Get ready to dive into the world of comparing investment vehicles. This introduction will take you on a journey through the ins and outs of various financial options, from stocks to real estate, all in a cool and engaging American high school hip style.

From risk profiles to liquidity, we’ll explore how different investment vehicles stack up against each other, giving you the knowledge to make informed financial decisions.

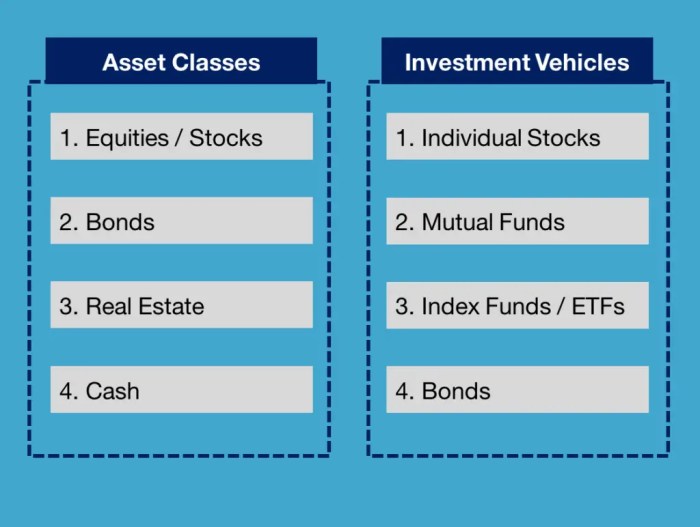

Types of Investment Vehicles

Investment vehicles are different options available for individuals to invest their money and grow their wealth. Some common types of investment vehicles include stocks, bonds, mutual funds, and real estate.

Stocks

Stocks represent ownership in a company and can offer the potential for high returns. However, they also come with high risk due to market volatility. Stocks are bought and sold on stock exchanges, making them relatively liquid investments.

Bonds

Bonds are debt securities issued by governments or corporations. They are considered less risky than stocks but typically offer lower returns. Bonds have varying levels of liquidity depending on the type and issuer.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer diversification and professional management but come with fees. Mutual funds are generally liquid investments that can be bought or sold at the end of the trading day.

Real Estate

Investing in real estate involves purchasing properties with the expectation of generating rental income or price appreciation. Real estate can provide steady cash flow and long-term growth potential. However, real estate investments are less liquid compared to stocks or bonds, as they may take time to sell.

Factors to Consider When Choosing an Investment Vehicle

When it comes to choosing an investment vehicle, there are several important factors to consider that can greatly impact your overall investment strategy. Let’s dive into some key considerations:

Risk Tolerance

One of the most crucial factors to consider when selecting an investment vehicle is your risk tolerance. This refers to your ability to withstand fluctuations in the value of your investments. If you have a high risk tolerance, you may be more comfortable with volatile investments such as stocks. On the other hand, if you have a low risk tolerance, you may prefer safer options like bonds or CDs.

Investment Goals

Your investment goals play a significant role in determining the most suitable investment vehicle for you. Whether you are saving for retirement, a major purchase, or simply looking to grow your wealth, your goals will influence the level of risk you are willing to take and the time horizon you have in mind for your investments.

Time Horizon

The time horizon or the length of time you plan to hold onto your investments is another crucial factor to consider. For short-term goals, you may opt for more liquid and stable investment options, whereas for long-term goals, you might be willing to take on more risk for the potential of higher returns.

Tax Implications of Different Investment Vehicles

Investing in various vehicles like stocks, bonds, and real estate can have different tax implications that impact your overall returns.

Tax Implications on Stocks, Bonds, and Real Estate

When it comes to stocks, you may be subject to capital gains tax on any profits made from selling your shares. Dividend income from stocks is also taxed, but at different rates based on how long you’ve held the stock.

Bonds, on the other hand, can generate interest income that is taxable at your regular income tax rate. Municipal bonds, however, may offer tax advantages as the interest income can be exempt from federal taxes.

Real estate investments can also have tax benefits such as mortgage interest deductions and depreciation. Rental income is taxable, but you may be able to offset it with expenses related to the property.

Tax Advantages of Retirement Accounts

Retirement accounts like 401(k)s and IRAs offer tax advantages that can help you grow your savings more efficiently. Contributions to these accounts are often tax-deductible, reducing your taxable income in the present.

In a traditional 401(k) or IRA, your investments grow tax-deferred, meaning you don’t pay taxes on the gains until you start withdrawing funds in retirement. Roth 401(k)s and Roth IRAs, on the other hand, offer tax-free withdrawals in retirement as contributions are made with after-tax dollars.

Tax-Efficient Investment Strategies

To minimize the impact of taxes on your investments, consider strategies like tax-loss harvesting to offset capital gains with losses, diversifying your portfolio to take advantage of different tax treatments, and investing in tax-efficient funds that minimize distributions.

Additionally, holding investments for the long term can qualify for lower capital gains tax rates, and utilizing tax-advantaged accounts like HSAs and 529 plans for specific goals can help maximize your tax savings.

Diversification Strategies Across Investment Vehicles

Diversification is a key strategy in investing that involves spreading your investments across different assets to reduce risk. By diversifying, you can protect your portfolio from the volatility of individual investments and increase the chances of achieving a more stable return over time.

Importance of Diversification

Diversification is crucial in an investment portfolio as it helps to minimize risk by not putting all your eggs in one basket. By spreading your investments across various asset classes and investment vehicles, you can potentially offset losses in one area with gains in another, leading to a more balanced and resilient portfolio.

- Diversification can be achieved by investing in a mix of stocks, bonds, real estate, and other assets.

- Using different investment vehicles such as mutual funds, ETFs, and index funds can also help diversify your portfolio.

- By diversifying across asset classes, you can reduce the impact of market fluctuations on your overall portfolio performance.

Benefits of Diversification

Diversifying across asset classes and investment vehicles can offer several benefits, including:

- Lowering overall portfolio risk by spreading investments across different sectors and industries.

- Potentially increasing returns by capturing opportunities in various markets or sectors.

- Providing a more stable and predictable investment performance over the long term.