Yo, listen up! Tracking expenses is all about staying on top of your financial game. In this guide, we’re diving deep into the world of expense tracking, helping you navigate through the ins and outs like a boss. So buckle up and let’s roll!

Tracking your expenses is essential for managing your money like a pro. Let’s explore the different methods, challenges, and tips to help you stay in control of your finances.

Introduction to Tracking Expenses

Tracking expenses refers to the practice of monitoring and recording all the money you spend on a regular basis. This includes everything from daily purchases to monthly bills and even occasional splurges. It is a crucial aspect of managing personal finances effectively.

Tracking expenses is essential for maintaining financial health and stability. By keeping a close eye on where your money goes, you can identify areas where you may be overspending or where you can cut back. This helps you stay within your budget, save more money, and avoid unnecessary debt.

Common Challenges in Tracking Expenses

- Difficulty in keeping detailed records of every single transaction, especially cash purchases.

- Forgetting to include irregular expenses or one-time payments in the tracking process.

- Lack of consistency in tracking expenses regularly, leading to incomplete or inaccurate data.

- Feeling overwhelmed by the amount of time and effort required to track expenses effectively.

Methods of Tracking Expenses

Tracking expenses can be done manually with pen and paper or digitally using expense tracking apps. Both methods have their own advantages and it’s important to choose the one that best fits your lifestyle and preferences.

Manual Methods (Pen and Paper)

- Requires discipline and consistency to record every expense

- Can provide a tangible record that some people find more satisfying

- May be prone to errors and difficult to organize and analyze

Digital Methods (Expense Tracking Apps)

- Convenient and easy to use on-the-go

- Automatically categorizes expenses for better organization

- Provides insights and analysis of spending habits

Benefits of Using Expense Tracking Apps

- Real-time tracking of expenses for better financial awareness

- Ability to set budgets and receive alerts when approaching limits

- Syncs across devices for accessibility anywhere, anytime

Popular Expense Tracking Apps

| App Name | Features |

|---|---|

| Mint | Tracks expenses, sets budgets, offers credit score monitoring |

| You Need a Budget (YNAB) | Focuses on budgeting and goal setting for better financial planning |

| Expensify | Designed for business expense tracking and reporting |

Setting Up Expense Categories

![]()

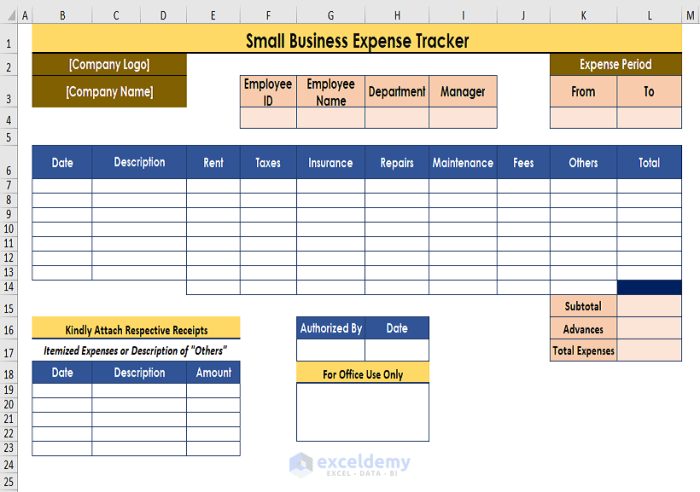

When it comes to tracking expenses, setting up categories is crucial to effectively manage your finances. By categorizing expenses, you can easily identify where your money is going and make informed decisions on where to cut back or allocate more funds.

Significance of Categorizing Expenses

Organizing expenses into categories allows you to see patterns in your spending habits, identify areas of overspending, and track progress towards financial goals. It provides a clear picture of your financial health and helps you budget more effectively.

Common Expense Categories

- Housing (rent/mortgage, utilities)

- Transportation (gas, public transportation)

- Food (groceries, dining out)

- Insurance (health, auto, home)

- Debt Payments (credit cards, loans)

- Entertainment (movies, concerts, subscriptions)

- Personal Care (haircuts, toiletries)

- Savings (emergency fund, retirement)

Customizing Expense Categories

Creating personalized expense categories can help tailor your budget to your specific needs and priorities. Consider adding categories such as pet expenses, travel, gifts, or hobbies based on your spending habits. Don’t be afraid to adjust or add categories as your financial situation evolves.

Creating a Budget

Creating a budget is crucial for managing finances effectively. Tracking expenses plays a key role in this process, as it provides valuable insights into where your money is going and helps you make informed decisions about your spending habits.

Steps to Setting Up a Budget

- Calculate your total monthly income: Add up all your sources of income to determine how much money you have coming in each month.

- Track your expenses: Use the data from your expense tracking to categorize and analyze your spending habits.

- Set financial goals: Determine what you want to achieve with your budget, whether it’s saving for a big purchase or paying off debt.

- Create a budget plan: Allocate specific amounts to different expense categories based on your tracked spending patterns.

- Monitor and adjust: Regularly review your budget and make adjustments as needed to stay on track with your financial goals.

Adjusting Budgets based on Tracked Spending Patterns

By analyzing your tracked expenses, you can identify areas where you may be overspending and make necessary adjustments to your budget. For example, if you notice that you’re consistently spending more than you budgeted for groceries, you can reallocate funds from another category to cover the excess expenses.

- Identify spending trends: Look for patterns in your expenses to understand where adjustments are needed.

- Make changes accordingly: Modify your budget categories and allocations to align with your actual spending habits.

- Stay flexible: Budgeting is a dynamic process, so be prepared to adapt to changes in your financial situation or goals.

Analyzing Spending Trends

When it comes to managing your finances, analyzing spending trends is crucial to understanding where your money is going and making informed decisions for the future. By looking at the data you have tracked, you can identify patterns, areas of overspending, and opportunities for saving.

Utilizing Tools for Visualization

- One way to analyze spending trends is by using budgeting apps or software that offer visual representations of your expenses. These tools can generate graphs, charts, and reports to help you see your spending habits at a glance.

- Another method is creating your own spreadsheets or using templates in programs like Microsoft Excel. By inputting your expense data and categorizing it accordingly, you can create customized visuals to track your spending trends over time.

Benefits of Identifying Spending Trends

- Identifying spending trends allows you to pinpoint areas where you may be overspending and make adjustments to your budget accordingly. For example, if you notice a consistent increase in dining out expenses, you can take steps to limit eating out and reallocate those funds to savings or other priorities.

- By analyzing spending trends, you can also set realistic financial goals based on your actual spending habits. This can help you create a more effective budget and work towards achieving your long-term objectives, such as saving for a vacation or paying off debt.

- Moreover, tracking spending trends can provide valuable insights into your overall financial health and help you make more informed decisions about where to cut costs or invest in the future. This proactive approach to money management can lead to greater financial stability and peace of mind.

Strategies for Improving Expense Tracking

Consistency is key when it comes to tracking your expenses. Here are some tips to help you stay on track:

Staying Consistent with Expense Tracking

- Set aside a specific time each day or week to update your expense tracking system.

- Use apps or software that sync with your bank accounts to make tracking easier.

- Keep all your receipts and make a habit of entering them into your tracking system immediately.

Once you have a good handle on tracking your expenses, you can start using the data to identify areas where you can cut back on unnecessary spending:

Reducing Unnecessary Expenses Based on Tracked Data

- Look for patterns in your spending and identify areas where you can make cuts without sacrificing too much.

- Set specific budget limits for certain categories and stick to them.

- Avoid impulse purchases by making a shopping list and sticking to it.

As your financial situation changes, it’s important to adapt your expense tracking methods to suit your current circumstances:

Adapting Expense Tracking Methods to Changing Circumstances

- Review and adjust your budget regularly to reflect changes in income or expenses.

- Consider using different tracking tools or methods if your current system is no longer working for you.

- Seek advice from financial experts or online resources to help you navigate major financial changes.