means lower overall borrowing costs.

Origination Fee

- Origination fees are charges that lenders apply for processing a new loan application.

- These fees are typically deducted from the loan amount before you receive the funds.

- Be aware of origination fees, as they can impact the total amount you receive.

Repayment Term

- The repayment term refers to the duration in which you must repay the loan in full.

- Shorter terms generally come with higher monthly payments but lower overall interest costs.

- Longer terms may have lower monthly payments but result in higher total interest paid over time.

Fixed-Rate vs. Variable-Rate Personal Loan

- A fixed-rate personal loan maintains the same interest rate throughout the loan term, providing predictable monthly payments.

- On the other hand, a variable-rate loan’s interest rate can fluctuate based on market conditions, potentially leading to changes in monthly payments.

- Consider your risk tolerance and financial stability when choosing between fixed and variable rates.

Penalties for Late Payments or Default

- Missing a payment deadline can result in late fees, damaging your credit score and incurring additional interest charges.

- Defaulting on a personal loan can lead to severe consequences, such as debt collection, legal action, and a significant drop in credit score.

- It’s crucial to communicate with your lender if you anticipate difficulty in making payments to explore alternative solutions.

Managing and Repaying a Personal Loan

When it comes to managing and repaying a personal loan, it’s essential to stay organized and on top of your payments. Failing to do so can lead to financial consequences that may impact your credit score and overall financial health. Here, we will discuss strategies for managing personal loan repayments effectively, the consequences of missing a personal loan payment, and tips on how to pay off a personal loan early to save on interest.

Strategies for Managing Personal Loan Repayments

- Create a budget: Artikel your monthly income and expenses to ensure you can afford your loan payments.

- Set up automatic payments: Avoid missing payments by setting up automatic deductions from your bank account.

- Communicate with your lender: If you anticipate any issues with payments, reach out to your lender to discuss possible solutions.

Consequences of Missing a Personal Loan Payment

- Damage to credit score: Missing payments can negatively impact your credit score, making it harder to secure loans in the future.

- Late fees and penalties: Lenders may charge late fees and penalties for missed payments, increasing the overall cost of the loan.

- Potential legal action: In severe cases, lenders may take legal action to recover the unpaid amount.

Tips to Pay Off a Personal Loan Early

- Make extra payments: By paying more than the minimum each month, you can reduce the principal amount and save on interest.

- Round up payments: Rounding up your payments to the nearest hundred or even fifty can accelerate your repayment schedule.

- Consider refinancing: If you can secure a lower interest rate, refinancing your loan can help you pay it off faster.