Importance of financial goals sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Financial goals are the roadmap to financial success, guiding individuals towards making informed decisions about their money and shaping their future. In a world where financial security is paramount, understanding the significance of setting financial goals is crucial for anyone looking to achieve stability and prosperity.

Importance of Financial Goals

Setting financial goals is crucial for personal financial planning as it provides individuals with a clear roadmap to achieve their desired financial outcomes. Without specific goals in place, it can be challenging to make informed decisions regarding spending, saving, and investing.

Financial goals help individuals prioritize their spending by identifying what is truly important to them. By having a clear goal in mind, individuals can allocate their resources effectively towards achieving that goal, rather than spending impulsively on unnecessary items.

Similarly, financial goals also help individuals prioritize saving. Whether it’s saving for a vacation, a down payment on a house, or retirement, having a specific goal in mind can motivate individuals to save consistently over time. This disciplined approach to saving can lead to long-term financial stability and security.

Examples of short-term financial goals include building an emergency fund, paying off credit card debt, or saving for a new car. These goals can have an immediate impact on an individual’s financial well-being by providing a safety net in case of unexpected expenses or reducing high-interest debt.

On the other hand, long-term financial goals may include saving for retirement, purchasing a home, or funding a child’s education. These goals require consistent saving and investing over an extended period and can significantly impact an individual’s financial future.

Short-term Financial Goals

- Building an emergency fund to cover unexpected expenses.

- Paying off high-interest credit card debt to improve financial health.

- Saving for a specific purchase like a new laptop or vacation.

Long-term Financial Goals

- Saving for retirement to ensure financial security in old age.

- Purchasing a home to build equity and stability.

- Funding a child’s education to invest in their future.

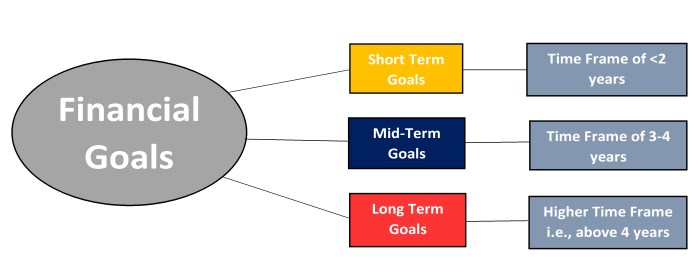

Types of Financial Goals

Financial goals come in various forms, each serving a specific purpose in our overall financial planning. Let’s explore different types of financial goals and how they influence our financial well-being.

Savings Goals

Savings goals are focused on setting aside money for future needs or emergencies. This could include saving for a down payment on a house, creating an emergency fund, or saving for a vacation. It is essential to have a specific amount in mind and a timeline for achieving this goal.

Investment Goals

Investment goals involve growing your wealth over time by putting money into various investment vehicles. These goals can include saving for retirement, building wealth through stocks or real estate, or funding your child’s education. It is crucial to have a clear investment strategy and risk tolerance level.

Debt Reduction Goals

Debt reduction goals focus on paying off outstanding debts, such as credit card debt, student loans, or mortgages. Setting a specific target amount to pay off each month can help you track your progress and stay motivated. It is important to prioritize high-interest debt first to save money on interest payments.

Retirement Planning Goals

Retirement planning goals involve saving and investing for your retirement years. This could include contributing to a 401(k) or IRA account, calculating how much money you will need in retirement, and determining your desired retirement age. It is crucial to start saving for retirement early to take advantage of compound interest.

Short-term vs. Long-term Financial Goals

Short-term financial goals are typically achieved within one year and can include saving for a vacation or paying off a credit card balance. Long-term financial goals, on the other hand, take more than five years to achieve and can include saving for retirement or buying a home. Planning and execution for long-term goals require more discipline and consistency compared to short-term goals.

Examples of SMART Financial Goals

– Save $5,000 for a down payment on a house by December 2023.

– Pay off $10,000 in credit card debt within two years by making monthly payments of $500.

– Contribute 10% of your income to a retirement account every month to retire by age 65.

Benefits of Setting Financial Goals

Setting financial goals can have a variety of benefits that go beyond just financial success. Let’s explore some of the key advantages below.

Reducing Stress and Anxiety

Setting clear financial goals can help reduce stress and anxiety by providing a sense of direction and purpose. When individuals have a clear roadmap of where they want to be financially, it can alleviate the uncertainties and worries that often come with managing money.

Motivating Financial Habits

Financial goals serve as a motivation for individuals to improve their financial habits. Whether it’s saving more, investing wisely, or cutting down on unnecessary expenses, having a specific goal in mind can inspire individuals to make positive changes in their financial behaviors.

Better Decision-Making and Financial Stability

By setting financial goals, individuals are forced to prioritize their spending and focus on what truly matters to them. This can lead to better decision-making when it comes to money matters, ultimately contributing to greater financial stability. When individuals have a clear vision of their financial goals, they are more likely to make informed choices that align with their long-term objectives.

Strategies for Achieving Financial Goals

Achieving financial goals requires a well-thought-out plan and consistent effort. Here are some practical steps to help you create an effective financial goal-setting process.

Importance of Budgeting

Budgeting is a crucial aspect of achieving financial goals as it helps you track your income and expenses. By creating a budget, you can allocate funds towards your goals and identify areas where you can cut back to save more money.

Tracking Expenses

Tracking your expenses is essential to understand where your money is going. By keeping a record of all your spending, you can identify unnecessary expenses and make adjustments to stay on track towards your financial goals.

Adjusting Goals as Needed

It’s important to be flexible with your financial goals and adjust them as needed. Circumstances may change, and it’s essential to review your goals regularly to ensure they are still relevant and achievable. Don’t be afraid to modify your goals if necessary.

Tips for Staying Motivated

Staying motivated towards reaching your financial goals can be challenging. One tip is to set smaller milestones along the way to celebrate your progress. Additionally, finding an accountability partner or joining a financial support group can help keep you motivated and on track towards achieving your goals.